Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

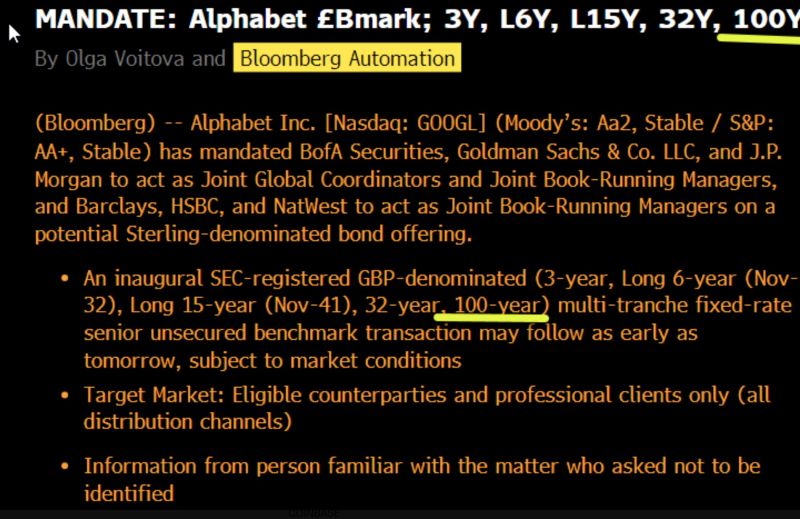

🚨There is BARELY any cash on the sidelines:

Cash levels in US equity funds fell to 1.1%, an ALL-TIME LOW. This is HALF the percentage seen just 3 years ago. US equity mutual fund cash balances as a % of total assets have been in a downtrend for the last 18 years. Nominally, cash and liquid assets fell to $135 billion, the lowest since 2013. Almost every equity fund is ALL-IN on US stocks. Source: Global Markets Investor, Goldman Sachs

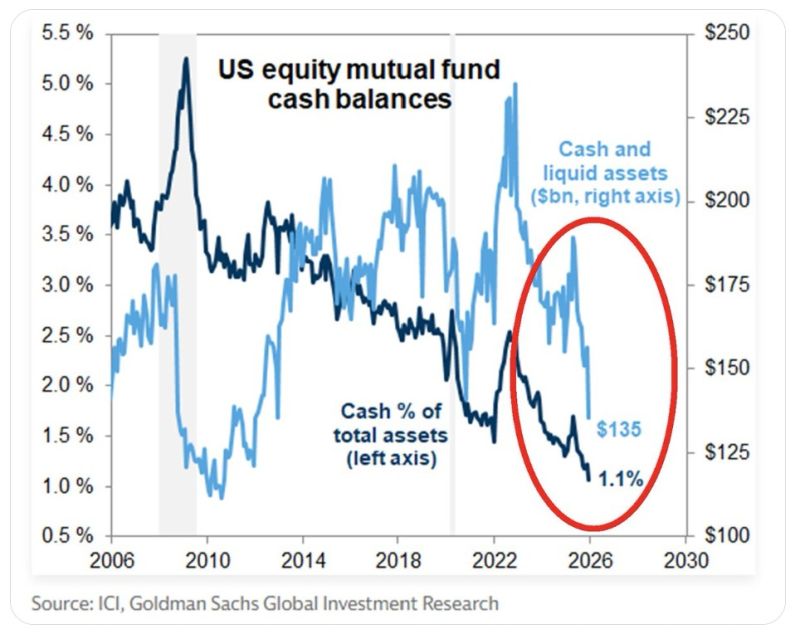

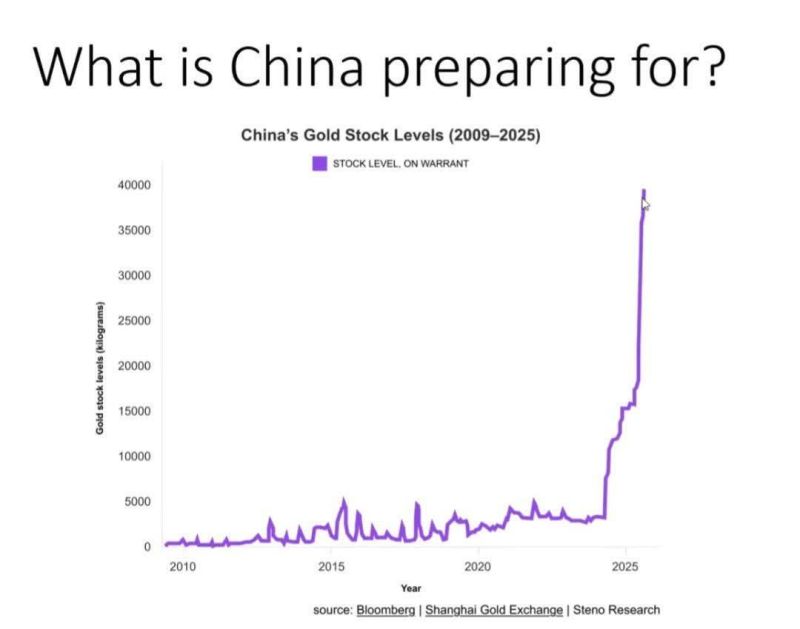

🔥Gold fund inflows are going parabolic:

Cumulative inflows to gold funds have surged to +$127 billion since 2020, according to BofA. Nearly +$120 BILLION has come since the start of 2025. Meanwhile, gold and gold mining ETFs received a record $91.86 billion worth of inflows in 2025, more than 8 TIMES the total in 2024. This all comes as gold hit multiple record highs over the last 2 years, and central bank buying remains historically elevated. Source: Global Markets Investor, BofA

J.P. Morgan in 1912: "Gold is money. Everything else is credit."

Source: Barchart

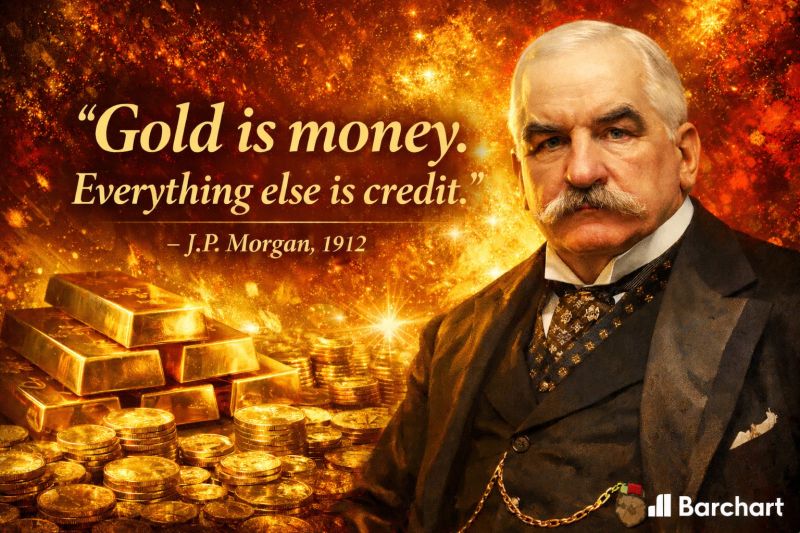

Alphabet has attracted >$100bn of orders for a bond sale that’s expected to be ~$15bn, BBG reports, citing people with direct knowledge of the matter.

The demand is among the strongest ever seen for a corporate bond offering, showing investor hunger to buy debt tied to the AI boom. Alphabet has also mandated banks for potential Swiss franc and Sterling debt offerings, including a rare 100-year Sterling note. Source: Bloomberg, HolgerZ

The AI action is in Asia

See below chart with SK Hynix, Samsung or Advantest all sky rocketing. Meanwhile, Nvidia $NVDA (below line in yellow) remains stuck Source: LESG, TME

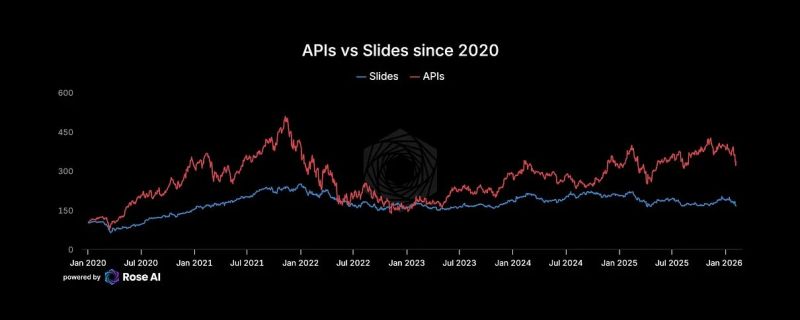

"A pair trade for the AI transition: long API / short slides"

🚨 The "Software is Dead" Narrative is Wrong. You’re Just Looking at the Wrong Software. The market is panicking. The $IGV hashtag#etf is down 30%. The headlines say AI is writing code now, so software companies are toast. 📉 They’re making a massive Category Error. If you're investing without looking at the "plumbing," you're missing the biggest bifurcation of the decade. Here is how the "Singularity" is actually playing out: 1. The Victim: Human-UI SaaS (Type 1) 🖱️ If your software requires a human to stare at a dashboard for 8 hours, you have a target on your back. The Logic: AI agents replace humans. One less Customer Service rep = one less Zendesk seat. One less PM = one less Monday.com seat. The Result: Seat-based SaaS compresses as headcount shrinks. 2. The Winner: Bot-Infrastructure (Type 2) 🤖 AI agents don't have eyes. They use APIs. They don't click; they call. The Logic: One human generates a few clicks an hour. One AI agent generates thousands of API calls per minute. The Winners: The "Tollbooth Operators"—Okta, MongoDB, Snowflake, Datadog. They don't care if the user is a human or a bot; they charge per unit of consumption. Bots consume orders of magnitude more than we do. 🪦 The Real Casualty: The "Body Shops" The IT outsourcing model (Infosys, Wipro, Cognizant) is built on Labor Arbitrage. Hire for $15/hr in Bangalore, bill for $80/hr in NYC. The Problem: AI makes labor arbitrage worthless. You can’t get cheaper than "nearly free." The Proof: India's Big 4 are already cutting thousands of heads. The hiring machine has stopped. 🛑 The Bottom Line: The market is selling "Technology" as a monolith. This is a mistake. AI replaces Road Workers (IT services/Human-UI). AI pays Tolls (Infrastructure/APIs). The Play: Buy the dip in APIs. Short the slides. The infrastructure layer is the only place to hide when the bots take over.

The Chinese leader told his people to hold gold. The people responded. Demand skyrocketed.

Now, the directive has shifted: Get USD off the books. The banks will respond. We aren't just talking about a policy change. We are talking about a fundamental shift in the global monetary order. Why does this matter? Liquidity is shifting: When the world's second-largest economy pivots away from the Dollar, the ripples hit every portfolio. Gold is the anchor: Central banks are returning to "real" assets as a hedge against geopolitical volatility. The Signal: When a superpower tells its financial institutions to de-risk from a specific currency, the "quiet part" is being said out loud. The world is de-dollarizing faster than most people realize. Source: Blomberg, Steno Research

Investing with intelligence

Our latest research, commentary and market outlooks