Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: WHITE HOUSE SCHEDULES FRIDAY CALL FOR ELON AND TRUMP

Trump and Elon are signaling a more measured tone after their recent debate over the “Big Beautiful Bill,” Trump’s signature legislative package. ➡️ In an interview with POLITICO, Trump projected calm, saying, “It’s going very well, never done better,” and emphasizing his strong poll numbers. White House aides encouraged the president to focus on the bill’s passage and avoid escalating any disagreements. A call is scheduled between Trump and Elon to discuss their views further. Hedge fund manager @BillAckman urged both men to work together for the country’s benefit, a sentiment Elon echoed on X. Source: POLITICO

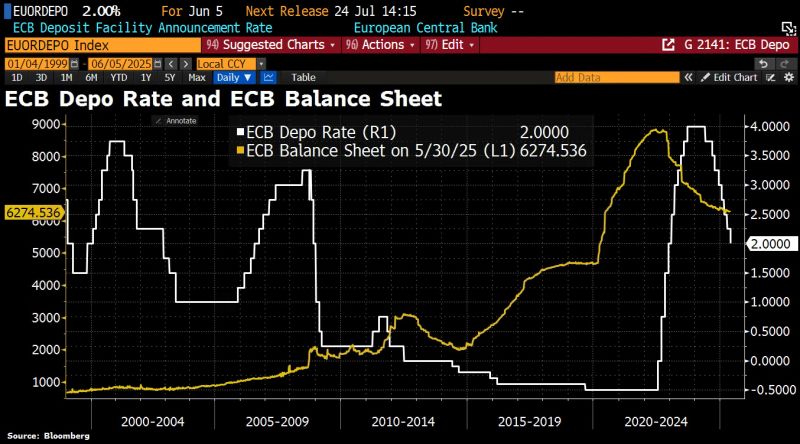

ECB lowered interest rates for the 8th time in a year after inflation dipped <2% and the economy suffered repeated blows from US tariffs.

ECB cut the deposit rate by 25bps to 2% and reiterated that it’s not pre-committing to a particular path. ECB balance sheet shrank to €6.3tn. Note that ECB deposit rate has fallen below the German inflation rate for the first time since September 2023. Source: HolgerZ, Bloomberg

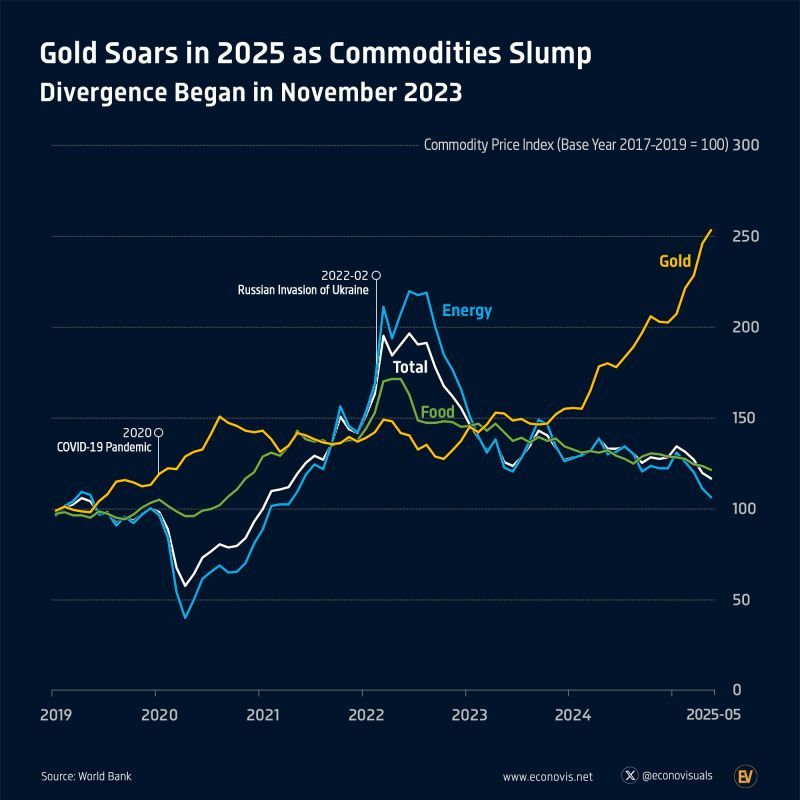

Gold’s 2025 Surge: Defying the Commodity Downturn

Divergence Began in November 2023 By May 2025, gold prices had surged 25.0% year-to-date, in sharp contrast to the broader commodity market slump. The overall commodity index fell 9.0%, with energy prices down 12.9% and food prices down 5.9%. Gold's value stood 153% above its pre-pandemic level—outpacing the commodity index by 117%, energy by 138%, and food by 109%. Source: Econonovis on X

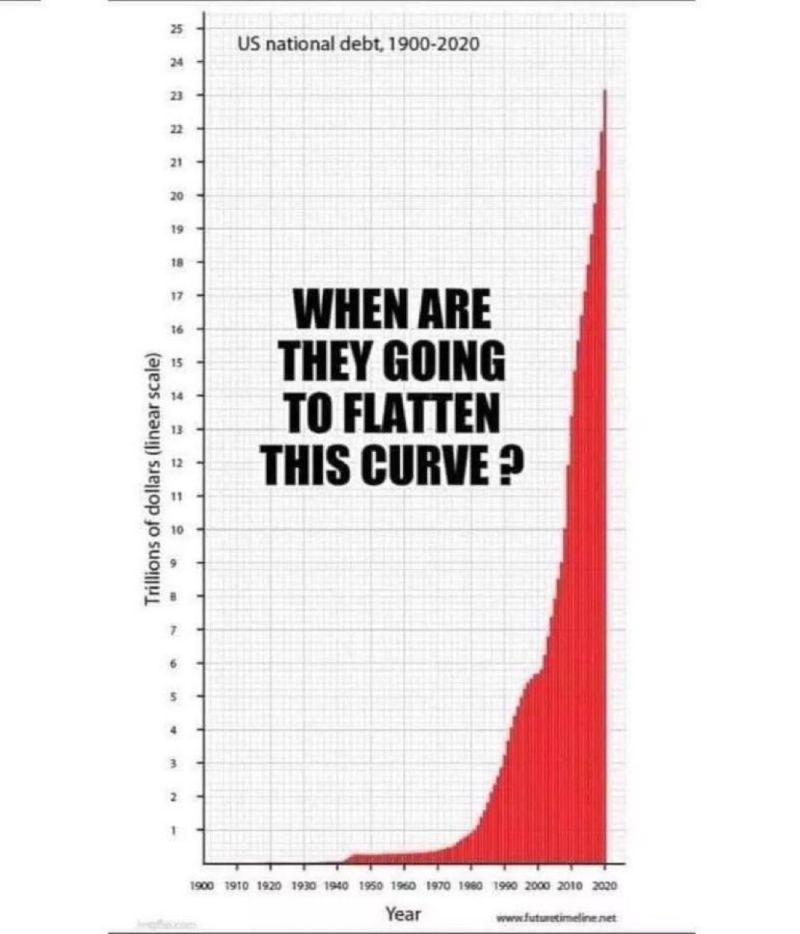

Elon Musk: "Flatten the curve"

Source: Future timeline

Apple $AAPL gets a downgrade from Needham which warns that investors shouldn't enter a position until the price hits $170-$180

Source: Barchart

“Early signs indicate that many businesses are quickly raising prices for shoppers, to cover most of the higher costs from sweeping U.S. tariffs on imported goods.”

Source: Kalani o Māui on X

Investing with intelligence

Our latest research, commentary and market outlooks