Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It is often a very good sign when you see strong momentum & trend in a sector / segment of the market while fund flows are lagging.

This has been the case for gold miners (e.g VanEck Gold Miners ETF $GDX) - see chart below. We've seen the first significant inflow in the GDX in the last six months. Despite the great GDX performance of 45+% during this period, six-month net flows are still very negative at -$2.54B. 🪙👇 Source: Oliver Groß @minenergybiz

The us budget deficit disaster continues with renewed momentum.

Source: zerohedge through Peter Mallouk on X

⚠️This has never happened before: The NASDAQ market cap relative to US GDP hit 105%, an all-time high.

The ratio has nearly doubled since the 2022 bear market low and is now ~40 percentage points above the 2000 Dot-Com Bubble. It is also at a record relative to world GDP. Source: Global Markets Investor, econovisuals

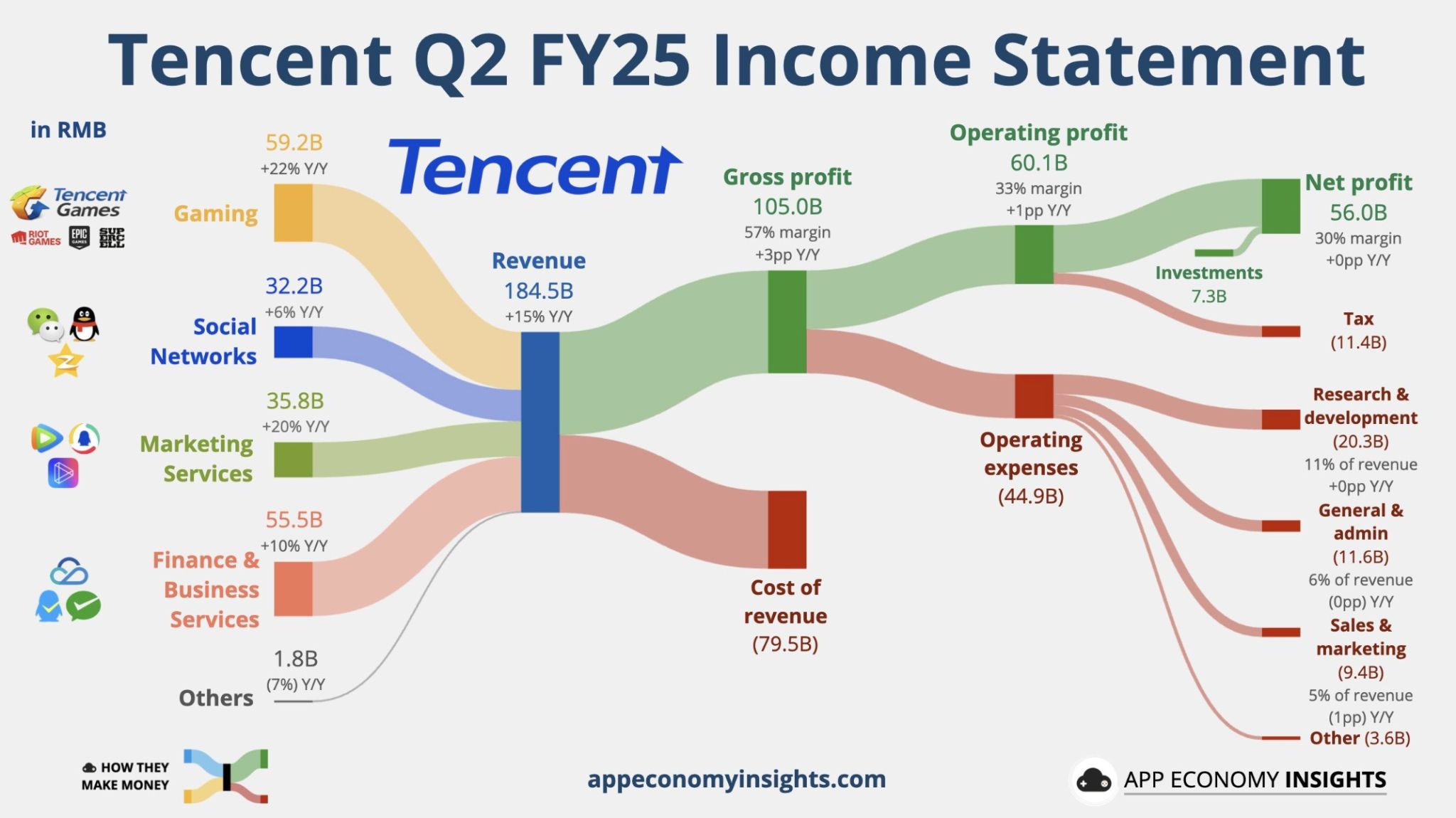

Tencent on Wednesday reported a 15% jump in second-quarter revenue as a strong performance in its gaming unit and AI investments boosted growth.

The ADR is up 7% today $TCEHY Tencent Q2 FY25: Revenue +15% Y/Y to RMB185B ($25.7B). Gaming +22% Social Networks +6% Marketing Services +20% Fintech & Business +10% Weixin/WeChat: 1.4B MAU (+3% Y/Y). Capex +119% to RMB19B ($2.7B). Source: App Economy Insights @EconomyApp

Bullish $BLSH shares open trading at $90 above the $37 IPO price

Cryptocurrency exchange operator Bullish (BLSH.N), opens new tab was valued at about $13.16 billion after its shares more than doubled in their NYSE debut on Wednesday, underscoring investor confidence in the sector and lifting prospects for future U.S. listings by other digital asset firms. The parent of crypto news website CoinDesk raised $1.11 billion in its IPO, valuing the company at $5.4 billion — another sign of mainstream adoption in a market that recently topped $4 trillion. Source: Reuters

Investing with intelligence

Our latest research, commentary and market outlooks