Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

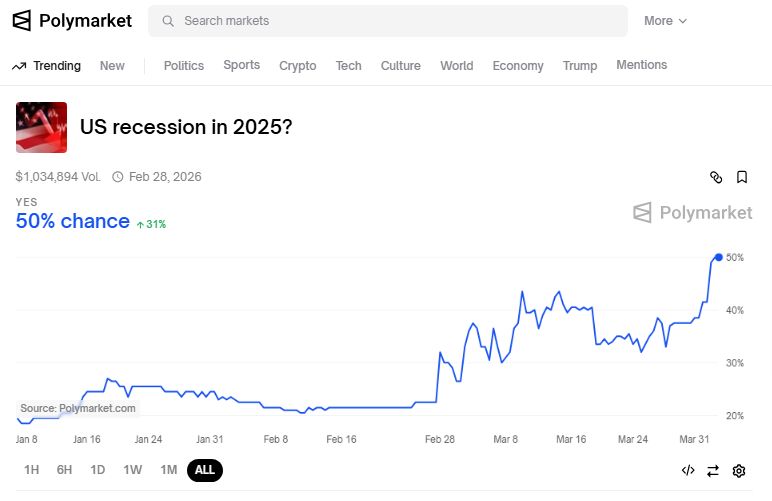

JUST IN 🚨:

The odds of a U.S. Recession occurring this year just soared to 50% on Polymarket 👀 Source: Barchart

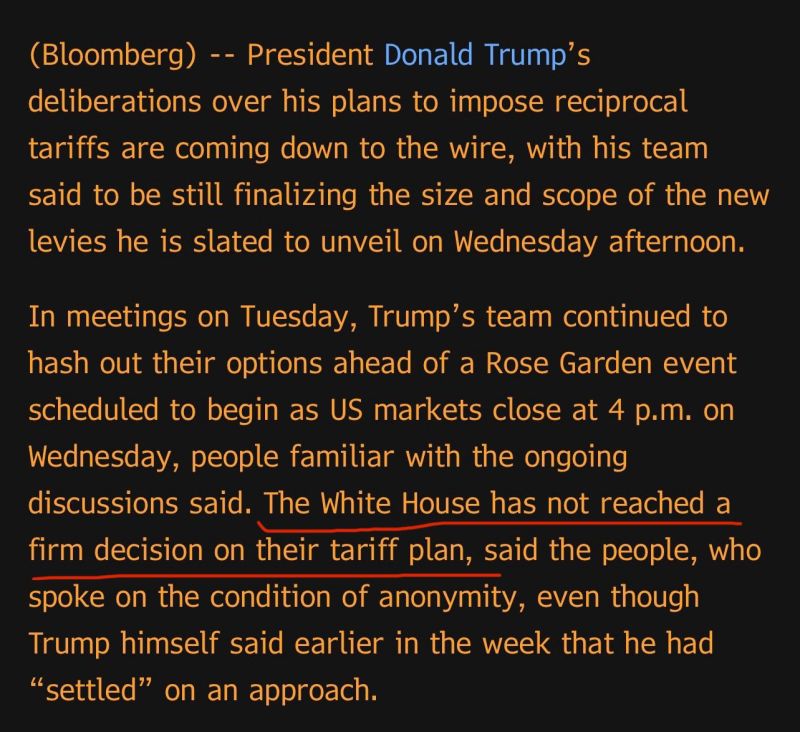

Is Trump's plan to reshore manufacturing already working?

This is the biggest increase in manufacturing jobs since October 22, which was followed by a 2 year manufacturing recession. Source: Bloomberg, www.zerohedge.com

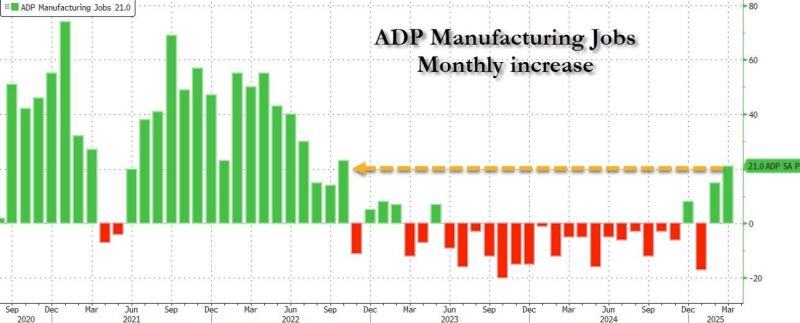

Richmond Fed asked companies how the plan to respond to tariffs.

Strong majority plan to raise prices... Source: Dario Perkins @darioperkins on X

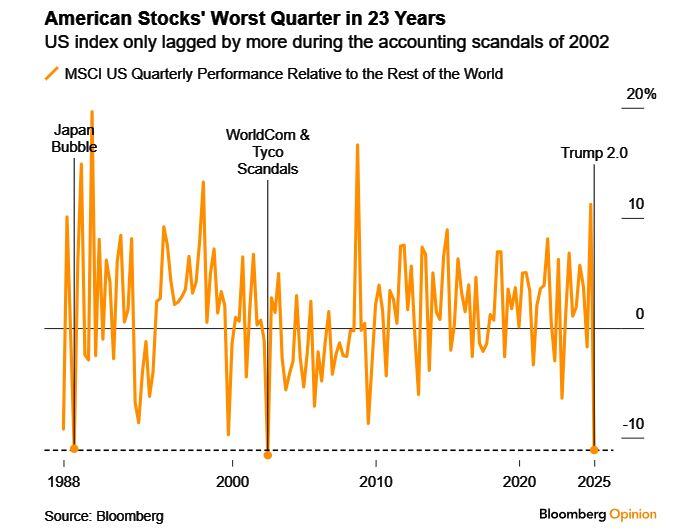

Worst quarter for US stocks relative to the rest of the world in 23 years

Source: Bloomberg Opinion, www.zerohedge.com

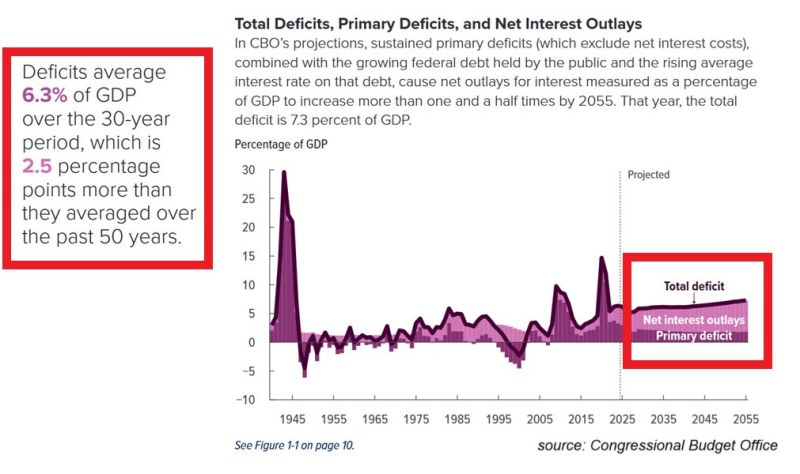

A MIND-BLOWING chart:

The US budget deficit is set to average 6.3% over the next 30 years. This would be higher than any other period outside of major crises and wars. This also would be 2.5 percentage points above the past 50-year average... Source: Global Markets Investor

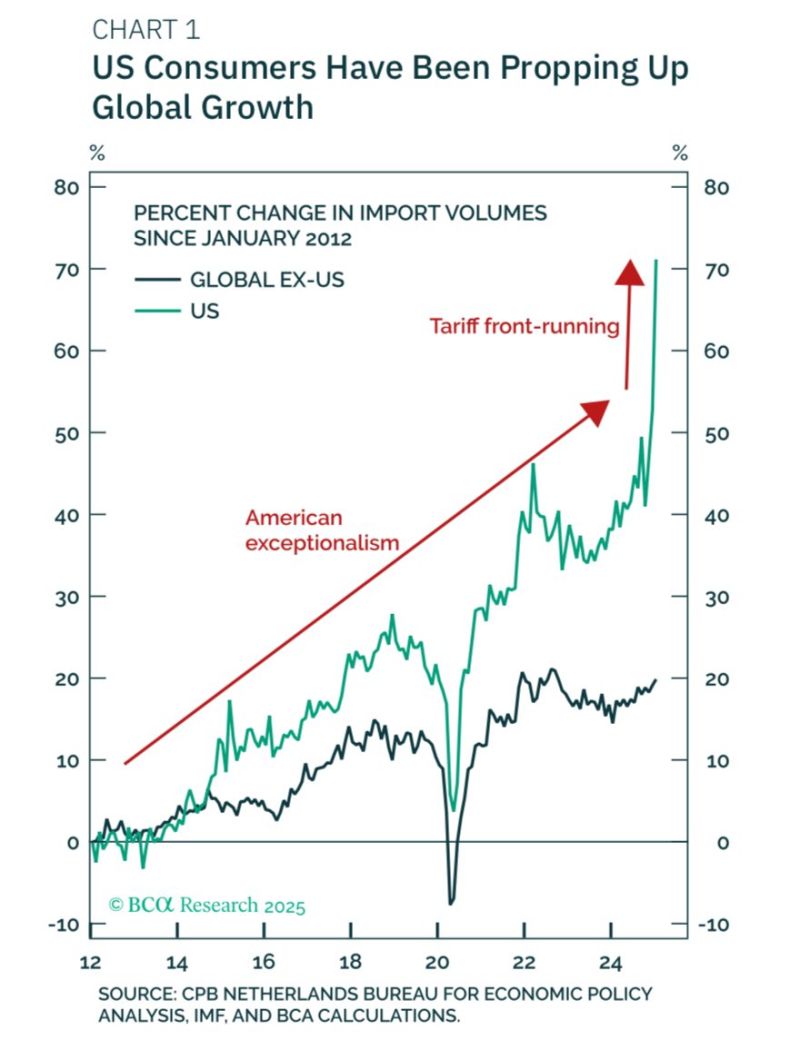

The global economy is currently benefiting from massive tariff front-running, as evidenced by the surge in imports to the US.

This has temporarily propped up production in places like Europe, Canada, and China. Will the floor fall out this week? Source: BCA, Peter Berezin on X

Investing with intelligence

Our latest research, commentary and market outlooks