Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

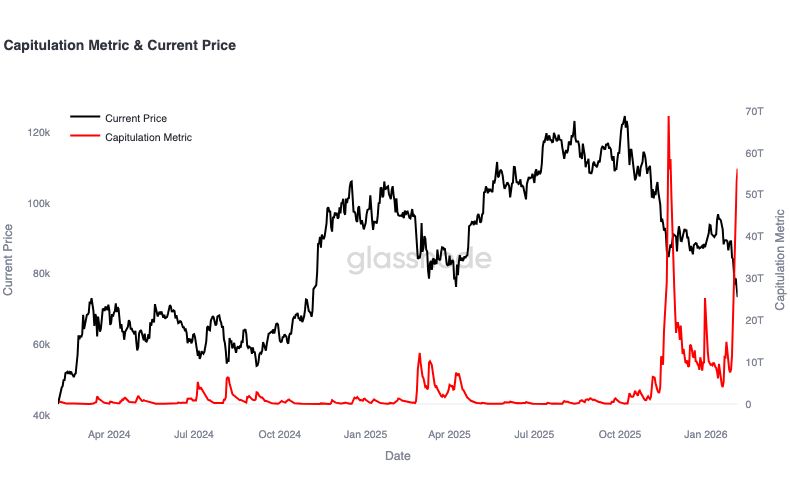

Bitcoin is experiencing severe sell-off pressure, with one of the worst days of the decade similar to past crisis moments (COVID crash, Terra Luna, FTX).

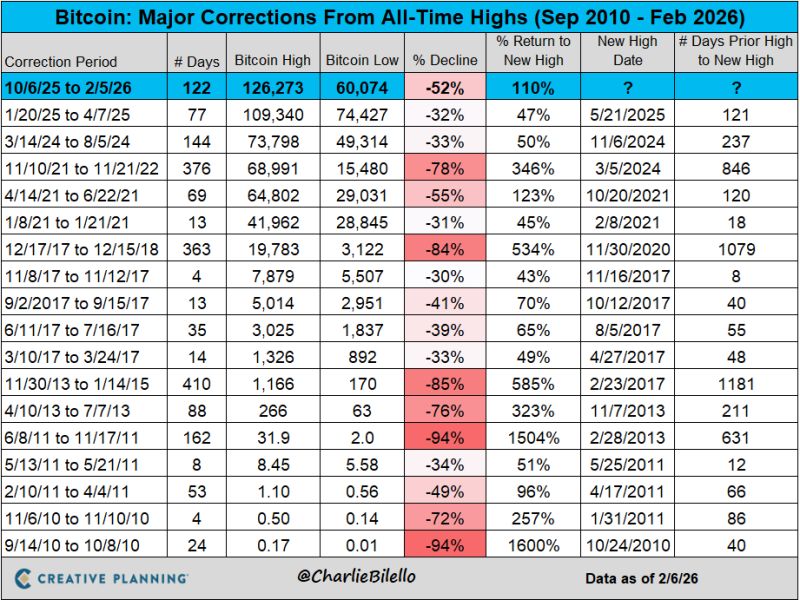

BTC is extremely oversold: daily RSI hit 16 and weekly RSI fell below 30 for only the 4th time ever. Historically, buying at these levels and holding for one year has delivered strong returns (+112% in 2015, +136% in 2019, +26% in 2022). Source: Trendspider

Big Tech is spending massively in AI as they all want to win the "AI war".

The combined 2026 capex for the Mag 7 now totals $655 BILLION. To put things in perspective, the German government special infrastructure fund is totalling €500 billion OVER 12 YEARS... ‼️ Source: The AI Investor

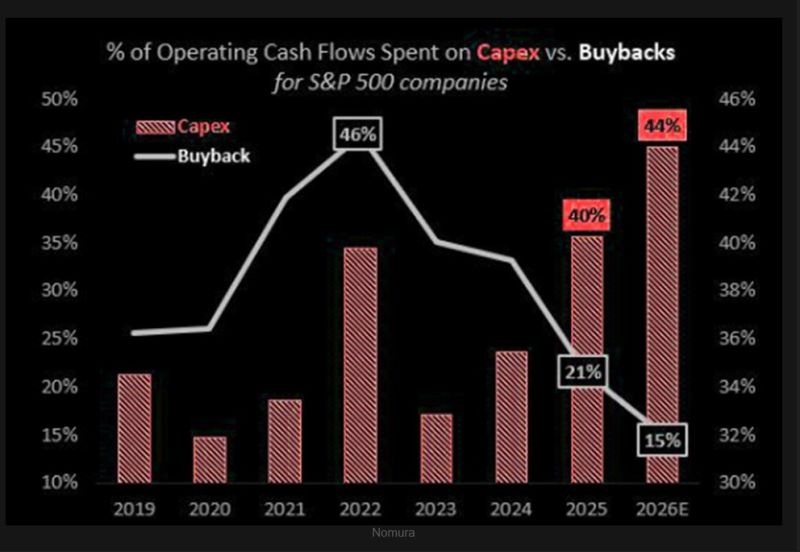

The End of the Buyback Era?

Mega-cap tech in the S&P 500 is undergoing a major shift. Before: buybacks exceeded CapEx, supporting valuation multiples. Now: CapEx exceeds buybacks, driven by the AI arms race.

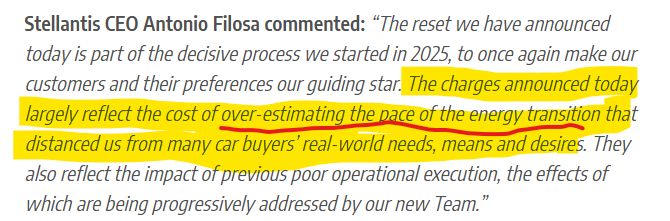

Shares of automaker Stellantis plunged 23% in European trading on Friday

The company said it expects to take a 22-billion-euro ($26 billion) hit from a business reset and hinted at a pull-back from its electrification push. After Ford and General Motors announced large write-downs linked to their EV strategy, today Stellantis has announced it will take ~€22 billion ($26 billion) in impairments as it scales back its EV plans. With a brutal admission by the CEO ⬇️ Source: Javier Blas

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning". Source: Glassnode

US companies announced the largest number of job cuts for any January since the depths of the Great Recession in 2009

according to data from outplacement firm Challenger, Gray & Christmas Inc Source: Bloomberg

To put things in perspective...

The Amazon $AMZN CAPEX estimates ($200B for 2026) aren’t even on the screen on the Bloomberg GF page yet… Source: Bloomberg, RBC

At yesterday's low of $60k, bitcoin was down over 52% from its October 2025 peak.

This was its 9th 50+% decline off an all-time high since it began trading on exchanges back in 2010. $BTC Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks