Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

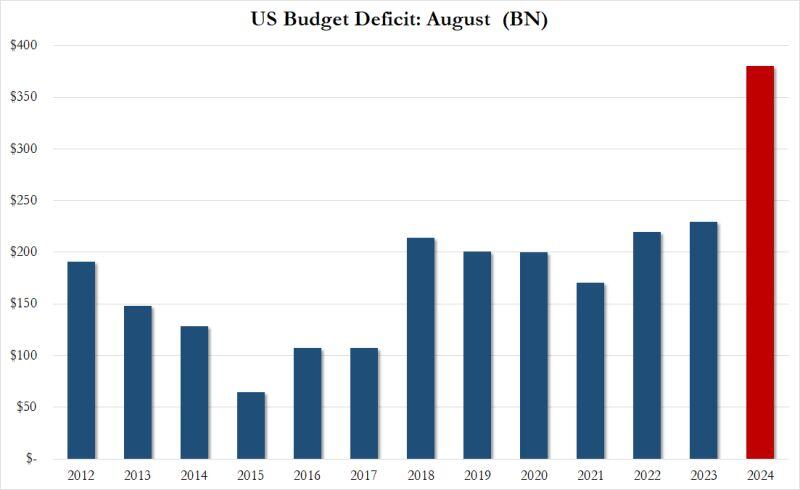

US fiscal stimulus: no surprise, we haven't seen any slowdwn in terms of spending ahead of the elections...

Source: Bloomberg, www.zerohedge.com

Ozempic is selling so well that an insurer requests USD 1 bn in payments back

Source: Bloomberg

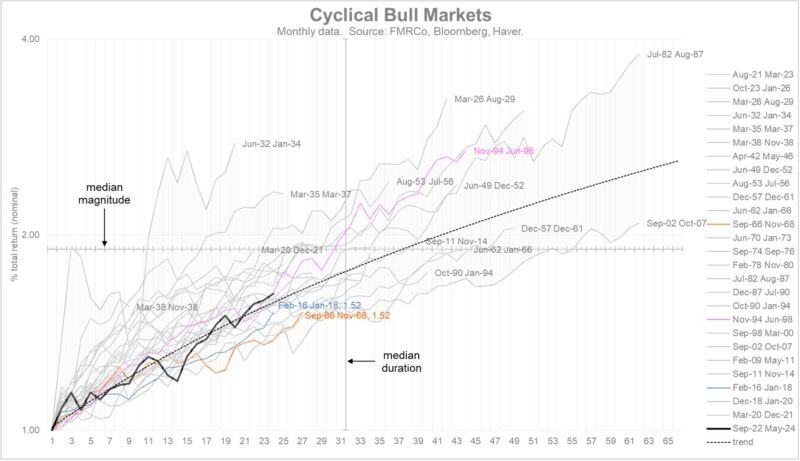

US equities bull market => are you afraid to be too late to the party?

If history is any guide, you aren't. As shown on the chart below, history shows there is still rooms to go for this bull market in terms of duration AND magnitue. Source: RBC

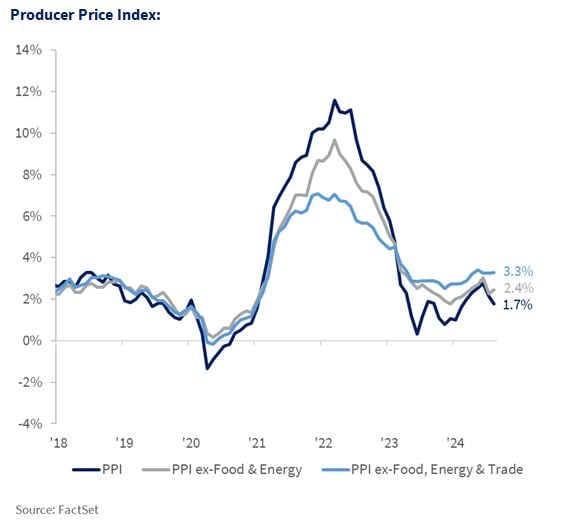

📈 BREAKING: August PPI inflation falls to 1.7%, below expectations of 1.8%.

Core PPI inflation was unchanged, at 2.4%, below expectations of 2.5%. PPI inflation is now at its lowest level since February 2024. On a sequential basis (MoM), the picture is not the same: August's core PPI rose more than expected, driven by higher service prices, while goods prices stayed flat. PPI 0.2% MoM, Exp. 0.1% PPI Core 0.3% MoM, Exp. 0.2% Source: Ali Dhanjion X, Factset

In case you missed it...

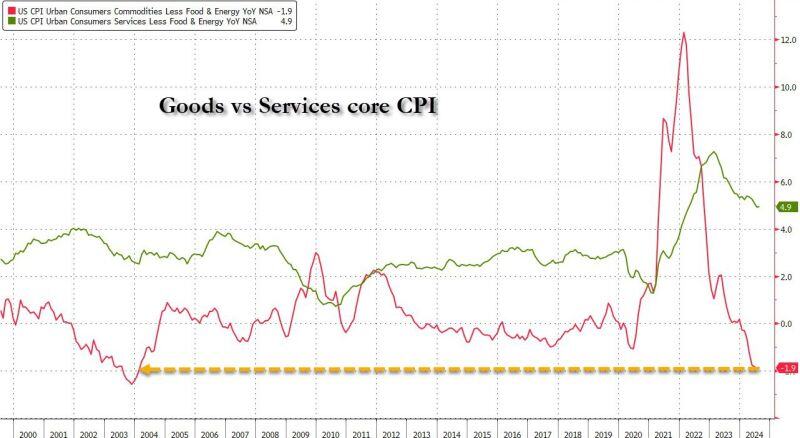

Goods deflation in the US is the biggest in 20 years... Source: www.zerohedge.com

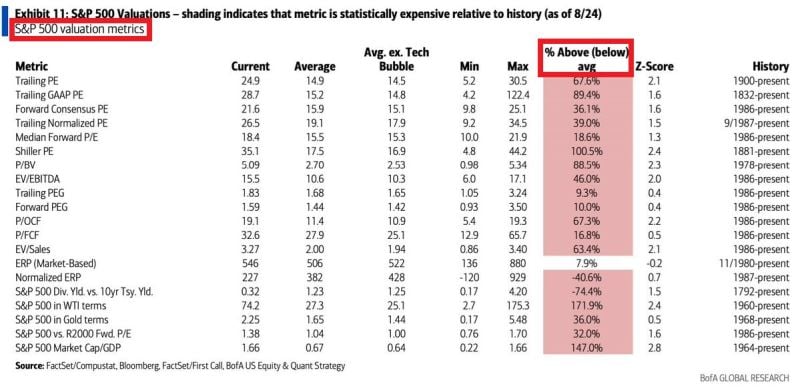

🚨 THIS IS ONE OF THE MOST EXPENSIVE MARKETS IN HISTORY 🚨

valuation remains a headwind for US equities (out of the 5 pillars of our investment process, valuation is the only negative one) . S&P 500 is expensive on 19 out of 20 metrics according to the Bank of America analysis. Some metrics are over 100% above historical averages. Shiller P/E and S&P 500 Market Cap to GDP are now 101% and 147% above averages. Source: Global Markets Investor, Facset, Bloomberg, BofA

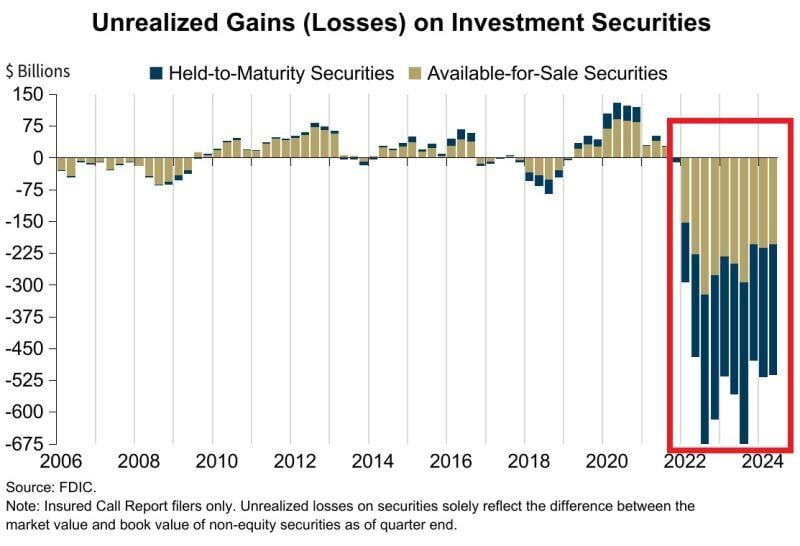

⚠️US BANKS UNREALIZED LOSSES HIT $512.9 BILLION IN Q2 2024⚠️

Q2 marks the 11th STRAIGHT quarter of unrealized losses on investment securities for banks, a streak never seen before. The number of banks on the FDIC Problem Bank List increased to 66 and represents 1.5% of total. Source: Global Markets Investor

The most important number of the day was US CPI number.

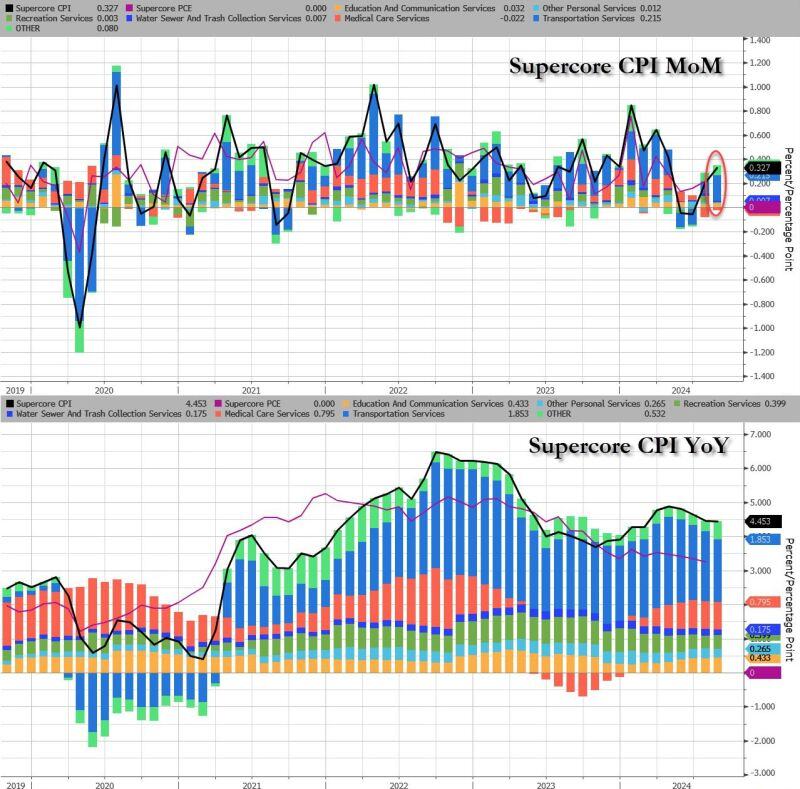

Inflation in August declined to its lowest level since February 2021, according to a Labor Department report Wednesday that also showed a key measure higher than expected, setting the stage for an expected quarter percentage point rate cut from the Federal Reserve. Indeed, while the headline CPI increased 0.2% for the month, in line with the Dow Jones consensus, the core CPI, which excludes volatile food and energy prices, increased 0.3% for the month, slightly higher than the 0.2% estimate. The slight uptick in core CPI keeps the Fed on defense against inflation, likely negating the probability of a more aggressive interest rate when policymakers meet next Tuesday and Wednesday. Here are the details: -> CPI 0.2% MoM (or 0.187% unrounded), Exp. 0.2% - in line -> CPI Core 0.3% MoM (or 0.281% unrounded), Exp. 0.2% - hotter than expected. Note that was the 51st straight month of MoM increases in Core CPI, and a new record high. The annual prints: -> CPI 2.5% YoY, Exp. 2.5% - in line. The annual CPI increase is the lowest since February 2021... -> CPI Core 3.2% YoY, Exp. 3.2% - in line Last, but not least, and perhaps most ominous of all, is that while the Fed is about to start cutting rates, Supercore CPI rose 0.33% MoM (see chart below), the biggest monthly increase since April, driven by continued acceleration in transportation services, which jumped the most in 5 months. Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks