Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

😨 China’s economy slowed across the board in July with factory activity and retail sales disappointing, suggesting the world’s No. 2 economy is losing traction

‼️ China Retail Sales rose 3.7% Y/Y in July, well below consensus of 4.6%. This is the weakest reading since November 2024. On a month-over-month basis, retail sales declined for a second consecutive month, by -0.1%. ‼️China Industrial Production rose 5.7% Y/Y in July, missing consensus of 5.9% and slowing from June's 6.8%. This marks the weakest pace of growth since January. The sequential M/M growth rate also slowed to 0.4%. 🔴 China Economic data👇 ▶️ July retail sales 3.7% y/y [Est.4.6%] ▶️July industrial growth 5.7% y/y [Est.5.9%] ▶️Jan-Jul fixed asset investment 1.6% y/y [Est.2.7%] ▶️ July Unemployment 5.2% [Prev. 5.1%] Note that while China's industrial production continues to run well above the pre-COVID trend, real retail sales have diverged further away from the pre-COVID trend. Source: Augur Infinity

An important remainder by Otavio Costa

Inflation data came in hotter than expected, but it is not just about tariffs. Inflation is fundamentally a monetary phenomenon. You don’t solve it with a 7% fiscal deficit and a money supply hitting record highs. Source: Tavi Costa, Bloomberg

US margin debt has hit $1 trillion for the first time in history.

This is a ~65% surge over the last 3 years. Source: Global Markets Investors

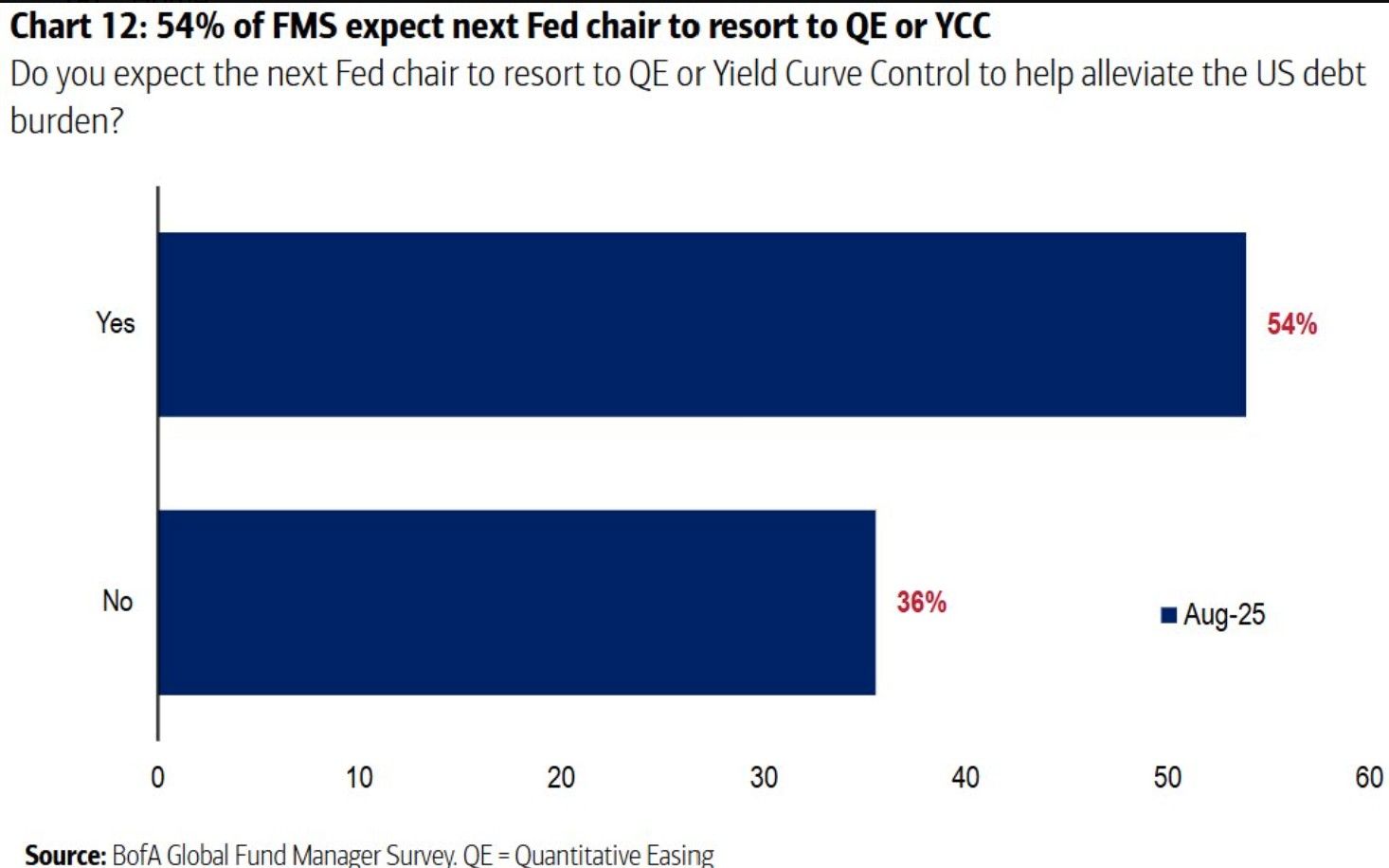

The majority of managers (via the BoA survey) see a return to QE or YCC to deal with the super-sized fiscal deficit.

This will be CPI inflationary, but with 10y bond yields pinned to (say) 4% maybe stocks might like that outcome for a while, before reality hits home. Source: Albert Edwards, H/T @johnauthers, BofA

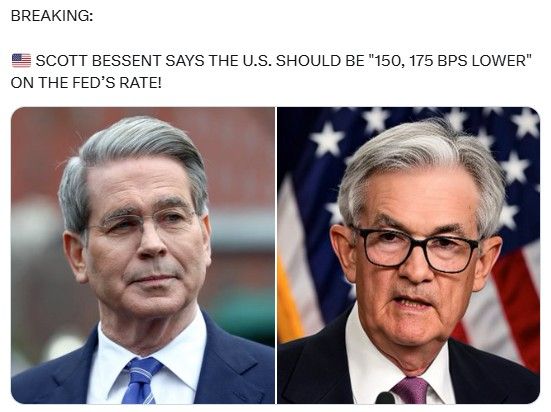

🔴 Scott Bessent says the U.S. should be "150, 175 bps lower" on the Fed's rate ‼️

😨 Vows to cut 50 bps at next Fed meeting. ⚠️ Bashes critics saying he can't be head of treasury and Fed at the same time - “If Elon can run two things at once, why can't I?” 🚀 🚀 🚀 Source: Coinvo

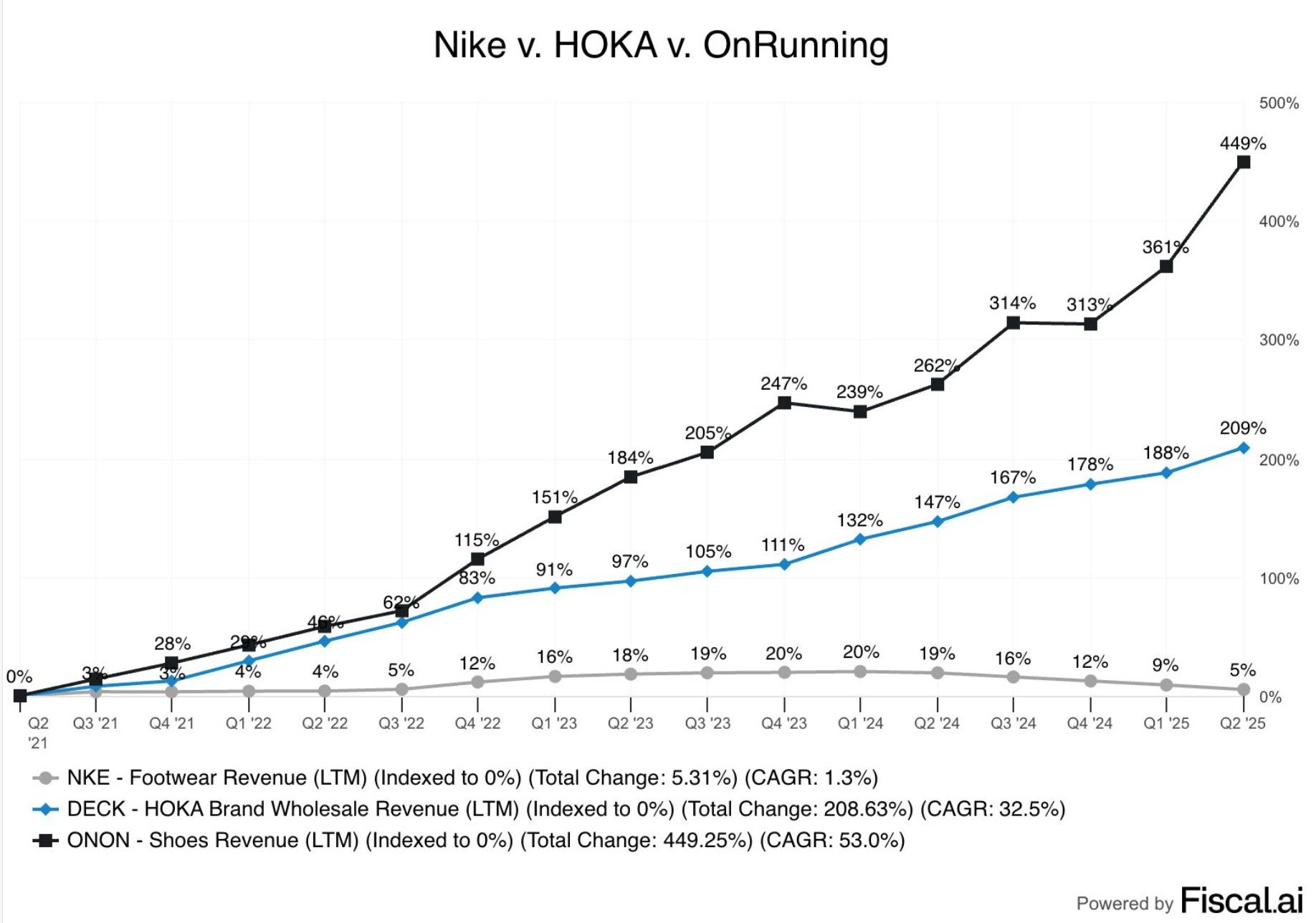

On running and Hoka continue to take market share in footwear space.

On running +449% Hoka: +209% Nike Footwear: +5% Source: fiscal.ai

Investing with intelligence

Our latest research, commentary and market outlooks