Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

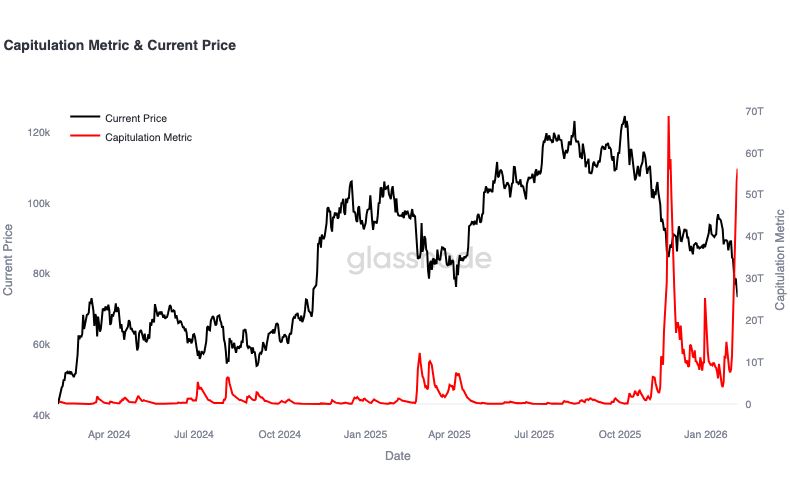

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning". Source: Glassnode

US companies announced the largest number of job cuts for any January since the depths of the Great Recession in 2009

according to data from outplacement firm Challenger, Gray & Christmas Inc Source: Bloomberg

To put things in perspective...

The Amazon $AMZN CAPEX estimates ($200B for 2026) aren’t even on the screen on the Bloomberg GF page yet… Source: Bloomberg, RBC

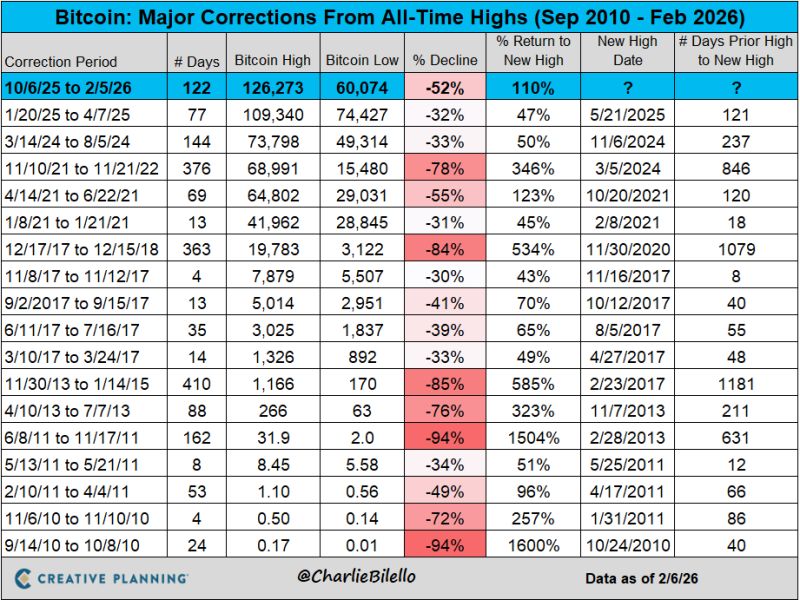

At yesterday's low of $60k, bitcoin was down over 52% from its October 2025 peak.

This was its 9th 50+% decline off an all-time high since it began trading on exchanges back in 2010. $BTC Source: Charlie Bilello

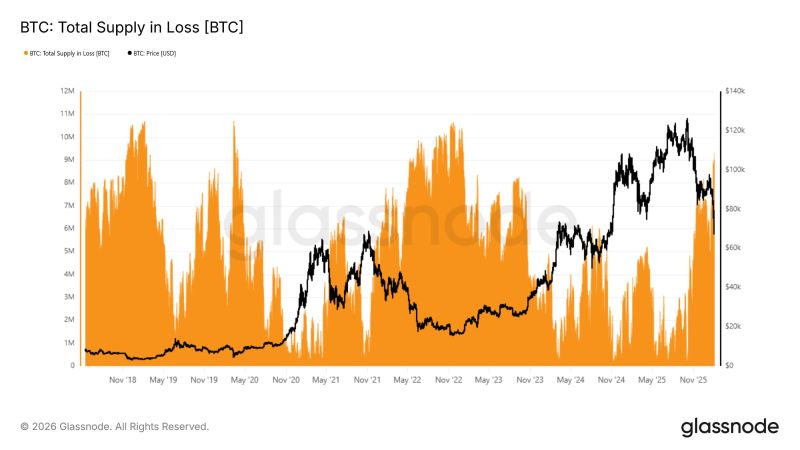

Over 9.3M Bitcoins are underwater, the highest supply in loss since January 2023, per Glassnode.

Source: www.cointelegraph.com

The economy is K-shaped. Premium spending remains strong while economy spending falls

Source: Blackstone investment outlook

Will the Nasdaq see the same pattern we saw from Nov ’24 into the Feb ’25 selloff???

This time, we consolidated since last November, and suddenly things look ugly again. Last year’s real puke began when NASDAQ broke the 100-day MA. We’re seeing that exact break today. Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks