Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

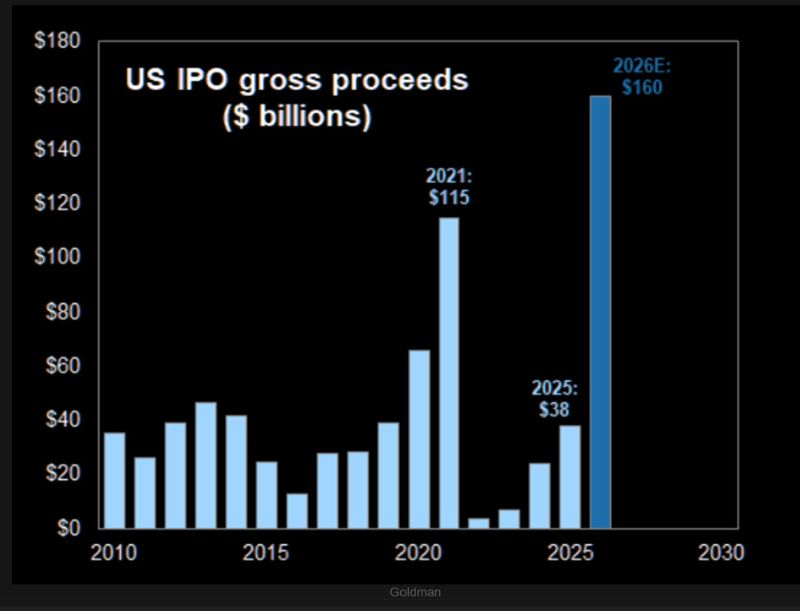

GS: "We forecast 120 IPOs this year and $160 billion in gross IPO proceeds in 2026".

Source: TME

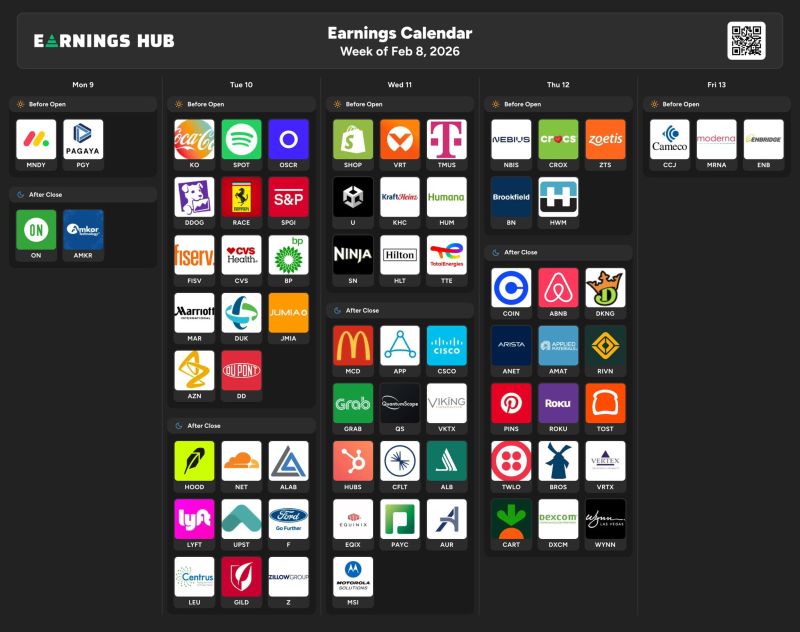

THE MASTER EARNINGS SEASON CALENDAR

Here are the most popular stocks that report earnings this week February 9th - February 13th. Source: Earnings Hub

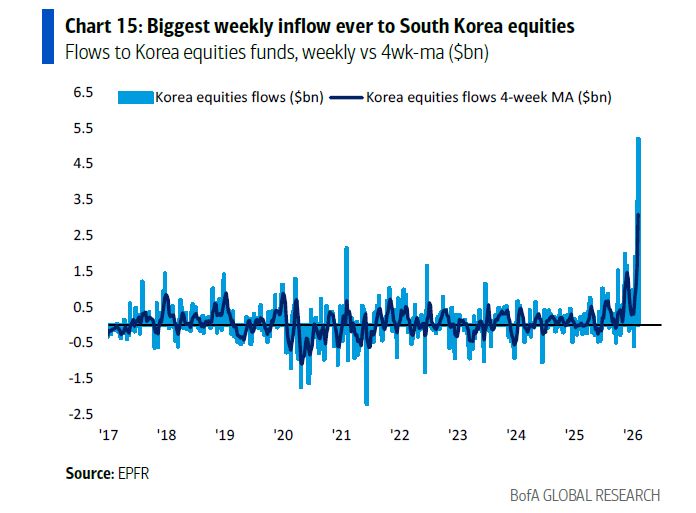

Massive inflows into Korean stocks have some cross-border ripple effects...

The Korean momentum kamikazes dumped bitcoin, dumped gold, dumped silver, dumped anything that did not have upward momentum and piled into Korean memory stocks at a record pace. Source: BofA, zerohedge

🚨NEXT WEEK COULD DECIDE THE FUTURE OF US CRYPTO REGULATION 🚨

Next week, the White House is hosting a high-stakes meeting that could change the U.S. financial system forever. 🇺🇸⛓️ The entire Crypto Market Structure Bill is currently deadlocked over one single, explosive question: Should stablecoin holders be allowed to earn yield? 💰 Here is what you need to know about the "Yield War" happening behind closed doors: 🏦 THE BANKS’ PERSPECTIVE: Traditional banks are terrified. If a stablecoin offers 3-4% yield while a standard checking account offers 0%, the math is simple. Industry groups warn that $6 TRILLION in deposits could migrate out of the banking system. They see this as an existential threat to their liquidity. ⚖️ THE CRYPTO PERSPECTIVE: Crypto firms and exchanges view yield as the heartbeat of the digital economy. They’ve made their stance clear: They would rather have no bill at all than a bill that bans yield just to protect legacy banks. ⏳ THE TICKING CLOCK: With the 2026 Midterm Elections looming, lawmakers are running out of time. If a compromise isn't reached by the end of February: The CLARITY Act remains stalled. Regulatory uncertainty continues. The U.S. risks falling further behind in global fintech. This isn't just about "crypto." It’s about the future of how money moves, how it grows, and who controls the rails. The Feb 10 meeting is the pressure point. Will the White House force a "Grand Bargain," or will the divide between TradFi and DeFi become a canyon? Source: Crypto Rover

The Swissfranc is holding its breakout to new all-time highs

Source: Sam Gatlin @sam_gatlin J-C Parets

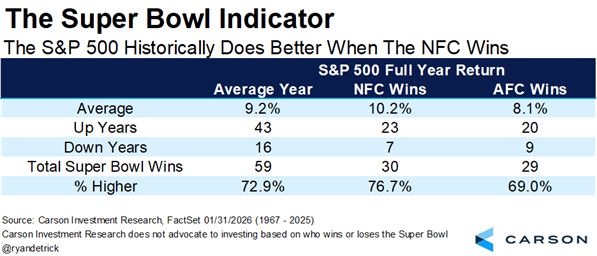

According to the Super Bowl Indicator

it should be noted, has no economic foundation—the Seahawks' win last night suggests that 2026 will be a bullish year for the markets Source: Sam Gatlin Source: Carson

So much for a hawkish incoming Fed chair.

Kevin Warsh, nominee for Fed Chair, has proposed a “New Fed-Treasury Accord” inspired by the 1951 agreement that granted Fed independence. The plan aims to restore Fed independence, shrink its $6.6 trillion balance sheet, and clarify roles between the Fed and Treasury. The Fed would focus on short-term rates and price stability, while the Treasury manages bond markets. Warsh also favors less forward guidance, letting the Fed react to data rather than constantly signaling. The goal is to prevent the Fed from becoming a tool for cheap government borrowing, modernize its balance sheet, and protect its ability to fight inflation.

Investing with intelligence

Our latest research, commentary and market outlooks