Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

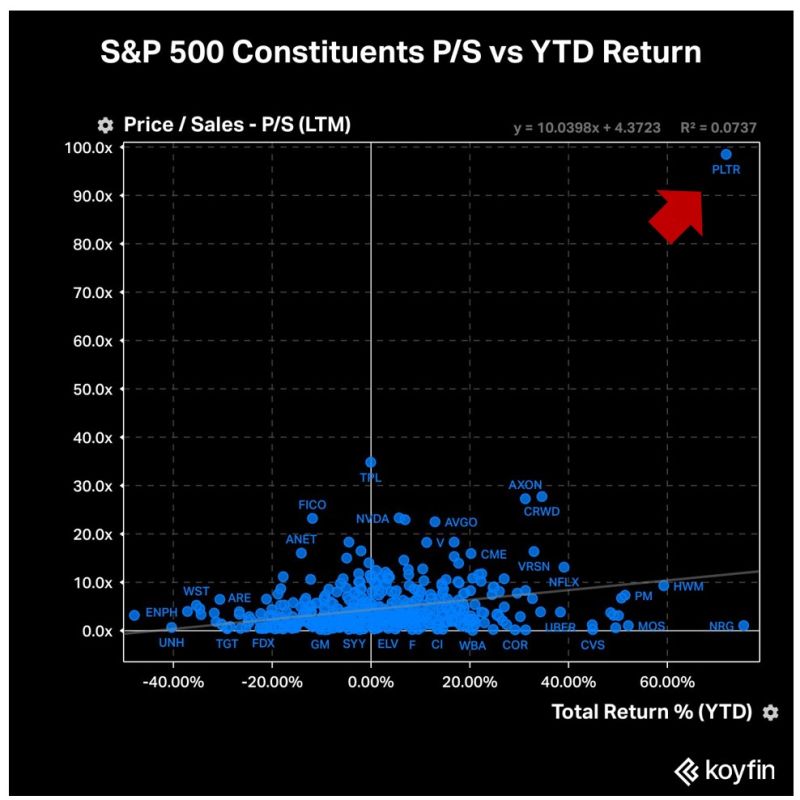

If you squint hard enough, you'll notice an outlier in the S&P 500 when it comes to Price/Sales vs YTD Return.

Source: Koyfin

Circle stock ($CRCL) surges 168% in blockbuster NYSE Debut as stablecoin giant goes public.

The stablecoin issuer's shares closed at $83.23, marking the crypto industry's second-largest public listing. The stablecoin giant's first day as a public company saw explosive trading activity, with 47.1 million shares changing hands as the stock swung between a daily high of $103.75 and low of $66.60. The dramatic price action pushed Circle's market capitalization to $16.7 billion by the closing bell, a remarkable turnaround for a company that had priced its IPO below its previous private market valuation. Circle's successful flotation represents the largest crypto-related public listing since Coinbase's 2021 debut and marks a watershed moment for the stablecoin sector. The Boston-based company raised $1.05 billion in an upsized offering that comes three years after a failed attempt to go public through a $9 billion SPAC transaction that collapsed in 2022. Source: www.blocklead.co

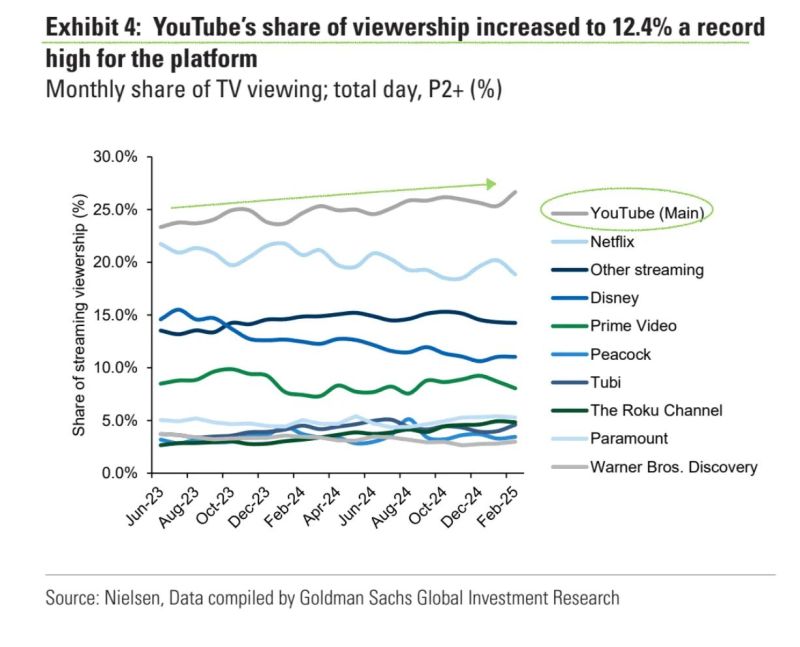

YouTube is now the No.1 platform on U.S. TVs, with a 12.4% share of total viewing and 25%+ among streamings.

Its ad + subscription revenue topped $50B last year. At Netflix's 12x sales multiple, YouTube alone could be worth $700B+. $GOOG $GOOGL $NFLX Source: Vlad Investment Bastion

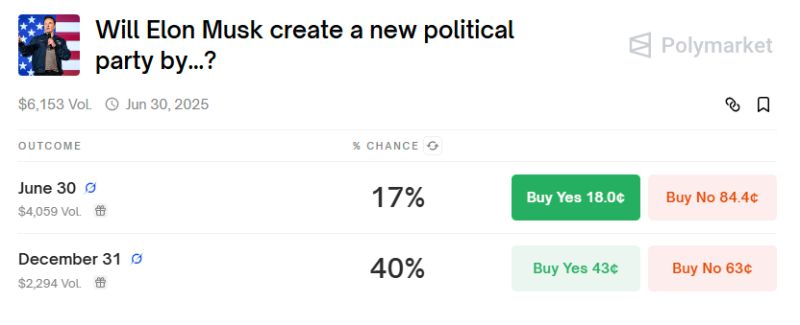

Will Musk create a new political party?

Source: www.zerohedge.com, Polymarkets

Current state of affairs 🍿Markets situation yesterday summarized in one image courtesy of Trend Spider.

Tesla was a big laggard in the session, down more than 14%, after President Donald Trump said he was “very disappointed” in CEO Elon Musk. Musk shot back at President Donald Trump, saying in a post on X that “without me, Trump would have lost the election.” The feud further intensified after Trump called Musk ”‘CRAZY” and signaled that he might cut his companies’ government contracts.

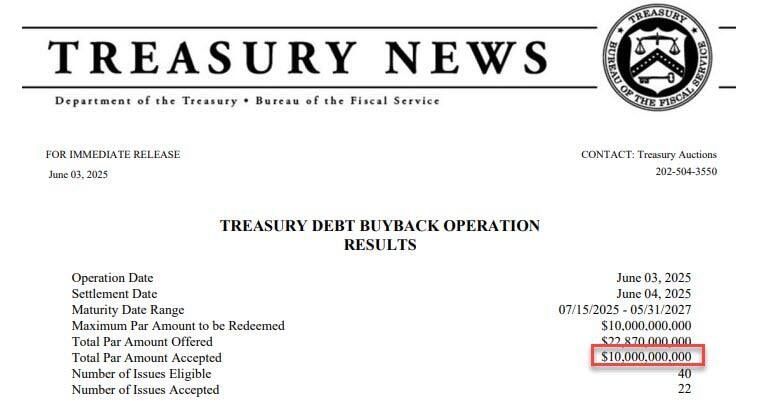

U.S. treasury just bought back $10 billion of its own debt, the largest buyback ever

Source: Department of the Treasury

The Trump-Elon meltdown: the breakup between the world’s most powerful politician and the world’s richest man is playing out in a manner befitting an era of hyperreality:

With stunning speed, wild recriminations, and in public via television and their own social media platforms. Tesla shares plunged 14%, comp lost $153bn in mkt cap, now worth less than $1tn. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks