Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Chinese Stocks jump to highest prices in more than a decade

Source: Barchart

Trump with European leaders sitting around his desk is the best photo of 2025.

Source: Mike Crispi @MikeCrispi

What if failure is just a step?

You do not need a perfect track record to succeed, but rather the courage to explore, learn, and try again, since even iconic entrepreneurs stumbled before building something that shaped the world. Source: agrassoblog.org

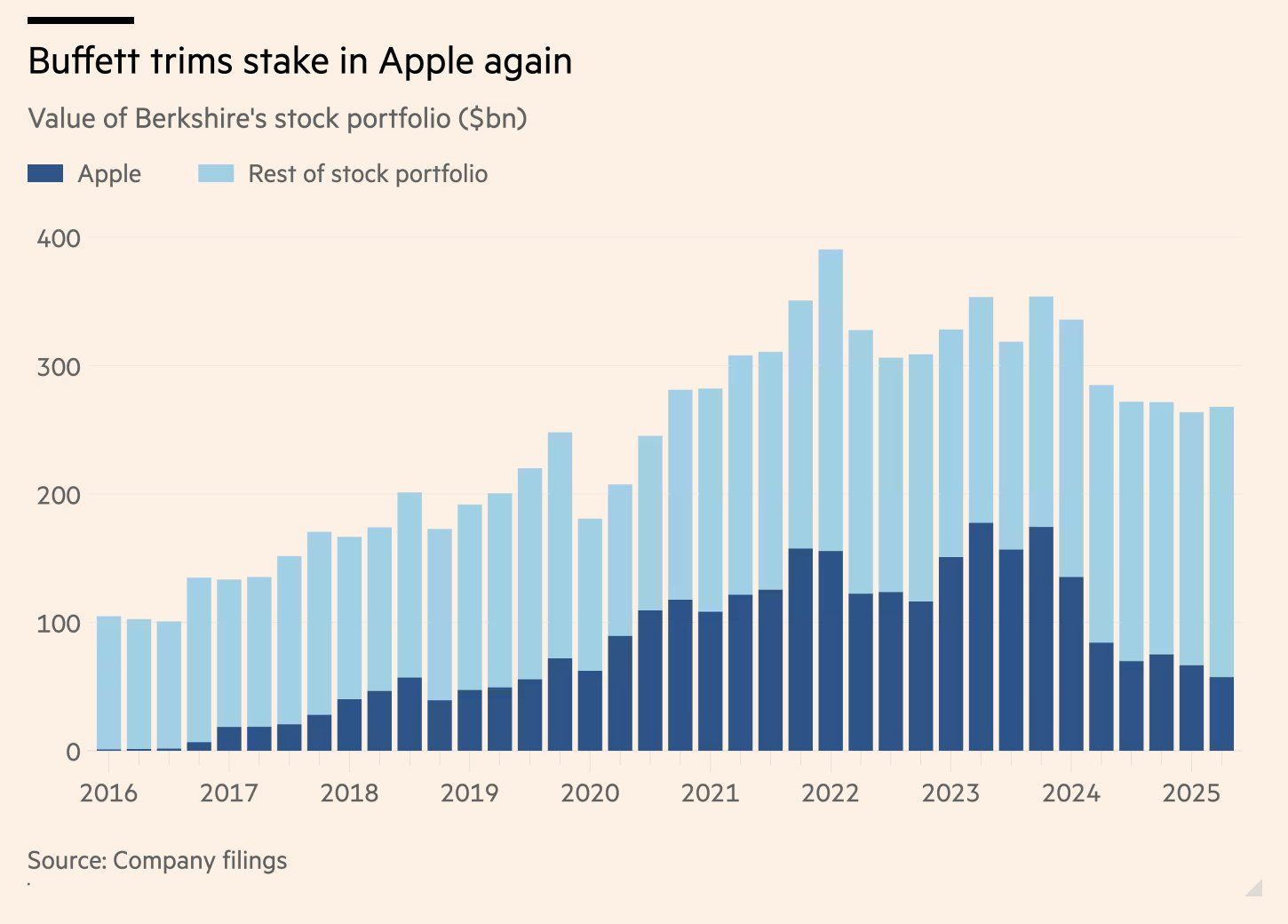

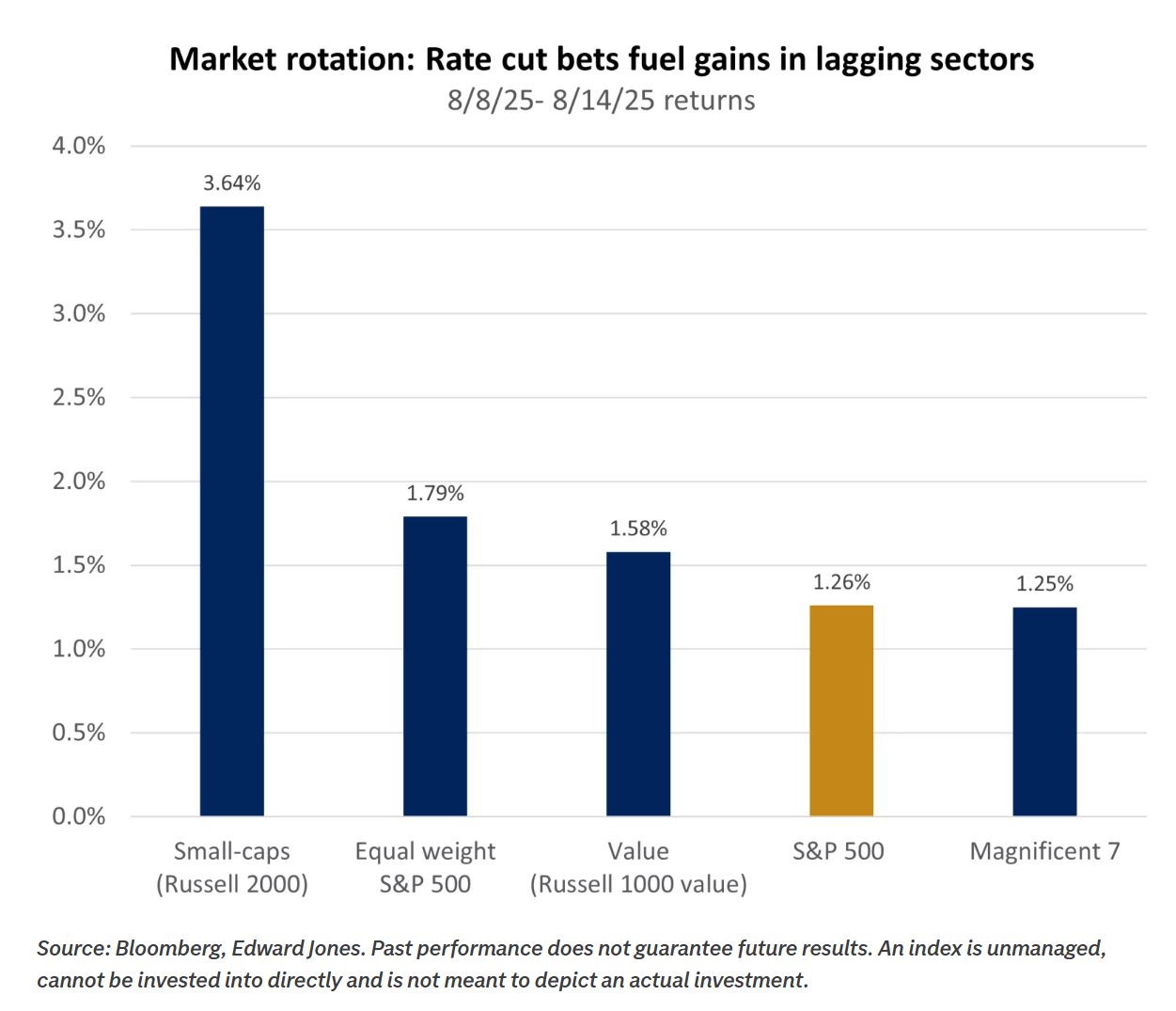

Last week we have see an interesting sector / size /style rotation within us equities.

The chart below - courtesy of Edward Jones - shows weekly returns for various indexes following the CPI release. Lagging segments of the market appeared to receive a boost from rising expectations of rate cuts. Source: Edward Jones

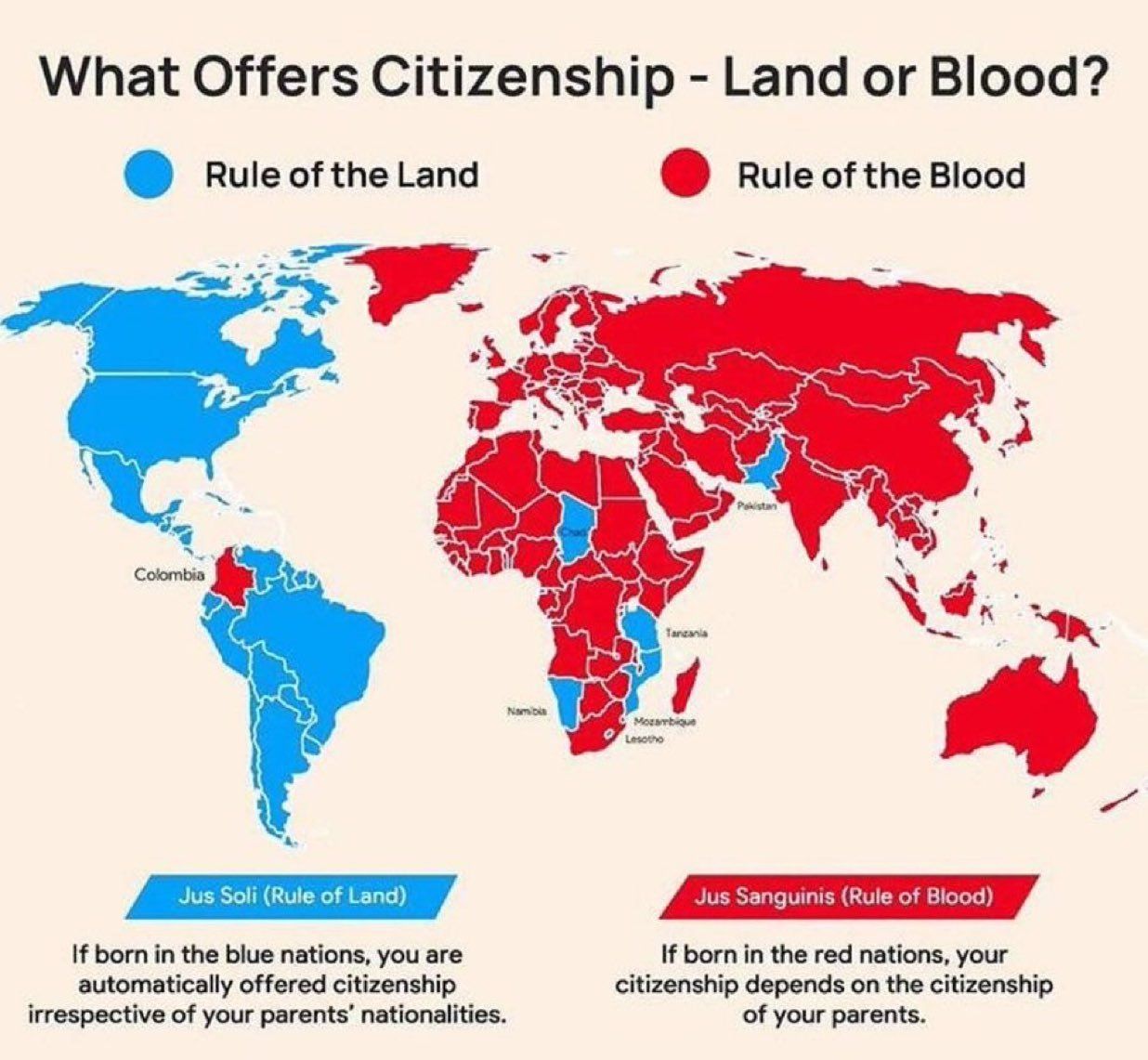

Citizenship: Land vs. Blood

This map shows most of the world ties citizenship to bloodline, locking millions out unless their parents qualify. Only a handful of countries offer citizenship by birthplace, instantly granting nationality to anyone born on their soil. Source: @TheRabbitHole84 thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks