Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Goldman Sachs $GS warns that US stocks could face more selling this week, driven by trend-following funds known as CTAs, which have already hit sell triggers in the S&P 500.

The bank estimates CTAs could dump up to $33 billion this week — and as much as $80 billion over the next month if the S&P 500 keeps falling. Source: Jesse Cohen

Japan’s prime minister Sanae Takaichi has led her party to a crushing victory in Japan’s snap general election on Sunday

Japan’s Prime Minister Sanae Takaichi won a landslide election, securing a two-thirds majority that enables major reforms. Her agenda includes strong economic stimulus, tax relief on food, increased tech investment, and possible constitutional change. Markets welcomed the political stability, pushing Japanese stocks to new highs.

The Most Important Investing Theme of 2026 is HALO

HALO stands for Heavy Assets, Low Obsolescence. These are undistruptible companies from an AI standpoint. There’s nothing Sundar Pichai and Sam Altman can take from them Source: Ritholtz

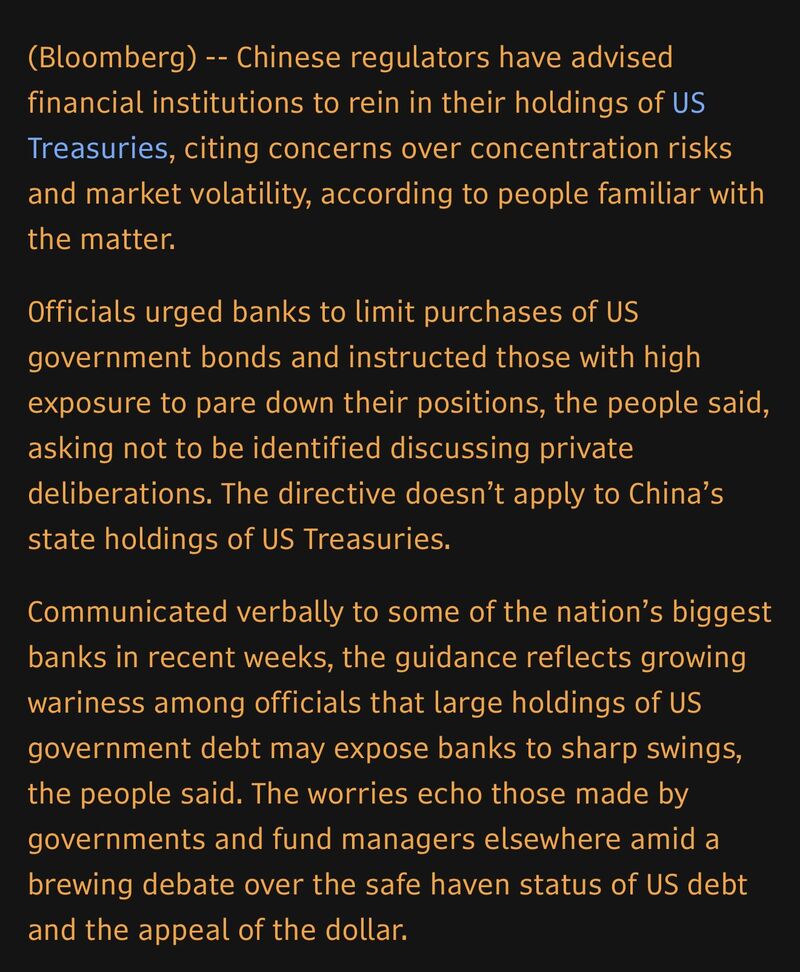

China urges banks to curb us treasuries exposure on market risk

Source: Bloomberg

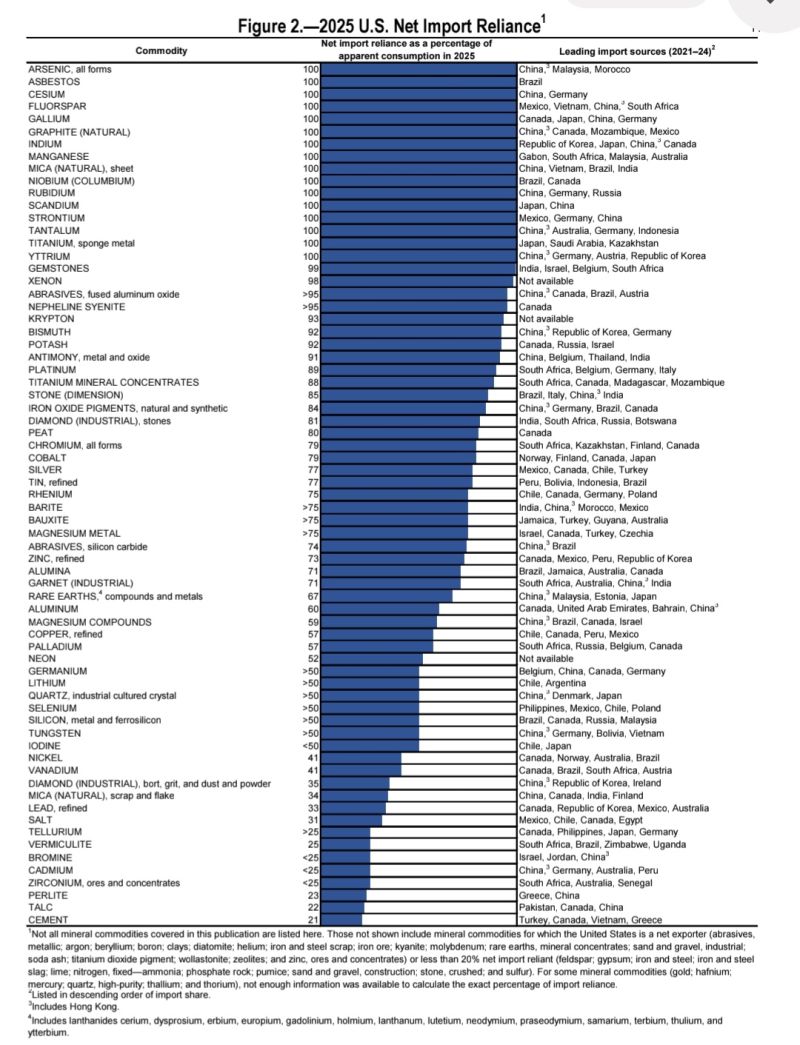

U.S. Mineral Import Reliance Hits New Highs

The latest USGS mineral commodities report shows the U.S. is becoming increasingly dependent on foreign sources for critical raw materials, raising risks for both national security and industry. Import reliance rose across nearly all non-fuel minerals, with the U.S. now 100% dependent on imports for 16 minerals and more than 50% reliant on imports for 54 of the 90 tracked commodities, both up from last year. This trend underscores the growing urgency to strengthen domestic supply chains as geopolitical and trade risks make foreign dependence more vulnerable. Tracy Shuchart (𝒞𝒽𝒾 ) @chigrl

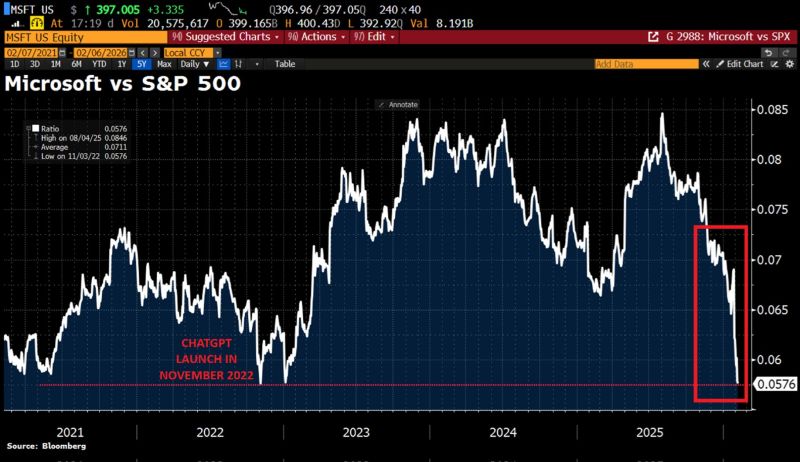

Microsoft, $MSFT, has erased all of its outperformance vs. the S&P 500 since ChatGPT launched in November 2022.

The stock is now -27% below its highs, the largest drawdown in over a decade outside of 2022. It also ERASED over 2 years of gains. The MSFT/SPX ratio is down to its lowest since November 2022 and well below the 5-year average. One of the biggest AI investors is now one of the WORST-performing mega-cap stocks. CapEx is not fancy anymore. Source: Bloomberg, Global Markets Investor

The "Bitcoin is dead" narrative just jumped the shark

Each cycle, Bitcoin is declared “dead,” but this ignores a deeper structural shift in monetary sovereignty. Behind the negative headlines, fundamentals are advancing: major U.S. regulation (CLARITY Act), rapid institutional adoption through asset tokenization, and crowded bearish positioning near the 200-week SMA. The transition from speculative asset to institutional financial infrastructure is painful but ongoing when the bear case relies on fear narratives, it often signals that the structural shift is already underway.

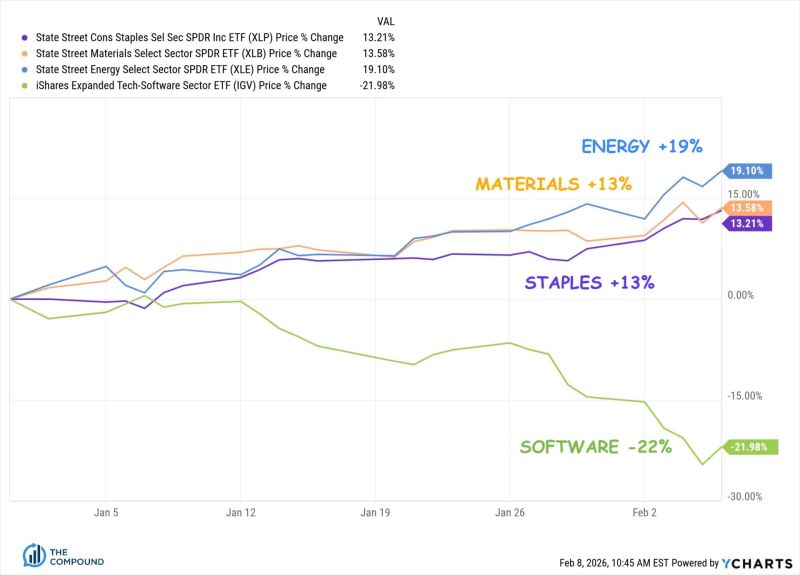

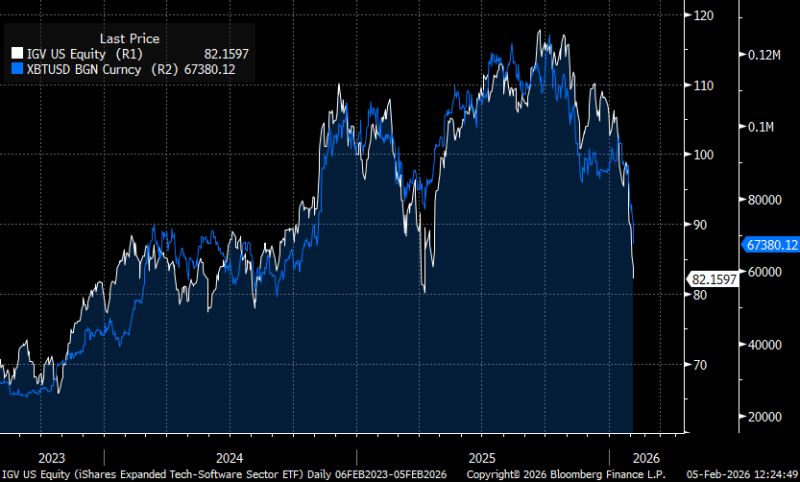

As shown on the chart below, the iShares Expanded Tech-Software Sector ETF (IGV) and bitcoin look like twins...

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks