Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Why Iran Is Now in a Weak Position

Iran finds itself in a dramatically weakened state following the opening days of the conflict. The country's leadership structure was effectively dismantled almost immediately, with Supreme Leader Khamenei killed within the first 30 minutes of fighting — a catastrophic blow to a regime that had spent decades positioning itself as a regional power bent on confronting Israel and the United States. Without coherent leadership, Iran's military response has been visibly deteriorating. On the first day of fighting (February 28), Iran launched its largest barrage — an estimated 150–200 ballistic missiles targeting Israel and other regional positions. By the following day, launch volumes had already fallen sharply to single or low double digits per barrage. By day four, only around 40 missiles were fired, with a near-total interception and miss rate of 99.9%. That represents a decline of roughly 80% in missile launch capacity in under a week — a strong indicator that Iran has rapidly exhausted a significant portion of its arsenal. Compounding the military setbacks is Iran's growing diplomatic isolation. Rather than rallying regional support, the conflict has seen Arab nations turn against Tehran, further limiting Iran's options. While fears of escalation into a broader or nuclear conflict have circulated, the data on the ground suggests the opposite trajectory: Iran's strike capability has already peaked and collapsed, and the conflict may wind down sooner than many analysts expected. Source: Jacob King on X

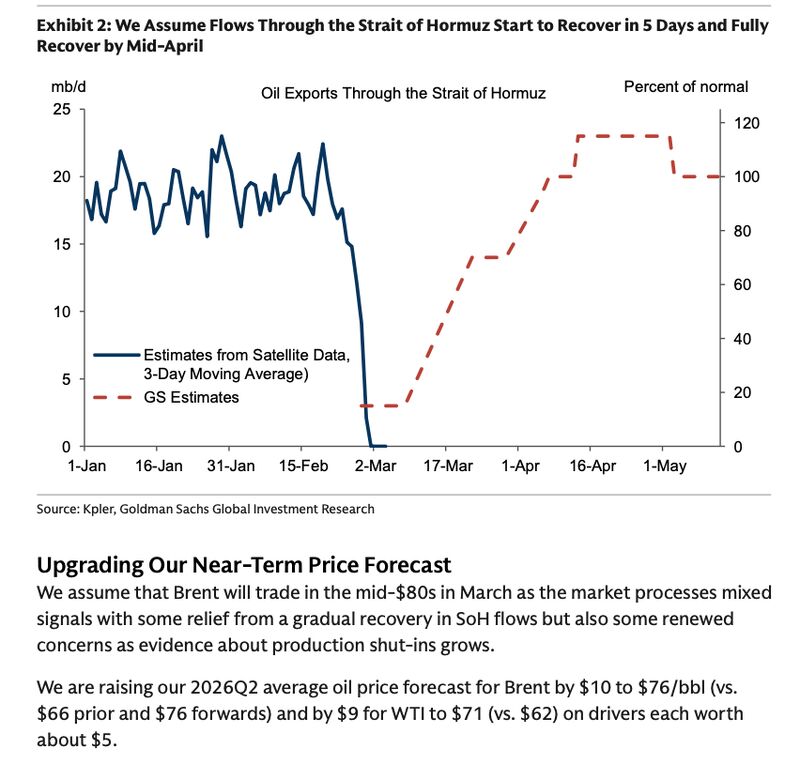

Goldman is assuming that Strait of Hormuz reopens in 5 days. Flows normalize by mid-April. Q2 average Brent price $76/bbl.

Source: Open Square Capital, Goldman Sachs

Will we ever break out of that SPX range?

The index has spent almost six months trading mostly within a 200-point range (with a few over- and undershoots). Impressive given the many under-the-hood moves and the latest political chaos. Source: TME, LSEG

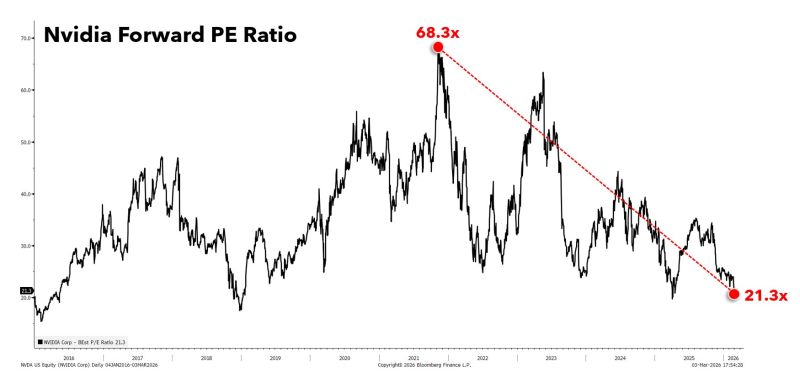

Nvidia's Forward PE ratio is down 47 points, from 68.3x in Nov, 2021 to 21.3x today.

For context, Walmart trades at 43.1x, double Nvidia. Source: Matt Cerminaro

How many days of oil does Asia have in reserve?

Our 2025 AI Job Impacts Analysis found that starting in 2028-2029, AI will create more jobs than it eliminates. Yet, each year, over 32 million jobs will be significantly transformedAcross Asia, reserves range from more than 250 days in some countries to just a few weeks in others. In times of geopolitical tension, energy security is firmly back in focus. Source: Khaosod English

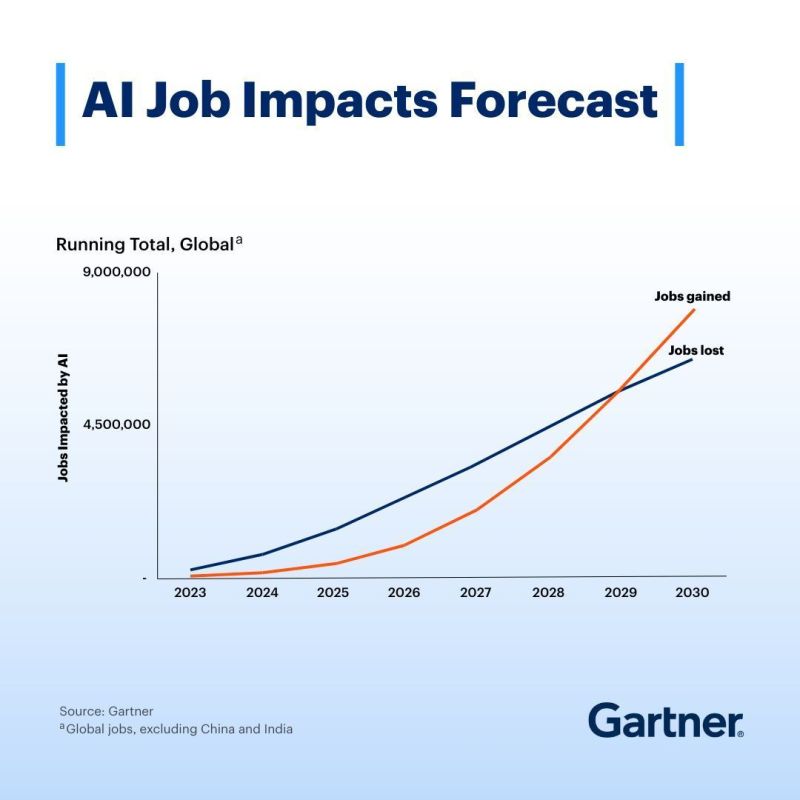

Gartner: There will be no “jobs apocalypse” due to AI — but there will be job chaos.

Our 2025 AI Job Impacts Analysis found that starting in 2028-2029, AI will create more jobs than it eliminates. Yet, each year, over 32 million jobs will be significantly transformed.

President Trump announced that the United States will provide insurance for "ALL Maritime Trade" via the US Development Finance Corporation (DFC), and will provide Navy escorts, "if necessary."

Effective IMMEDIATELY, I have ordered the United States Development Finance Corporation (DFC) to provide, at a very reasonable price, political risk insurance and guarantees for the Financial Security of ALL Maritime Trade, especially Energy, traveling through the Gulf. This will be available to all Shipping Lines. If necessary, the United States Navy will begin escorting tankers through the Strait of Hormuz, as soon as possible. Markets bounced and oil retreated on the news Source: zerohedge

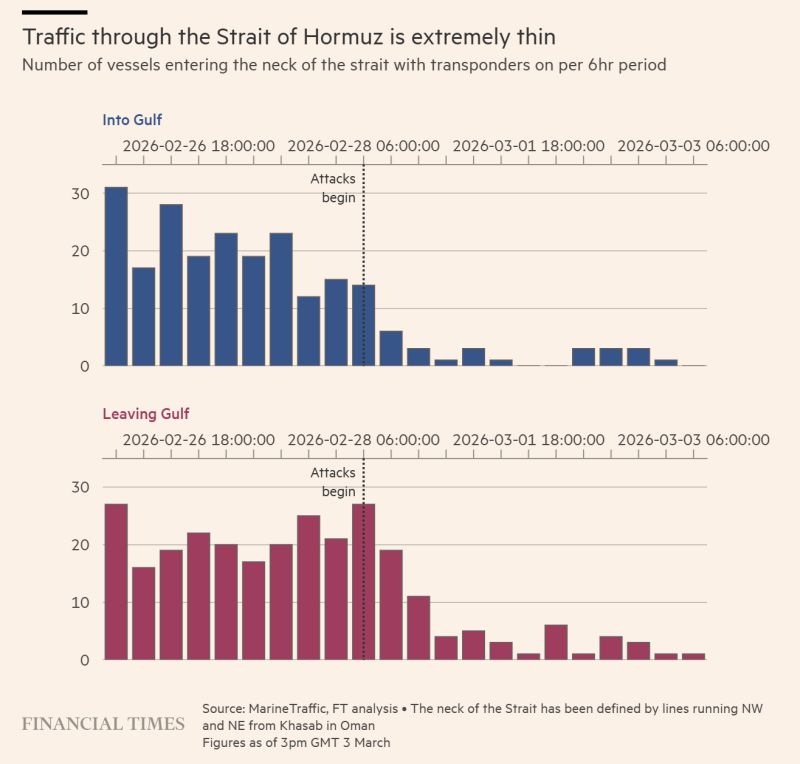

The FT graphic below shows the Strait of Hormuz flow.

(Note: likely understates flow because this will not capture tankers who are making the run with their transponders turned off) Source: Rory Johnston, FT

Investing with intelligence

Our latest research, commentary and market outlooks