Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 JPMorgan now expects the Fed to cut rates four times in 2025, starting as early as September and bringing the benchmark down to 3.25%–3.5%.

Source: CryptosRus @CryptosR_Us

German 30y bond yields climbed to 3.35%, the highest level since 2011.

Investors are demanding higher term premia as the surge in bond supply weighs on the market. Source: HolgerZ, Bloomberg

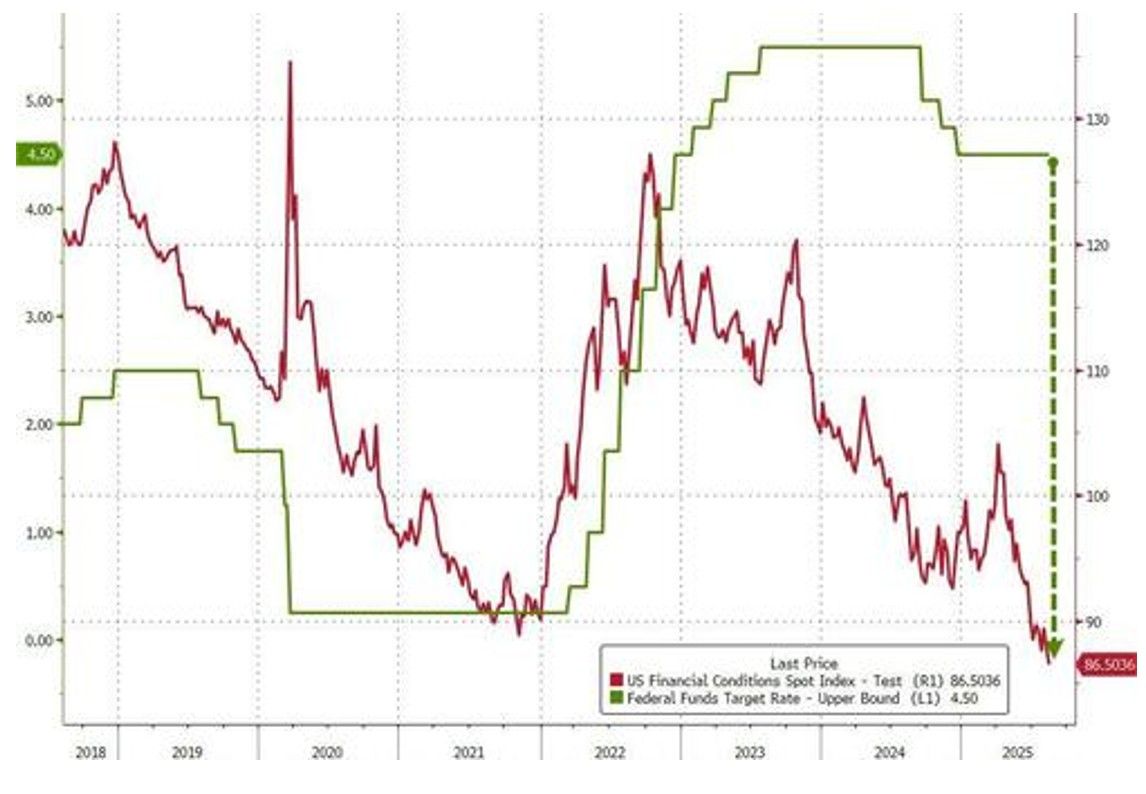

Ahead of Jackson Hole this week, we note that US Financial Conditions are basically at their loosest in the post-COVID era...

Source: zerohedge

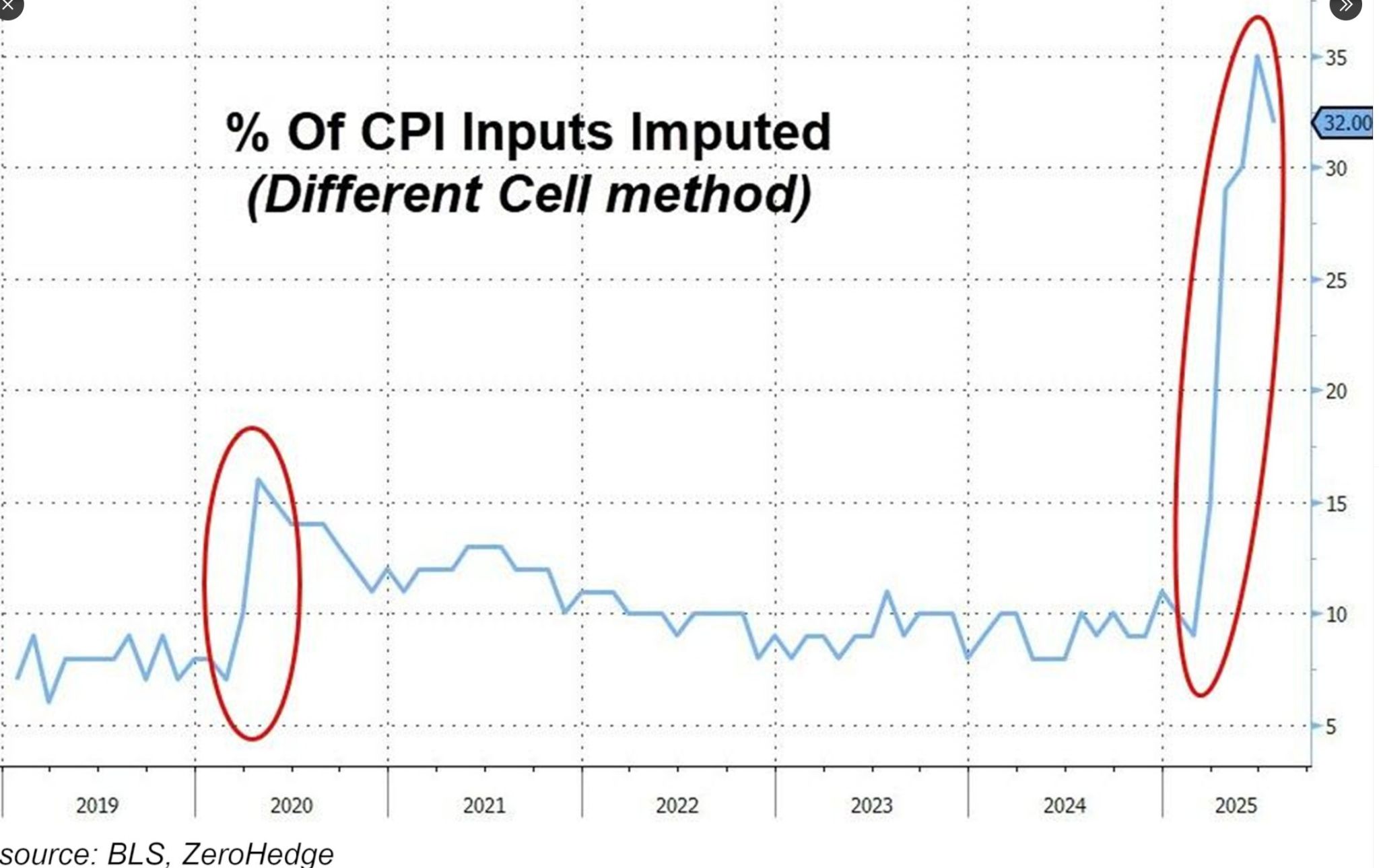

🚨A very interesting chart: The BLS collects roughly 90,000 price quotes each month across 200 categories to calculate CPI.

Normally, about 10% of prices are estimated when data is missing. Now around 32% are MADE UP, based on assumptions, not real prices, double the share seen in the 2020 Crisis... Source: Global Markets Investors, BLS, zerohedge

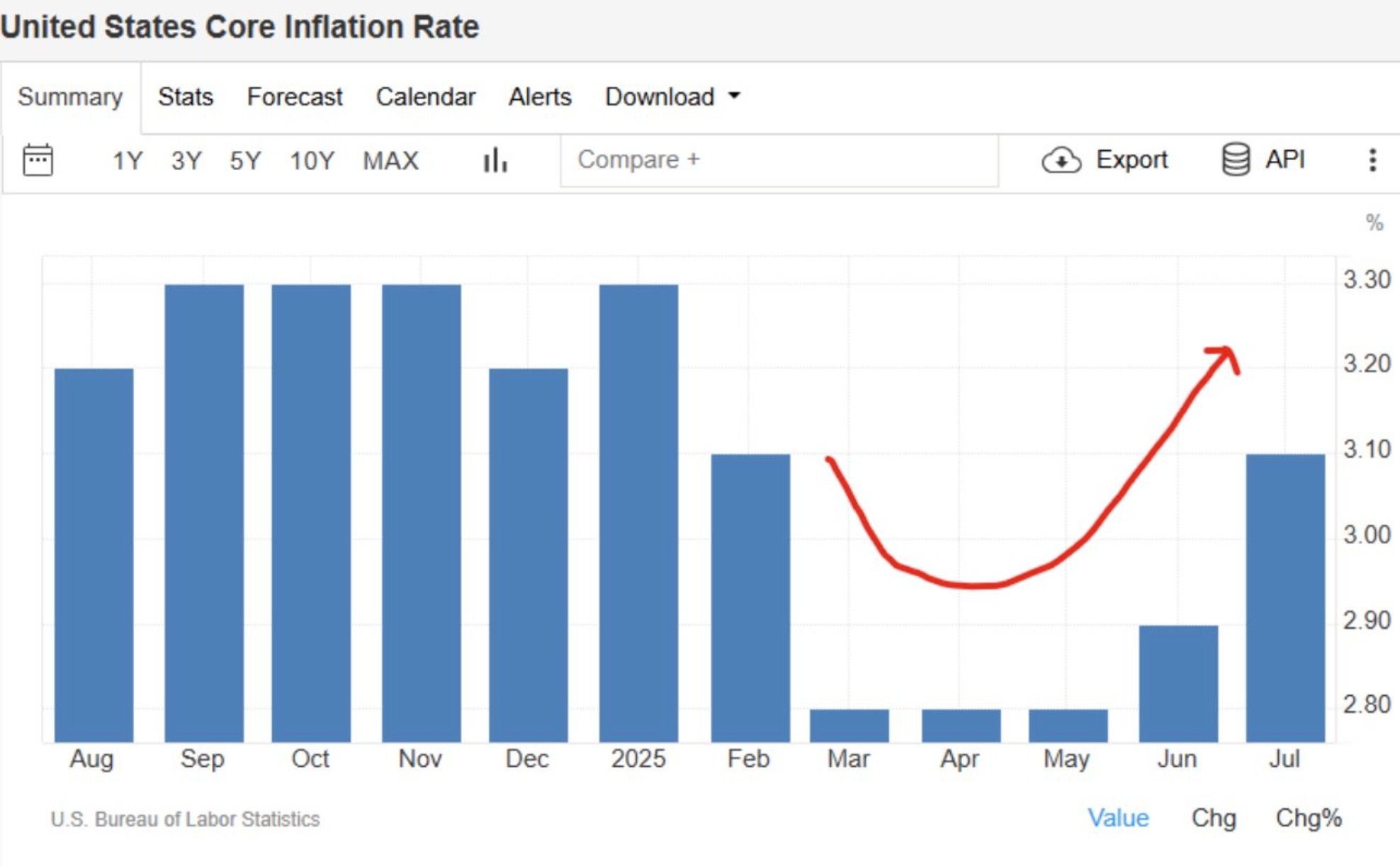

Another look at us core inflation...

What do you see? Do you think it is steady? "A picture is worth 10,000 words" Source: Andrea Lisi, CFA @Andrea_Texas_82

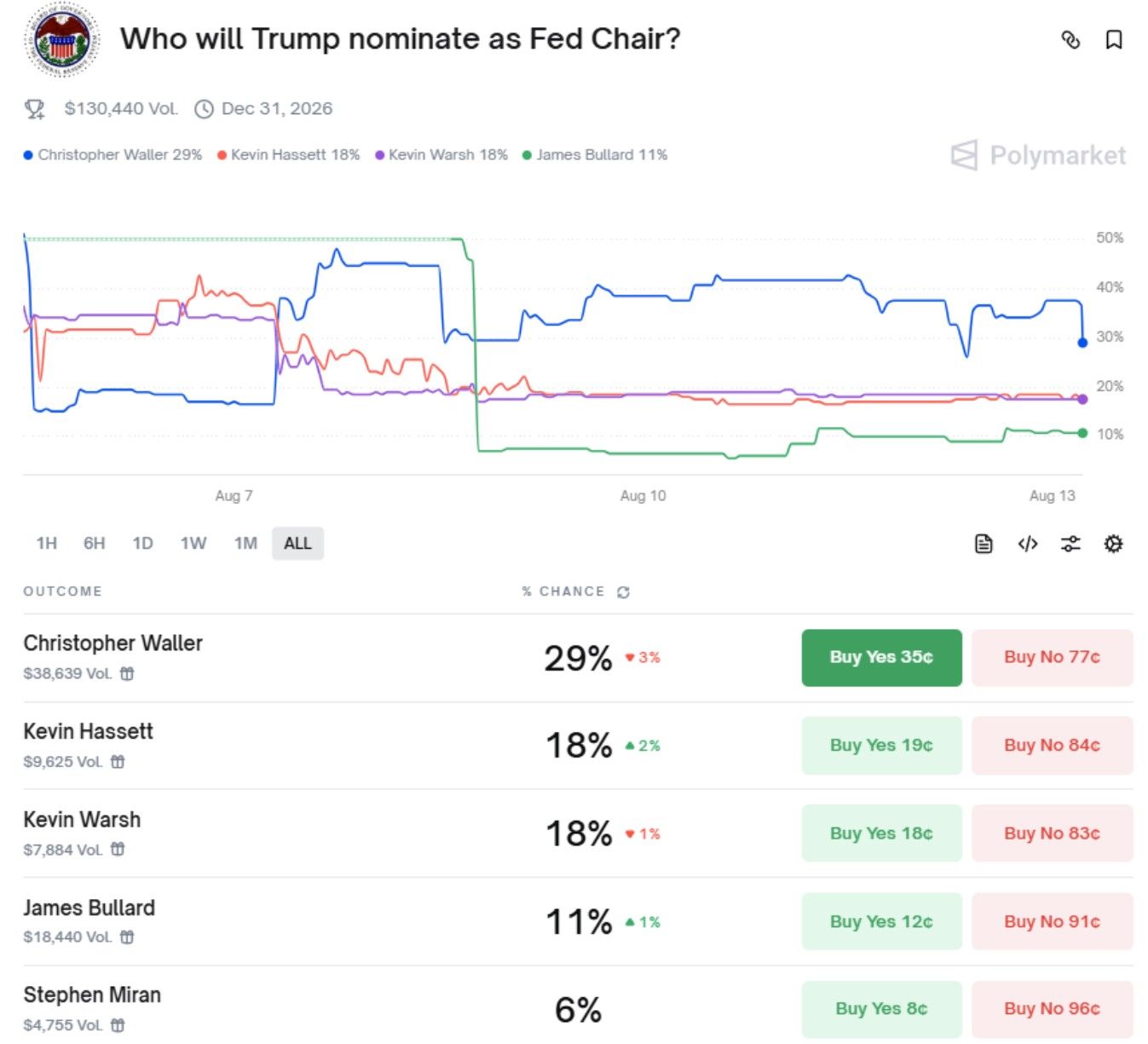

President Trump is reportedly eyeing 11 names to replace Fed chair Powell

Full List: 1. David Zervos -- Chief Market Strategist at Jefferies 2. Kevin Warsh -- Former Federal Reserve Governor 3. Rick Rieder -- CIO for Global Fixed Income at BlackRock 4. James Bullard -- Former St. Louis Fed President 5. Michelle Bowman -- Fed Vice Chair for Supervision 6. Chris Waller -- Fed Reserve Governor 7. Philip Jefferson -- Fed Vice Chair 8. Marc Summerlin -- Former economic advisor in the George W. Bush admin 9. Lorie Logan -- Dallas Fed President 10. Kevin Hassett -- Director of the National Economic Council 11. Larry Lindsey -- Former Fed Reserve Governor Polymarket lists Waller at +250 for next Fed Chair. Source: Polymarkets, Shay Boloor @StockSavvyShay

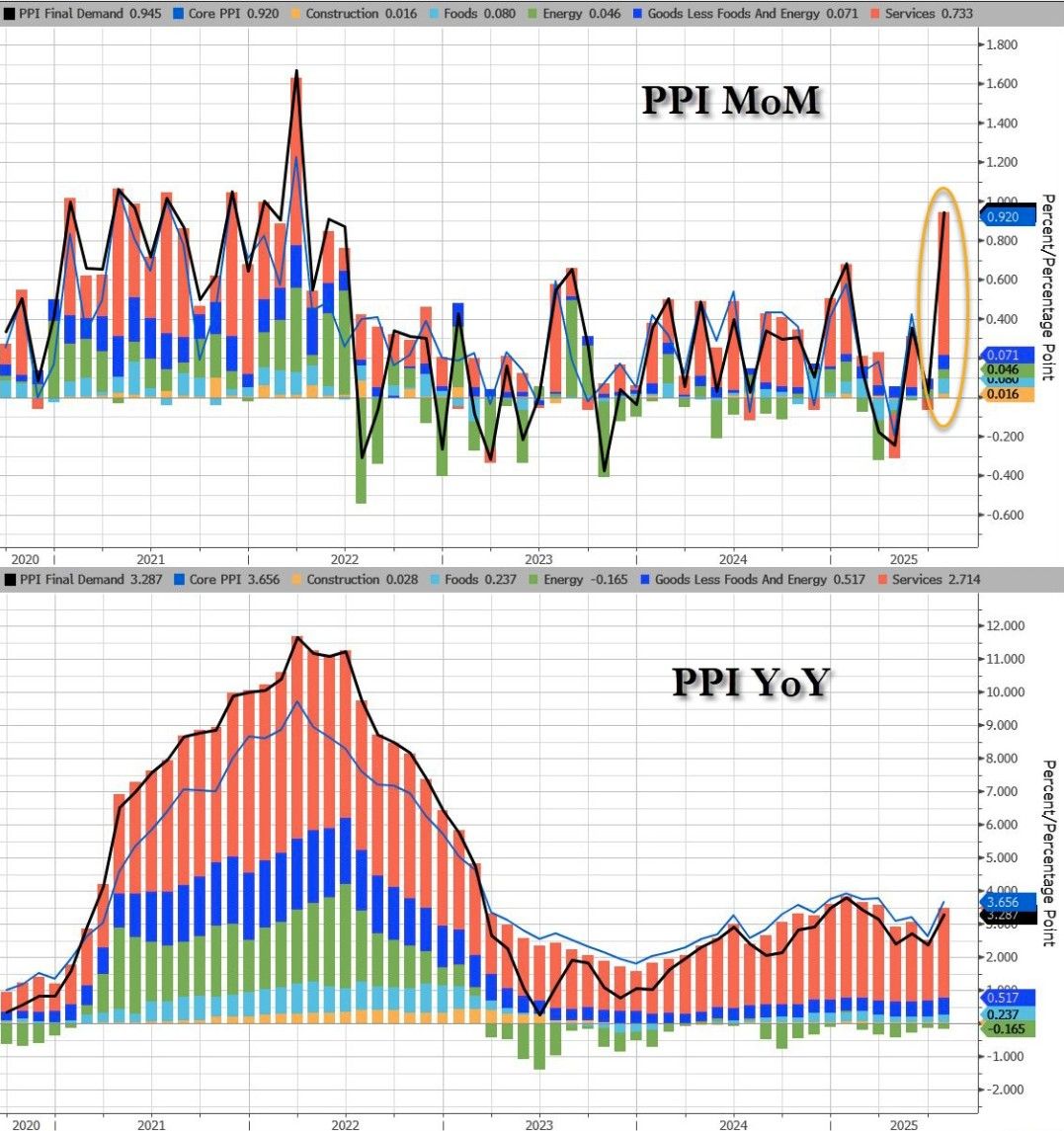

😨 Well, that’s not good…

Maybe "Too late Powell" is that that late... • PPI: 3.3% YoY vs. 2.5% est. • PPI: 0.9% MoM vs. 0.2% est. • Core PPI: 3.7% YoY vs. 3.0% est. • Core PPI: 0.9% MoM vs. 0.2% est. ‼️This is PPI MoM hottest since March 2022 as services PPI explode higher Over half of the increase is attributable to margins for final demand trade services, which jumped 2.0% 🤢 Our take 👇 ▶️ The higher than expected producer prices seems to confirm the underlying price pressures in the service sector already exhibited in the consumer price indices ▶️ This is bad news for the hashtag Fed in his fight against inflation. Market expectations for several key rate cuts in the next months will likely get partially priced out now. ▶️ We stick to our view that the current trade and overall economic environment in the USA will not let the US-Fed to lower its rate by more than 1 cut for the remainder of the year.

Bitcoin fell below $119,000 on Thursday after US Treasury Secretary Scott Bessent said the government will not make new BTC purchases to fund a Bitcoin reserve.

▶️ Treasury secretary Scott Bessent says the US will not be buying any bitcoin ▶️They will hold the $15-$20 billion in bitcoin they already have and confiscate more ▶️The statement contrasted with President Donald Trump’s earlier executive order directing the government to develop “budget-neutral strategies” for increasing Bitcoin holdings. ▶️In April, Bo Hines, who at the time was a part of the Presidential Council of Advisers for Digital Assets, said the administration was exploring funding options for Bitcoin acquisitions, including tariff revenue and a reevaluation of the Treasury’s gold certificates. ▶️In a silver lining to the sentiment-dampening statement, the Bessent did confirm that the US does not plan to sell any of its existing Bitcoin holdings ▶️Bessent’s comments echo White House AI and crypto czar David Sacks, who said a Bitcoin reserve would be “a digital Fort Knox for the cryptocurrency,” and the US wouldn’t sell any Bitcoin it put in the reserve. Source: cointelegraph

Investing with intelligence

Our latest research, commentary and market outlooks