Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tesla stock $TSLA, surges over +5% as President Trump says he is not getting rid of his Tesla.

Trump also called Starlink a “good service” and say he wishes Elon well. Global Pulse on X: “Despite rising tensions, the Trump Vs Musk conflict will cool down in the coming days till next election. Both are high-stakes players, and neither wants to risk their empires”. Source image: Not Jerome Powell on X

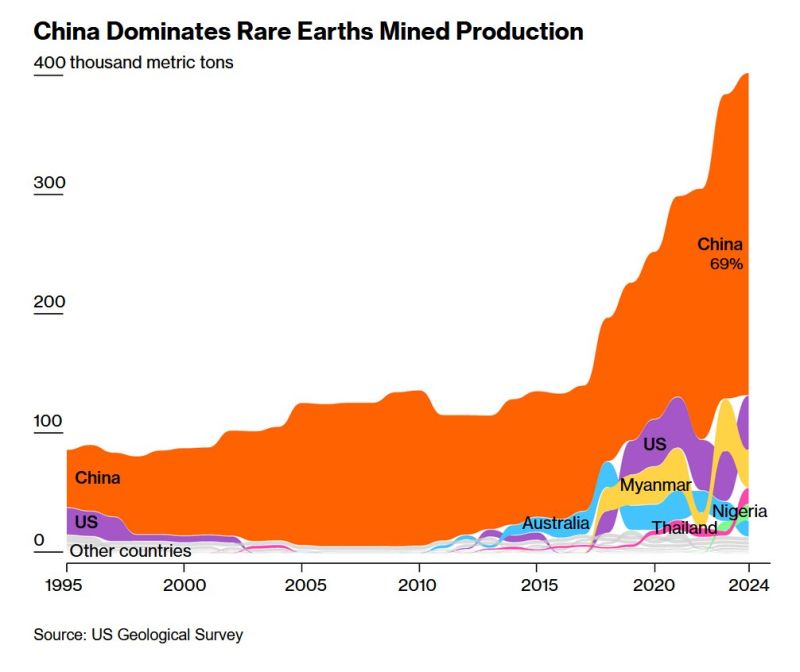

China dominates global rare earths production:

China now produces nearly 400,000 metric tons of rare earths a year. This is a massive 69% of the global output, per the US Geological Survey. The US is seeking to restore flows of critical minerals in today's trade talks. Source: Global Markets Investor

I know, it does not mean anything... still, this is a really big number...

Source: ₿TCHEL2025

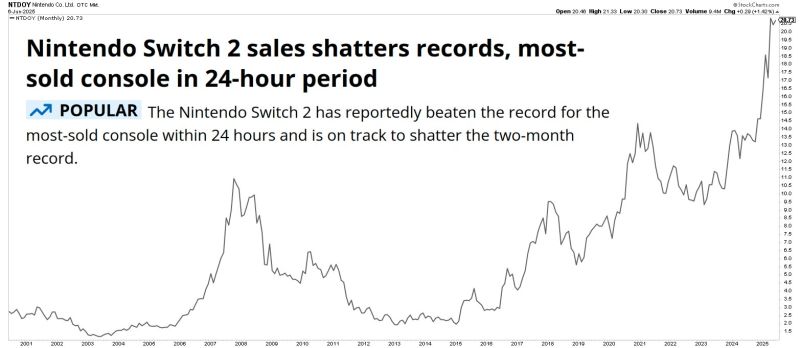

The Nintendo Switch 2 launch absolutely blew away expectations.

Below the monthly chart of Nintendo stock $NTDOY (7974.T-JP:Tokyo Stock Exchange) Source: Markets & Mayhem

Lesson of the week-end...

Always believe in yourself... till the very end

China’s exports growth missed expectations in May

dragged down by a sharp decline in shipments to the U.S., with analysts saying effects of a Beijing-Washington trade truce will be visible in June data. 🟥 Chinese exports to the U.S. plunged 34.5% from a year ago, marking the sharpest drop since February 2020, according to Wind Information, when the Covid-19 pandemic disrupted trade. Imports from the U.S. dropped over 18%, and China’s trade surplus with America shrank by 41.55% year on year to $18 billion. Overall exports rose 4.8% last month in U.S. dollar terms from a year earlier, customs data showed Monday, shy of Reuters’ poll estimates of a 5% jump. 🟥 Imports plunged 3.4% in May from a year earlier, a drastic drop compared to economists’ expectations of a 0.9% fall. Imports had been declining this year, largely owed to sluggish domestic demand. That was largely offset by its shipment to the Southeast Asian bloc, which jumped nearly 15% from a year, and those to European Union countries and Africa, which rose 12% and over 33%, respectively. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks