Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TRUMP TAPS PALANTIR: A DATABASE FOR ALL AMERICANS….

Trump is moving ahead with a plan to create a sweeping national citizen database using Palantir Technologies. The collaboration, has Palantir’s Foundry platform pulling data from across federal agencies, including health records, bank details, and social services, into one central hub. Critics say it’s a “surveillance nightmare,” with fears it could be misused for political ends. Source: Yahoo Finance, Benzinga, NewsNation thru Mario Nawfal on X

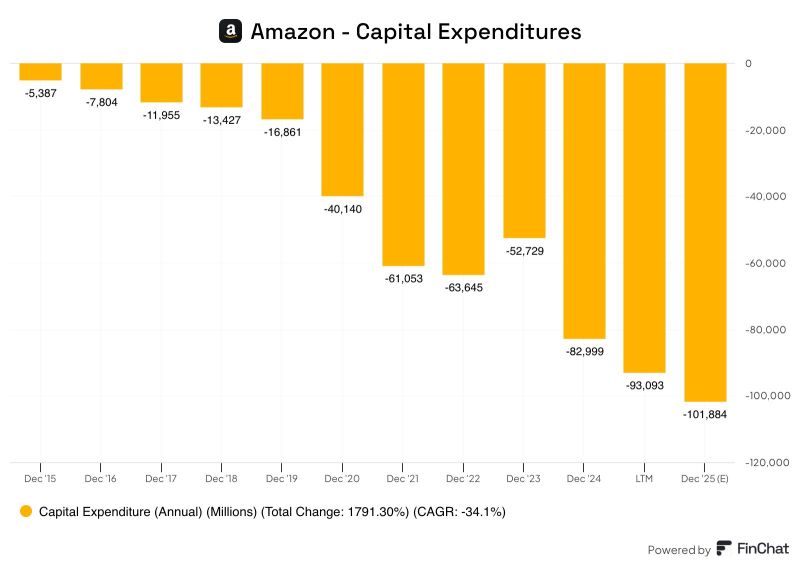

Amazon will be the first company ever to spend more than $100 billion on capital expenditures in a single year.

More than 50% of that CapEx will be spent on tech infrastructure. How much more runway does AWS have to grow? $AMZN Source: finchat

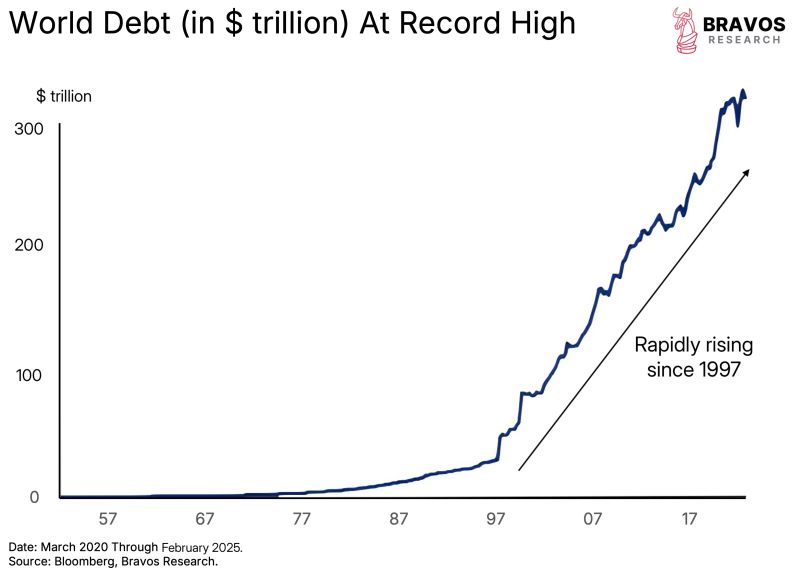

World debt has now officially crossed $300 trillion

And still continues to climb aggressively Source: Bravos Research

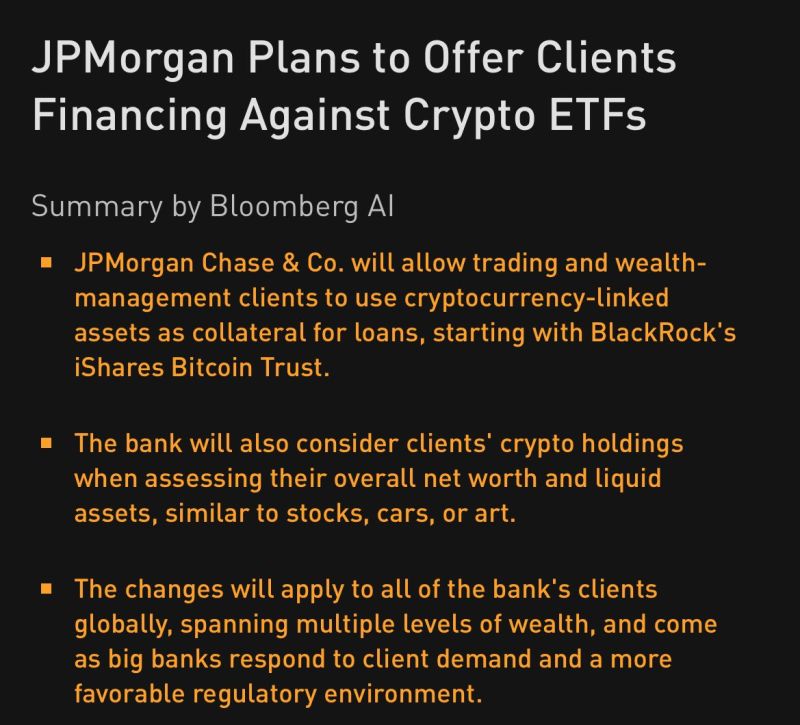

Human nature doesn’t change, just the bubbles change

Source: Michel A.Arouet

US private sector hiring rose by just 37,000 jobs in May, the lowest in more than 2 years… Trump had this to say 👇

Source: Stocktwits

BlackRock Chairman and CEO Larry Fink writes in the FT that the old economic model is coming apart.

So what comes next? He talks about the emerging second draft of globalization, built not just to generate prosperity, but to aim it towards the people and places left behind the first time: https://on.ft.com/4kGO3vQ

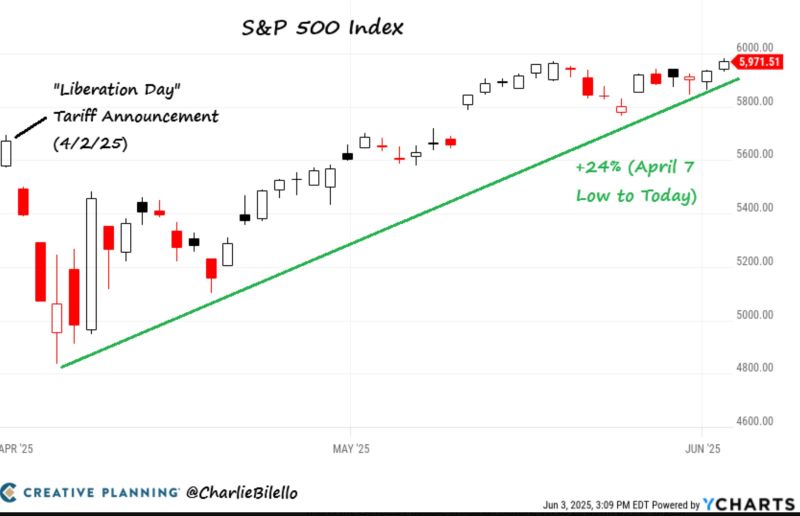

After a 24% rally from the April lows, the S&P 500 is now up 5% since the "Liberation Day" tariff announcement.

$SPX Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks