Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

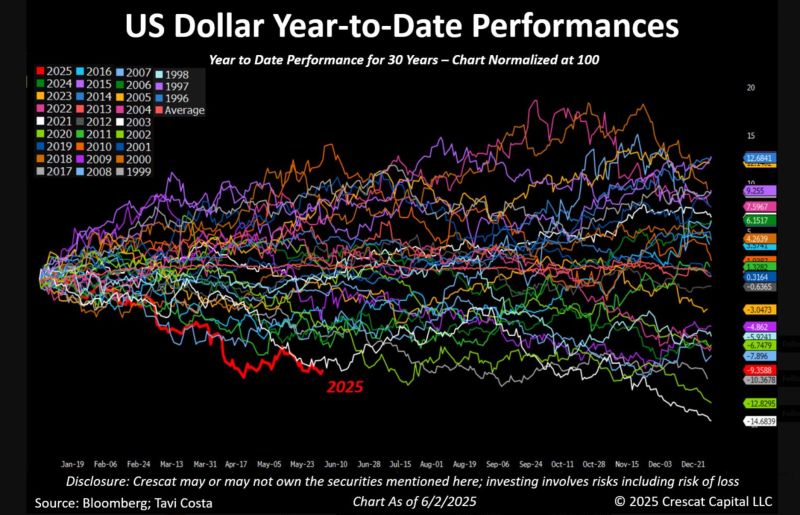

The US dollar is on track for its worst performance in three decades

Resource stocks, emerging and other developed markets, and foreign currencies are beginning to perform well. Source: Crescat Capital, Bloomberg

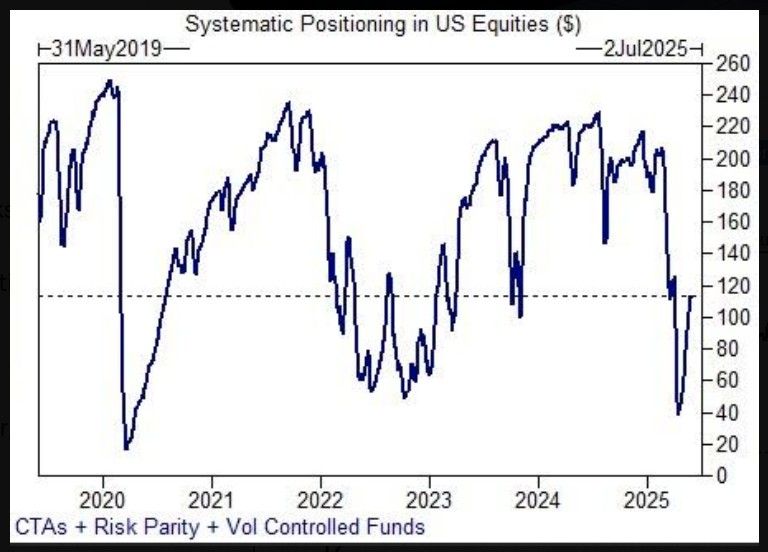

Systematic US equity exposure remains low, according to data from Goldman Sachs, i,.e they will be forced buyers if the rally continues 🚀

Source: Markets & Mayhem @Mayhem4Markets on X, Goldman Sachs

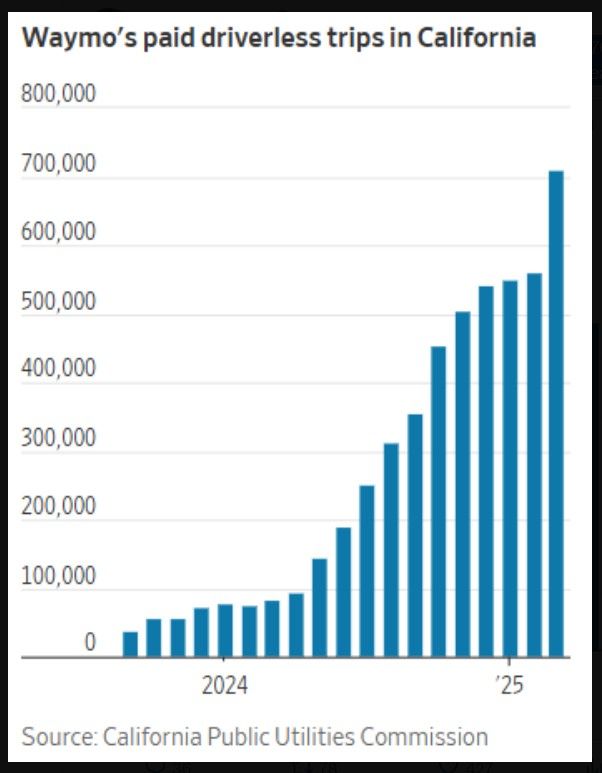

Autonomous vehicle is a reality

Self-driving taxi company Waymo is now doing over 700,000 rides per month in California, up from fewer than 100,000 a year ago. Source: Charlie Bilello

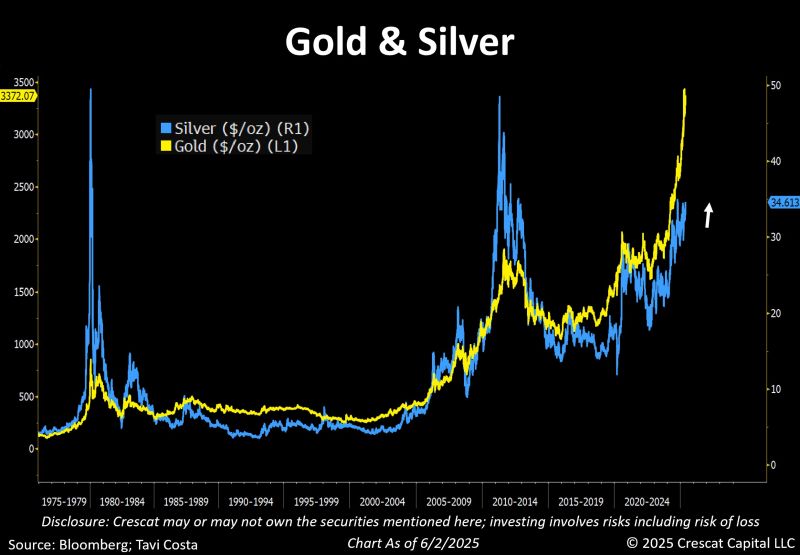

Here we go...

Silver blasting by more than 5% for its best day in more than 1 year 📈📈 Source: Barchart

An intentional leak to give markets further hope?

Source: Adam Taggart @menlobear on X

Is it time for silver to shine?

If history is any guide: Gold makes the first move — then silver takes over. With the gold-to-silver ratio near 100, is yesterday's sharp move on Silver (up +5%) just the beginning? Source. Bloomberg, Crescat Capital

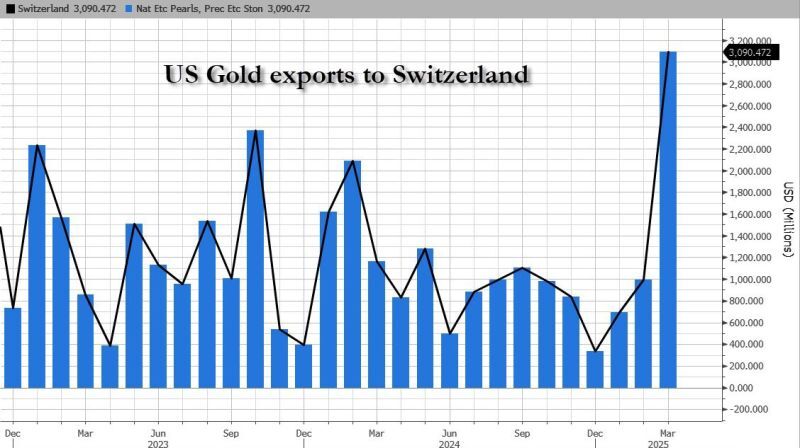

The Atlanta Fed was forced to adjust its entire tracker to exclude gold imports which were skewing GDP by 1.5%.

How long until the Atlanta Fed also excludes soaring physical gold EXPORTS TO Switzerland to reduce the surge in Q2 GDP??? Source: zerohedge

U.S. EXTENDS TARIFF PAUSE ON SOME CHINESE GOODS TO AUGUST 31

The U.S. government has extended its pause on some tariffs imposed on Chinese goods until August 31, 2025. This move comes during ongoing trade negotiations between the Donald Trump administration and several key global trading partners. #taco (Trump Always Chicken Out) #trade Source: Vincent Artman @geogvma

Investing with intelligence

Our latest research, commentary and market outlooks