Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Over the last few weeks, markets have been moving higher partly due to the fact that investors have been pricing in more rate cuts.

With July PPI and core CPI prints surprising on the upside this week, odds of rate cuts in September and beyond are moving lower. Could it trigger a decent market correction? Source image: @RealStockCats

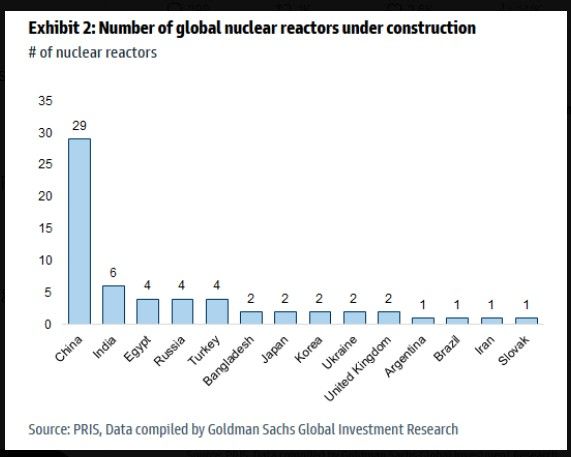

Nuclear reactors under construction around the world.

Source: zerohedge

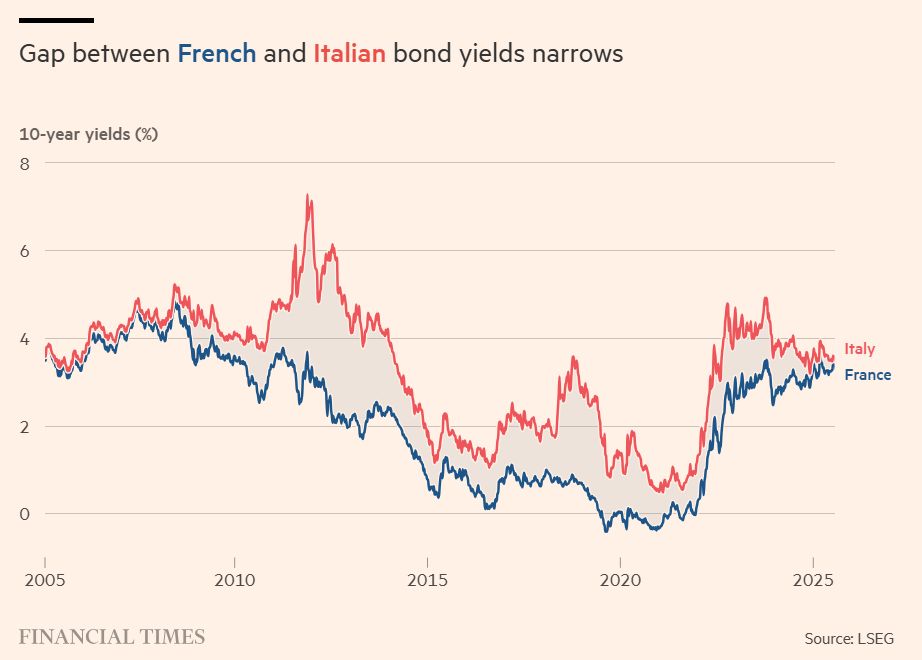

France’s long-term borrowing costs are converging with Italy’s for the first time since the global financial crisis.

Yields on 10-year French government bonds have jumped above 3 per cent over the past year, as months of political instability and concerns about the public finances take their toll. This has brought France’s benchmark borrowing costs to just 0.14 percentage points less than those of Italy, whose bond yields have been driven lower as a display of fiscal prudence from Giorgia Meloni’s administration has won over investors. The convergence has upended long-held views on France’s position as one of the region’s safest borrowers and Italy as one of its most risky, with a huge stock of public debt equal to about 140 per cent of GDP. Italy’s “spread” over France — the difference between their bond yields — ballooned to more than 4 percentage points during the Eurozone debt crisis of the 2010s. Source: FT

Buy-now-pay-later firm Klarna reported AI-driven sales growth for the second quarter, enabling the company to generate revenues of $1 million per employee.

👉 The Swedish company said it had 20% like-for-like sales growth in the second quarter, with total revenues coming in at $823 million for the period. 👉The firm also saw adjusted operating profits of $29 million, up significantly from the first quarter’s $3 million. “AI adoption continues to deliver significant, tangible results. As a result of this strategy, average revenue per employee reached $1.0m, up 46% [year on year in the second quarter],” the company said in its quarterly report. 👉Klarna has aggressively leveraged AI to boost productivity performance. It has shed two in five jobs over the past two years as a result. “This shift reflects the growing impact of AI and automation in eliminating manual, time-consuming work across Klarna,” the company had said in its first-quarter results.

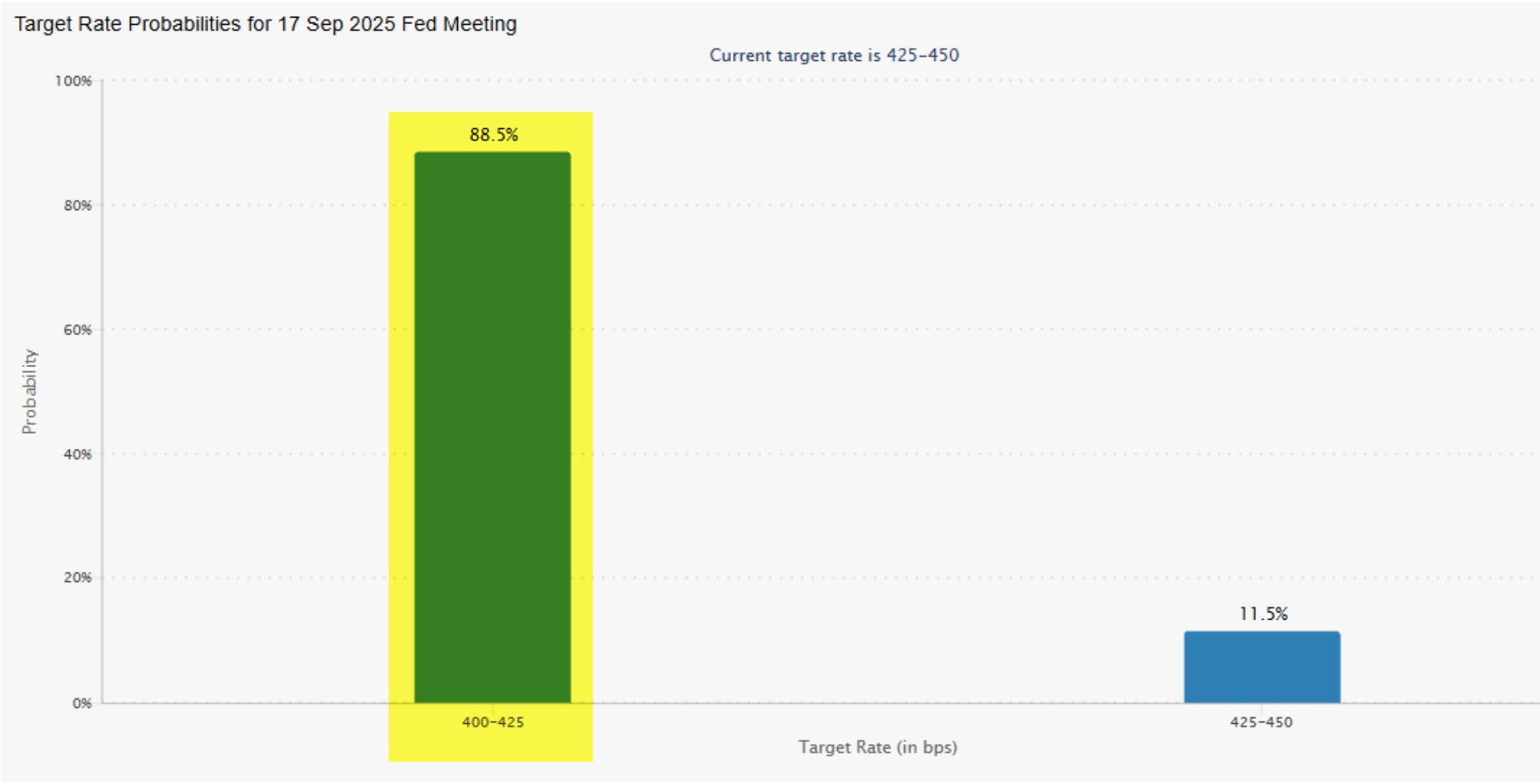

September rate-cut odds of 99.9% yesterday have now fallen down to 88.5%.

From "guaranteed" to "not so fast." Source: Bespoke

🔴 Warren Buffett's Berkshire Hathaway takes a $1.6 Billion position in UnitedHealth $UNH

Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks