Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The army of retail investors is fighting the US stock market:

Mom-and-pop investors have bought US equities for 7 days STRAIGHT ending Wednesday. Individuals have sold stocks on net only in 7 trading sessions out of 52 in 2025. Is the army of retail investors going to win? Source: Global Markets Investor @GlobalMktObserv

US tariffs on April 2nd: Will it be not as bad as expected?

A “Trump put” ahead? Some articles caught a lot of bullish notice this weekend. S&P Futures are going UP this morning Source: Bloomberg, WSJ

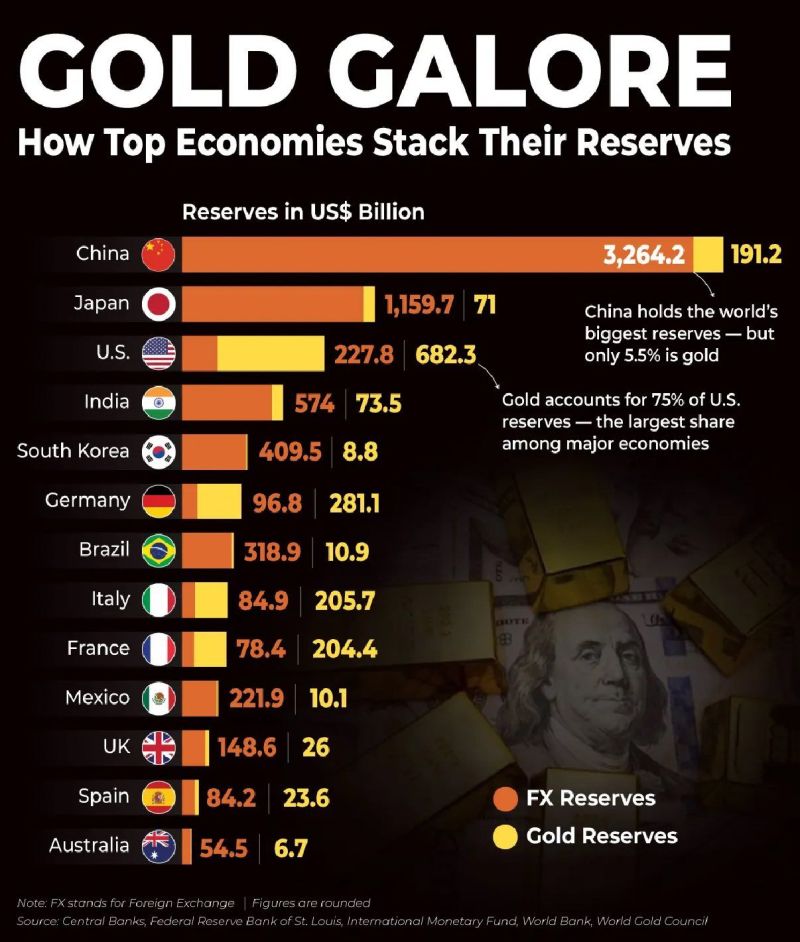

How Top Economies Stack Their Reserves...

Gold account for 75% of US reserves, the largest share among major economies. China holds the world's biggest reserves - but only 5.5% is gold... Source: Brad Moseley

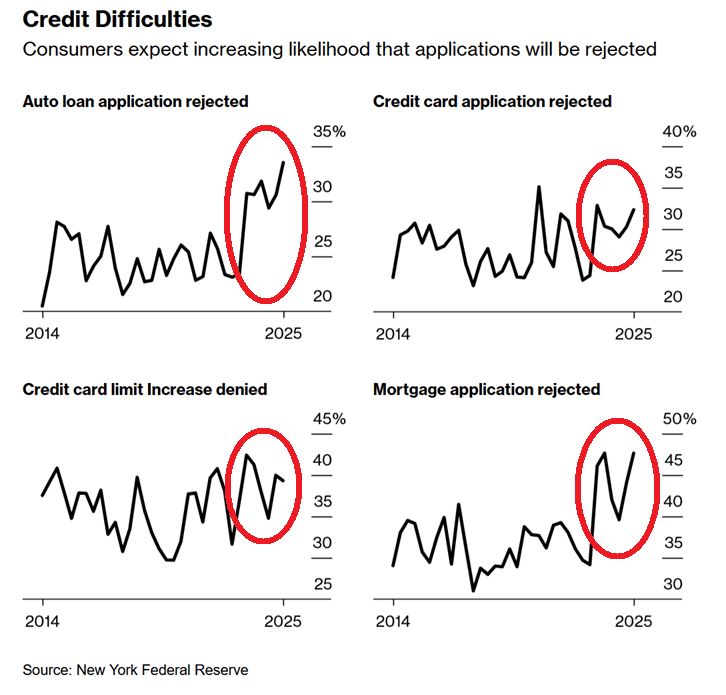

Americans expect credit application REJECTIONS at a higher rate than ever:

The perceived likelihood of credit application rejections: Auto loan: 34%, the highest on record Mortgage: 48%, the highest on record Credit card: 32%, the 3rd-highest ever Card limit increase: 39% Source: Global Market Investors, Bloomberg

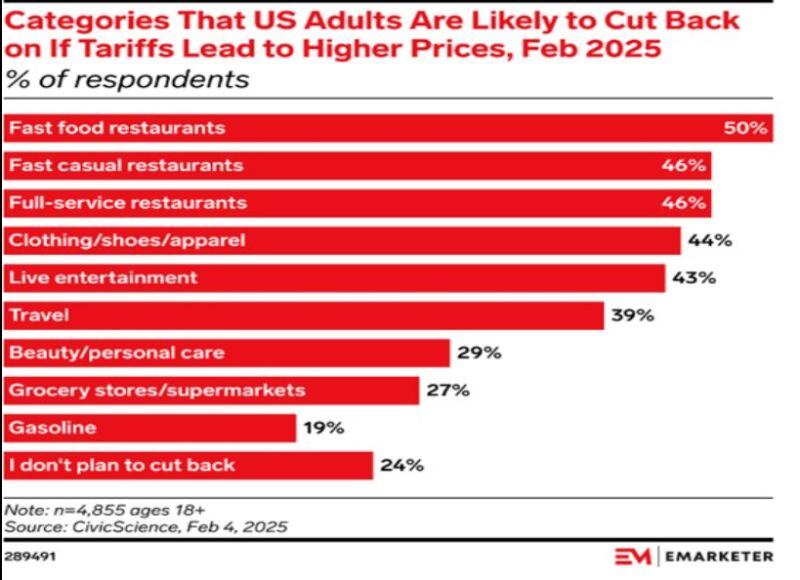

Categories that US adults are likely to cut back on if tariffs lead to higer prices

source : emarketer

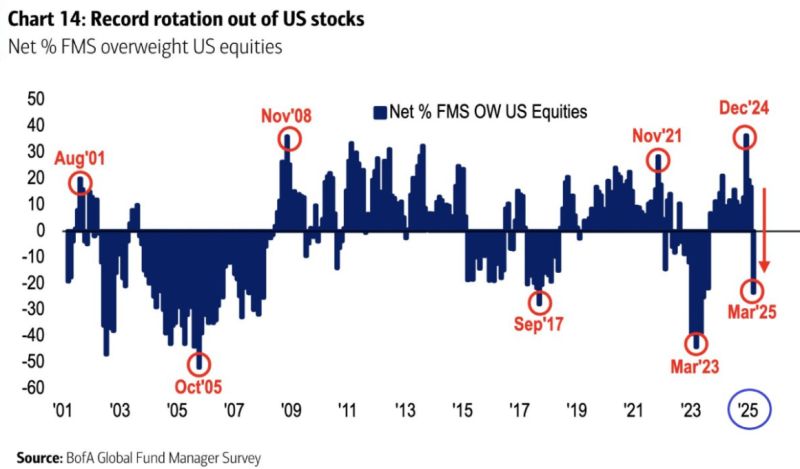

Fund Managers just rotated OUT OF U.S. Stocks at the fastest pace in history

source :BofA

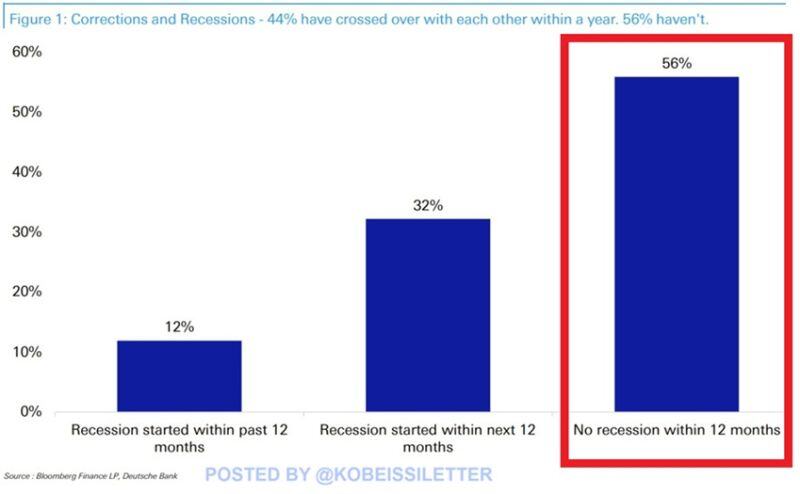

How often do market corrections lead to a recession in the US?

There have been 60 S&P 500 corrections including the most recent one, according to Deutsche Bank analysis. Historically, in 12% of corrections, a recession had already begun in the previous 12 months. 32% of the time a recession took place within the next 12 months. In 56% of corrections, the US avoided an economic downturn within the next 12 months. In other words, market corrections are only accompanied by a recession ~44% of the time. Can we avoid a recession this time? Source: The Kobeissi Letter

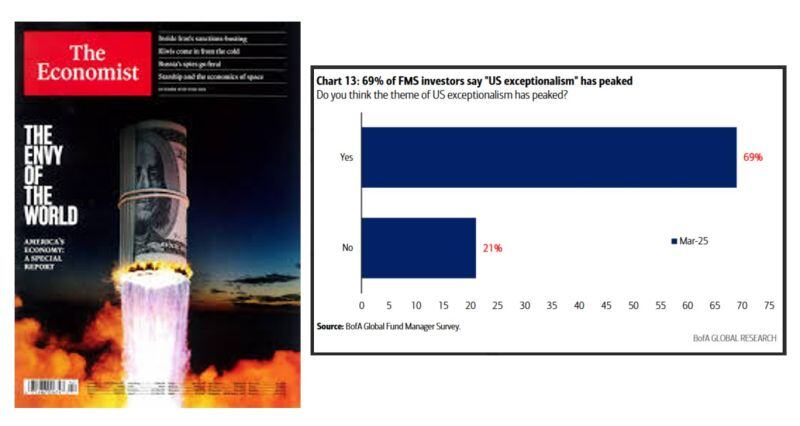

Lots of things have happened since this cover page by The Economist (October 2024)...

According to the BofA Fund Manager Survey, 69% of investors believe that US exceptionalism has peaked... Have we moved from one extreme to another ????

Investing with intelligence

Our latest research, commentary and market outlooks