Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Presidential debate: Not all topics have been tackled...

Nothing about government spending. Nothing about national debt. Nothing about taxes. Meanwhile, the US debt clock is ticking... Source: Kurt Altrichter on X

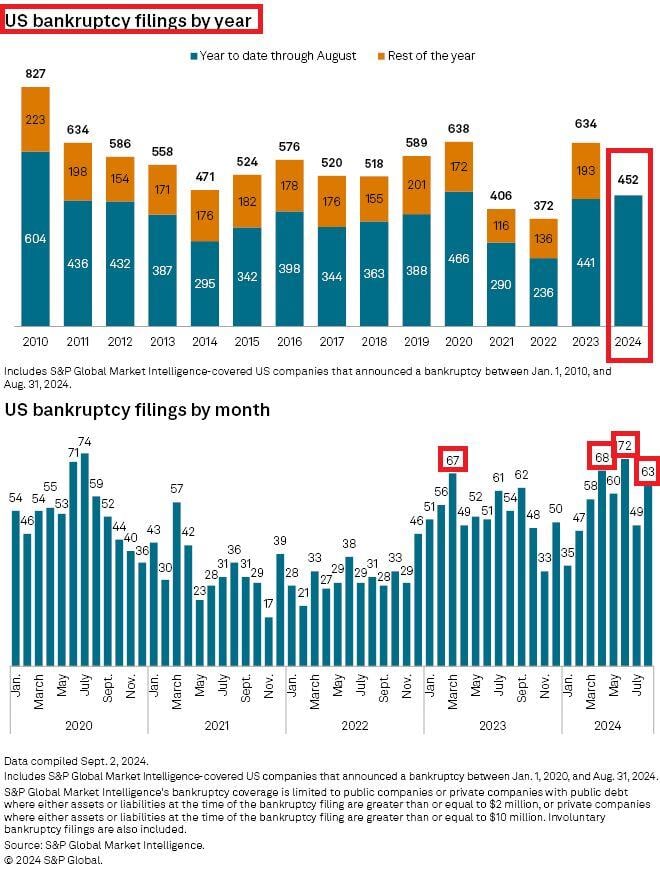

🚨US BANKRUPTCIES ARE ON THE RISE🚨

The number of bankruptcy filings hit 452 year-to-date, the 2nd largest in 13 YEARS. In August alone, 63 companies went under, the 4th LARGEST since the COVID CRISIS. Most bankruptcies have been seen in the consumer discretionary sector. Source: Global Markets Investor

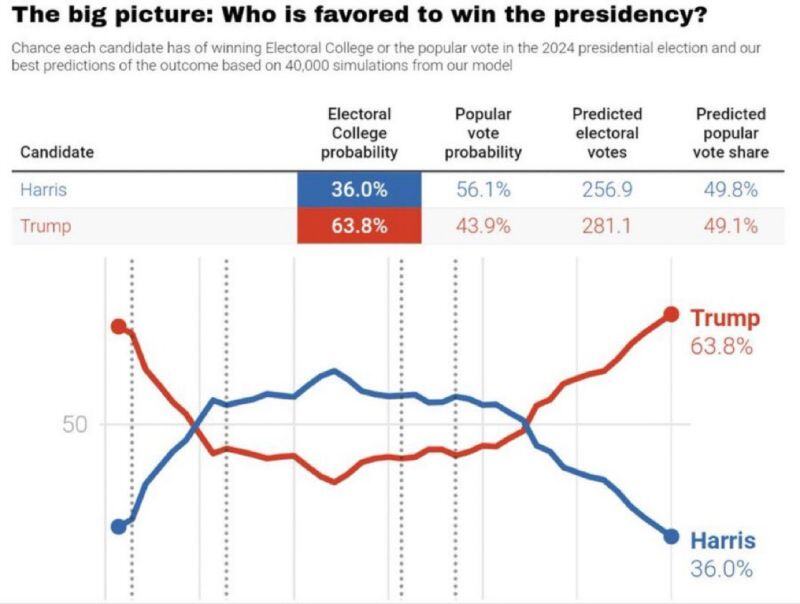

Harris is tonight's winner based on betting markets

Source: David Ingles, Bloomberg

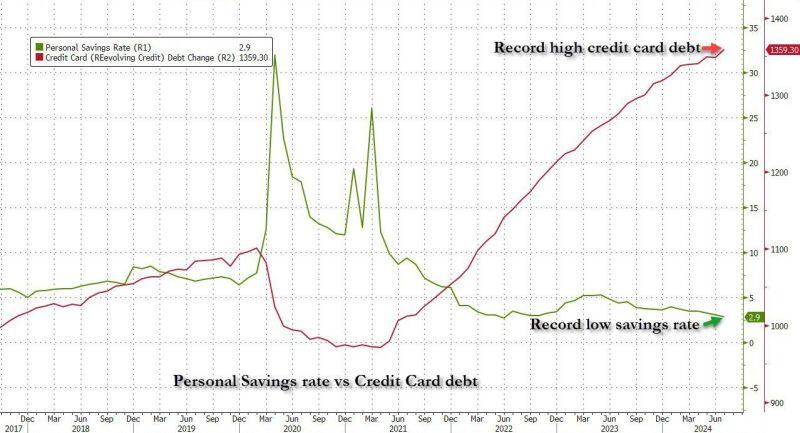

In the US, Total credit card debt is at an all-time high while the personal savings rate is record low!

Source: www.zerohedge.com

Americans make more money than they did at the end of 2019, even after adjusting for unusually high inflation since then.

Source: WSJ, Mike Zaccardi, CFA, CMT, MBA

BREAKING: Trump has a whopping 27.8% lead over Harris in Nate Silver’s updated electoral college prediction poll.

Trump - 63.8% Harris - 36% NB: The graph shows the chance of winning, not the percentage of the vote !!! Source: Leading Report, Nate Silver

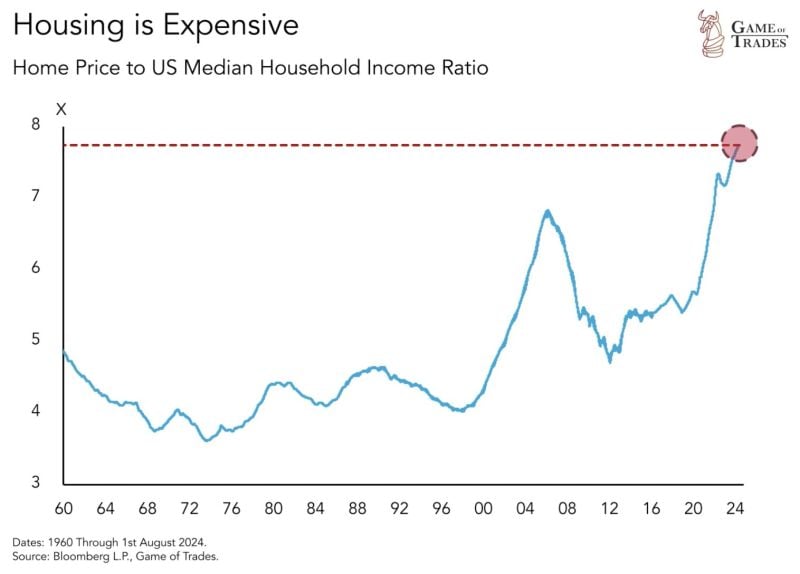

US home price relative to median income is now at the highest level ever seen

Source: Game of Trades

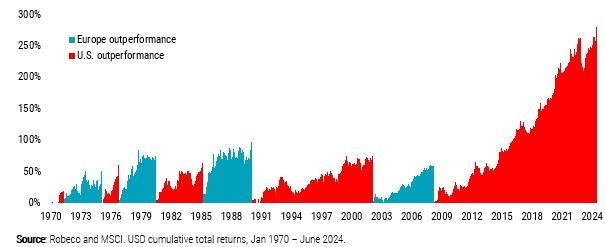

Will Europe ever outperform again?

From Robeco thru Mike Zaccardi, CFA, CMT, MBA.

Investing with intelligence

Our latest research, commentary and market outlooks