Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

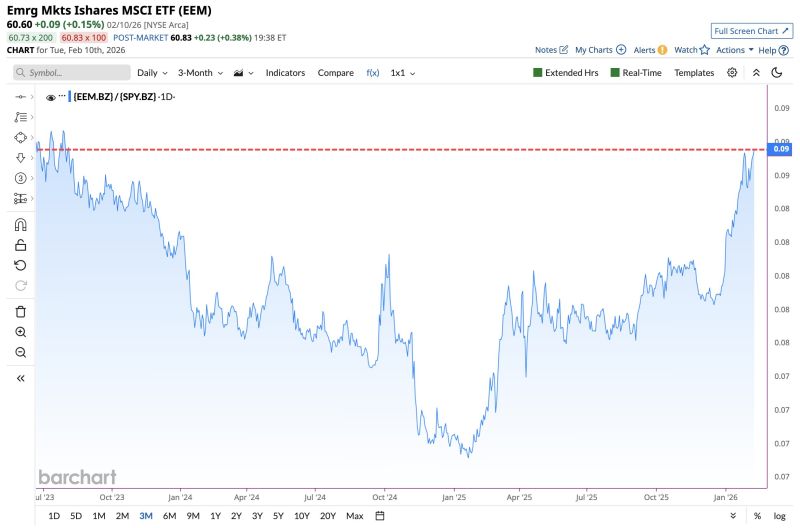

Emerging Market Stocks now outperforming U.S. Equities by the largest margin since 2023

Source: Barchart @Barchart

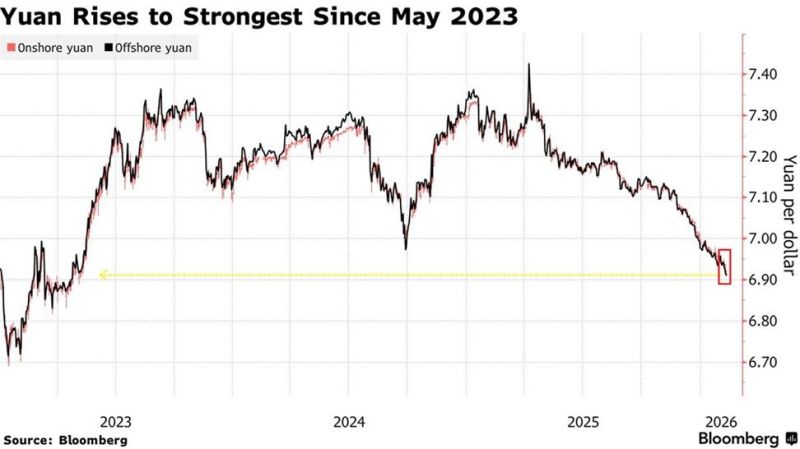

The Chinese Yuan has strengthened to 6.91 against the US Dollar, the strongest since May 2023.

The Yuan is now on track for its 7th consecutive monthly gain, the longest streak since 2020-2021, up+5% since 2025. It has also been the 3rd-best-performing currency in Asia since September. The most recent move comes after Chinese regulators advised banks to limit purchases of US Treasuries and instructed those with high exposure to pare down positions. China is benefiting from the US Dollar's weakness. Source: The Kobeissi Letter, Bloomberg

The "Old Guard" of Finance is officially on notice.

For years, complex tax planning was a key competitive advantage for expensive firms because it was slow, manual, and mentally demanding. Altruist has disrupted this model with Hazel AI, which can instantly analyze documents like tax returns, pay stubs, and meeting notes to generate personalized strategies in real time—turning days of back-office work into minutes. It enables advanced “what-if” scenario modeling for bonuses, home sales, retirement, and lifestyle changes through interactive dashboards, while addressing security concerns with zero-data-retention policies. At just $60 per month, it democratizes sophisticated tax optimization tools previously reserved for the ultra-wealthy, shifting power toward independent advisors. The message is clear: simply understanding tax returns is no longer enough—advisors who leverage AI to enhance insights and strengthen client relationships will be the ones who thrive. Source : Davis Janowski

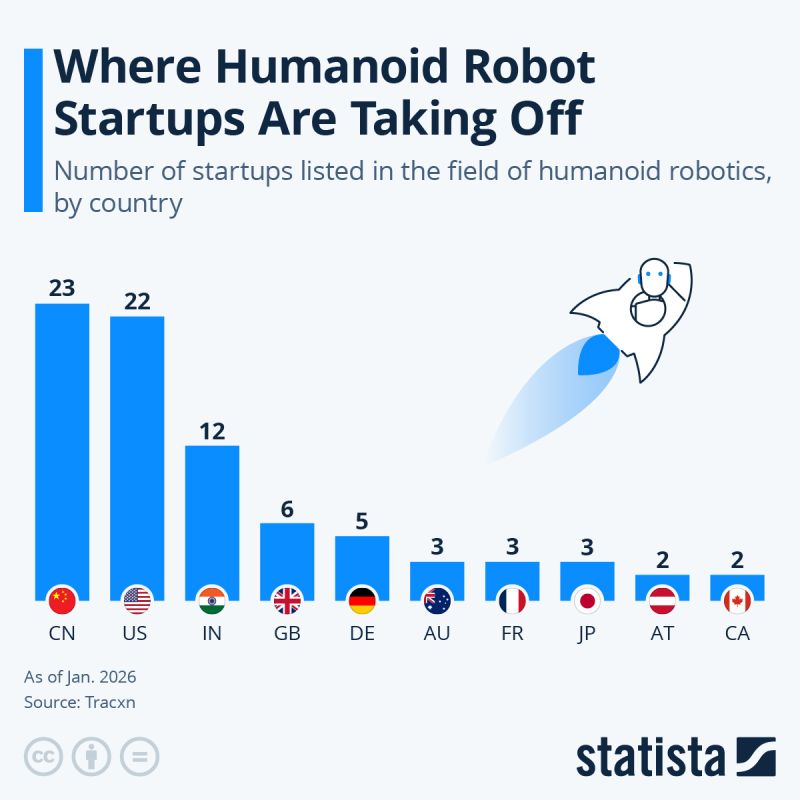

The "Humanoid Revolution" just hit escape velocity.

If you thought humanoid robots were still "science fiction," the 2025 investment data is a massive wake-up call. We aren't just dreaming about the future anymore—we’re funding it at a record-breaking scale. The $2.65 Billion "All-In" Moment: In 2025 alone, investors poured $2.65 billion into humanoid startups. To put that in perspective: That is more than the previous six years combined. The smart money has officially decided: Humanoids are no longer "lab experiments." They are commercial assets. The Global Leaderboard: It’s a two-horse race at the top, but the gap is closing fast: 🇨🇳 China: Leading with 23 specialized startups. Companies like Unitree and Agibot are already churning out 5,000+ units a year. 🇺🇸 USA: Right behind with 22 startups. Big names like Tesla (Optimus) and Boston Dynamics (Atlas) are gearing up for a massive 2026 industrial rollout. 🇮🇳 India: The surprise "dark horse" in 3rd place with 12 startups. 🇪🇺 Europe: Holding steady with hubs in the UK (6), Germany (5), and France (3). Why this matters now: We are moving from the "Look what it can do!" phase to the "Look how many we can build" phase. With China leading on sheer volume and the US leading on high-end integration, the race for the "labor force of the future" is officially on. Source: Zerohedge, statista

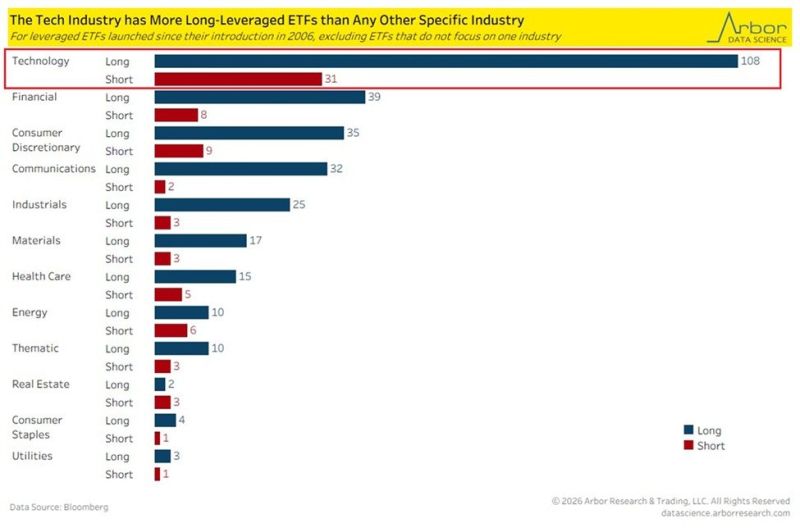

Is the tech sector building a house of cards?

There are now 139 tech-related leveraged ETFs (108 long, 31 short). That is 3x more than the next largest sector (Financials). To put that in perspective: Tech now has more leveraged ETFs than Financials, Consumer Discretionary, and Communication Services COMBINED. 🤯 We’ve moved past simple indexing into a world of hyper-fragmented, high-octane gambling vehicles. Source: The Kobeissi Letter, Arbor Research & Trading

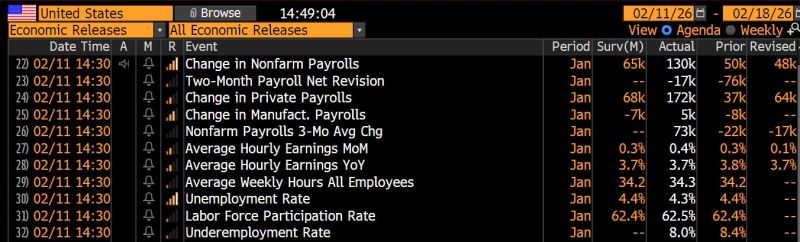

The January jobs report just SMASHED expectations.

Establishment Survey showed 130k new payrolls, well above 65k consensus estimate – and ahead of “whisper numbers” that were closer to 50k or even lower. This is the strongest number since April 2025... And here’s the kicker: -34,000 GOVERNMENT jobs. Private sector up. Government down ‼️ According to Household Survey, employment jumped by 528k in January, pushing the unemployment rate down to 4.3% from 4.4% in December. US Treasuries are selling off in response, with US 10y yield up 6bps. This better than expected report has caused odds of a rate cut in March to drop from around 20% to 6%. Source: Bloomberg, HolgerZ

A very important development for global markets ‼️

➡️ JGBs long-term bond yields are moving LOWER (see below the 30Y over the last month) while the Yen is firming against dollar (From nearly 158 on Sunday evening to roughly 155 this morning, it’s been a significant move in USDJPY). Takaichi landslide victory - which implies fiscal stimulus & tax cuts - hasn't trigger a bond or yen crash. Quite the contrary. Meanwhile, Japan equities continue to move upward. This is quite a compelling development overall for Japan macro & markets landscape.

🔴Hedge funds are pulling back from gold at the fastest pace in months:

Net long positions in gold dropped -23% last week, to 93,438 contracts, the lowest in 15 weeks and near the lowest in at least 12 months. This comes after gold suffered its biggest single-day plunge since 2013 on January 30. Net long positioning has now fallen -60% from the February 2025 peak of ~240,000 contracts. Hedge fund sentiment on precious metals is shifting rapidly. Source: Global Markets Investor, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks