Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another data source for analyzing BTC and Bitcoin ETFs on the Bloomberg terminal: BTC volatility

James Seyffart @JSeyff

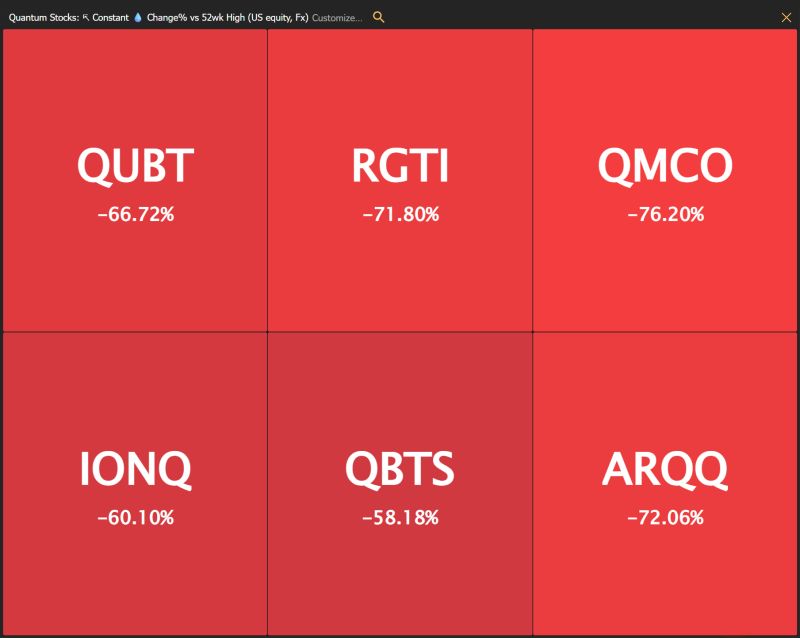

Quantum stocks are down substantially from their 52-week highs...

Source: Trend Spider

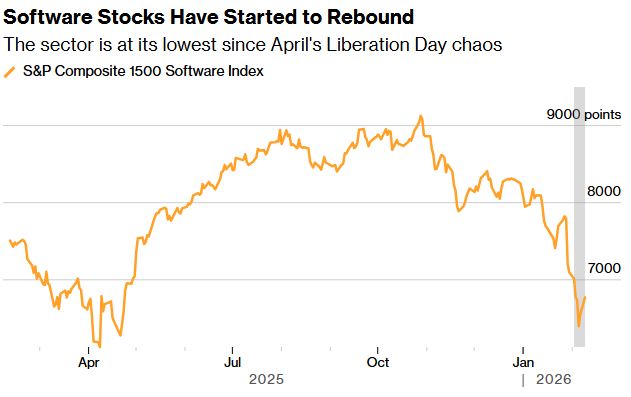

AI FEARS OVERDONE IN SOFTWARE

JPMORGAN: AI FEARS OVERDONE IN SOFTWARE JPMorgan says the selloff in software stocks is overblown, driven by unrealistic fears of near-term AI disruption. Strategists recommend rotating back into high-quality, AI-resilient names. They cite strong fundamentals, high switching costs, and positive earnings trends, naming Microsoft and CrowdStrike as beneficiaries. With 2026 earnings growth forecast near 17%, the team sees a rebound opportunity. Source: *Walter Bloomberg @DeItaone

Another day, another fresh high in skew.

The year-to-date rise is becoming meaningful, with the crowd long and paying up for downside protection. Rising markets alongside rising skew are a combo worth watching closely, and looks pretty similar to last year’s setup... Source; TME

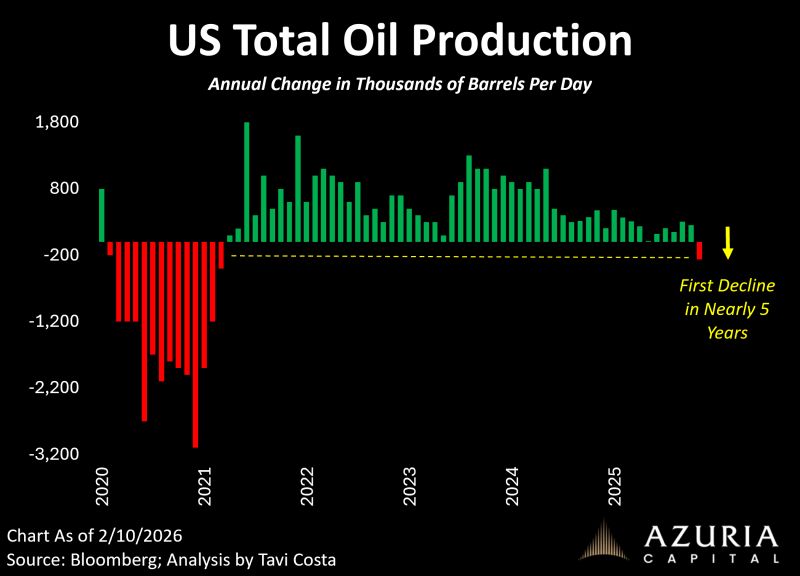

For the first time in nearly five years, total US oil production is declining on a year-over-year basis.

After a roughly 30% drop in active rigs over the past three years, improved drilling technology has not been enough to compensate for reduced capital investment, proving that fundamentals ultimately prevail. Despite this tightening supply, oil remains one of the most heavily shorted assets in over a decade, raising the question of whether prices could be poised for an upward move. Source chart: Tavi Costa

Brace yourselves: "One Shouldn't Panic" At How Bad The January Jobs

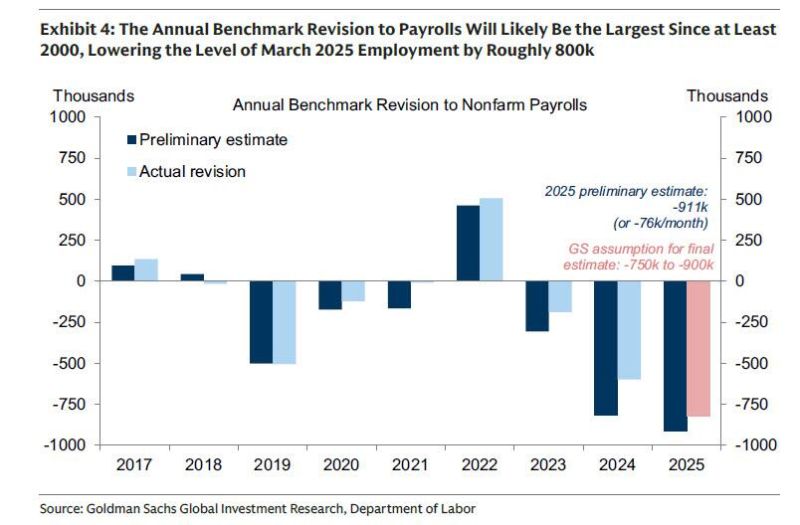

The real focus of Wednesday’s January jobs report is not the monthly headline figure but the major BLS revisions that could erase over one million previously reported jobs, revealing a much weaker labor market than believed. Economists are already preparing markets for softer data, with some suggesting that 50,000 monthly job gains may become the new benchmark amid a federal hiring freeze, productivity gains, and immigration shifts. The report may also appear weaker due to updates to the “birth-death” model, which could eliminate tens of thousands of previously estimated jobs each month. While unemployment is expected to hold around 4.4%, the Fed is closely watching signs that job growth has been overstated, marking a broader transition from labor hoarding to a cooling and more fragile economic environment.

Investing with intelligence

Our latest research, commentary and market outlooks