Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

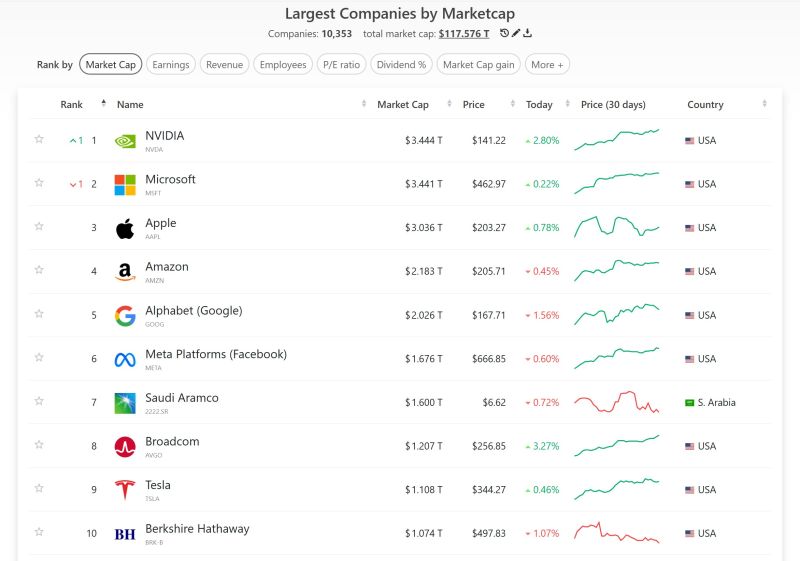

Yesterday, Nvidia $NVDA became the world's most valuable company at $3.444 Trillion, surpassing Microsoft $MSFT

Source: Companies Market Cap

In case you missed it... The MSCI All Country World Index (iShares MSCI ACWI ETF) hit an ALL-TIME HIGH yesterday...

#taco #tuesday Source: Mike Zaccardi, CFA, CMT, MBA

Credit Card debt at all-time highs? Party on.

#visa #mastercard $V $MA Source: Trendspider

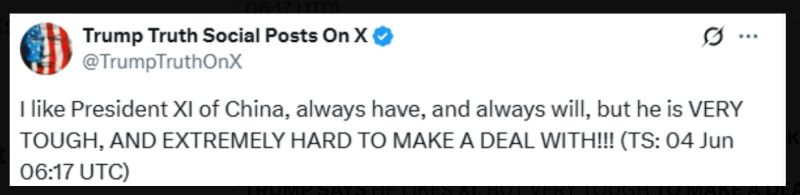

Donald Trump said Wednesday that China’s President Xi Jinping was “extremely hard” to make a deal with

At a time when the White House has been suggesting the two leaders could talk this week amid a rise in trade tensions: “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!,” the U.S. president wrote on Truth Social. That post on the social media platform came after a senior White House official told CNBC on Monday that Trump and Xi were likely to speak this week. Chinese Foreign Minister Wang Yi told the new U.S. Ambassador David Perdue during a meeting Tuesday that the recent string of “negative measures” by the Trump administration were based on “groundless reasons,” and undermined China’s legitimate rights and interests, according to the official English readout. Source: CNBC

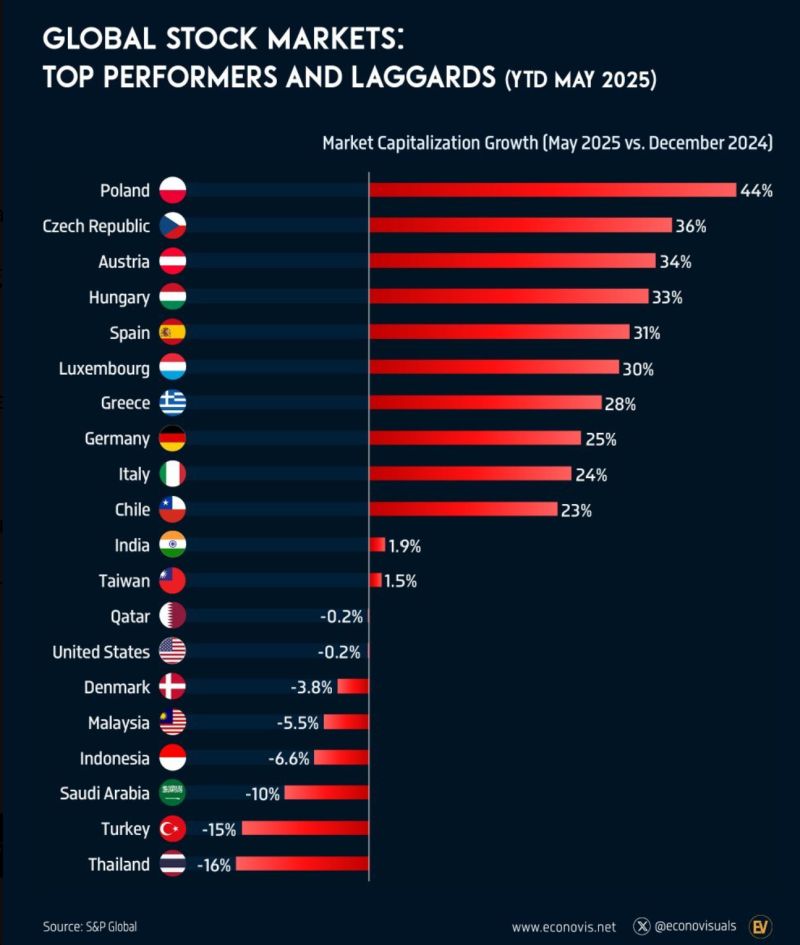

European markets have outperformed the US this year.

Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat. Source: Global Markets Investor

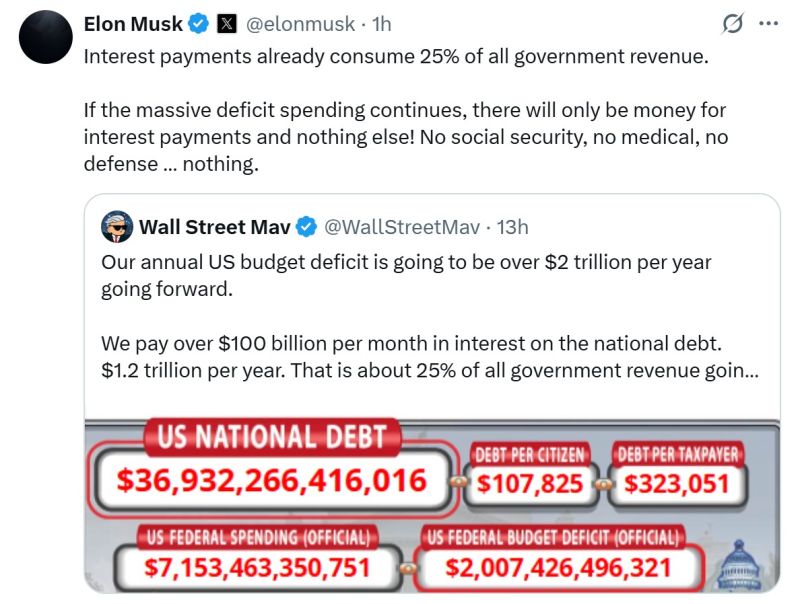

Elon keeps pounding the table on the fiscal & debt side...

He probably feels that D.O.G.E didn't go far enough...

China's manufacturing activity plunges to lowest level since September 2022 📉

Source: Barchart, LESG

Investing with intelligence

Our latest research, commentary and market outlooks