Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 Why JPMorgan's Desk Thinks The Greenland Standoff Ends In A Bullish "Negotiated Arrangement" 🚨

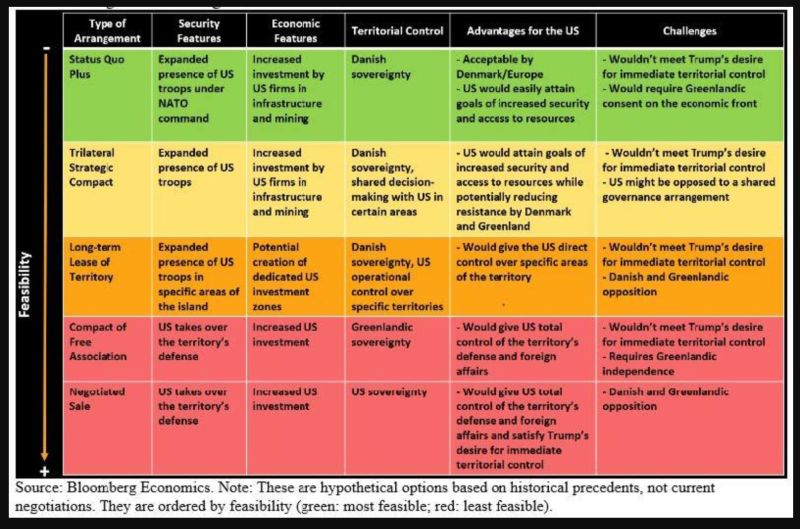

The headlines are screaming "Trade War." JPMorgan’s desk is whispering "Opportunity." 📈 While the media focuses on the chaos, JPM’s International Market Intel team is looking at the scoreboard. Here is why they think the "Greenland Standoff" is actually a bullish signal for 2026: 1. It’s a Negotiation, Not an Invasion. 🤝 Federico Manicardi (JPM) calls it straight: This is classic Art of the Deal. Trump throws out a maximalist stance (10% EU tariffs / buying Greenland) to create leverage and urgency. The goal? A "Negotiated Arrangement," not a sale. 2. The "Bullish" Outcome. 🐂 JPM expects a deal where: ✅ Denmark keeps sovereignty. ✅ The US gets Arctic security & missile defense upgrades. ✅ Access to critical natural resources is secured. Result? Uncertainty clears, and the 2026 growth reboot stays on track. 3. The "Tail Risks" are Overblown. 🧊 An actual invasion? "Melts NATO faster than Arctic ice" and polls horribly. A sale? Unlikely and unnecessary. JPM sees the downside limited to a mid-single-digit (MSD) drop at worst before the rebound. 4. Eyes on Davos. 🏔️ With Trump addressing the World Economic Forum tomorrow, expect the rhetoric to shift from "threats" to "affordability and growth." The Bottom Line: Volatility is a gift if you understand the playbook. The market is anticipating a growth reboot, and JPM believes this "orange flag" is just noise on the path to a deal. Source: ZeroHedge

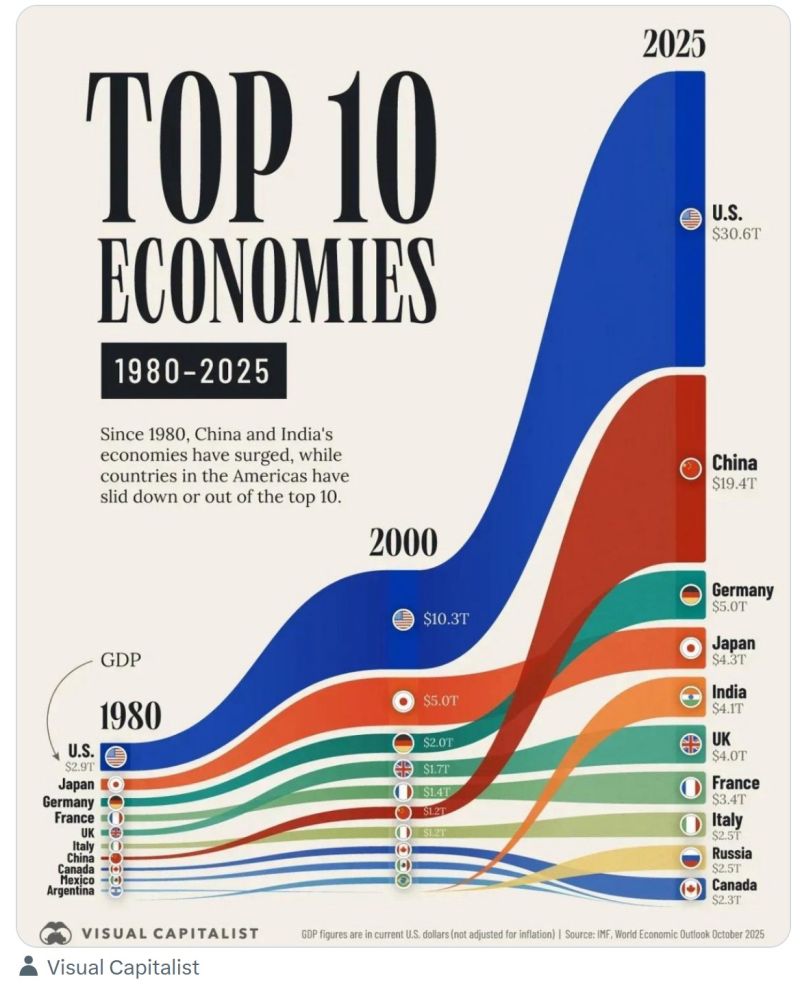

Here are the largest economies around the world over the last couple of decades

Source: Evan, Visual Capitalist

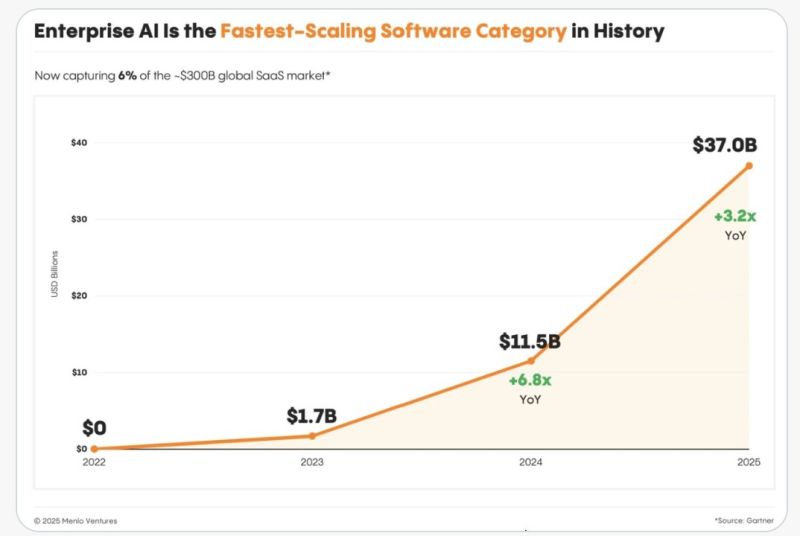

Enterprise AI adoption is booming!

In '25, 76% of AI use cases were purchased by enterprises, rather than built internally (vs. 53% in '24). Enterprise AI software refers to artificial intelligence applications specifically designed for large-scale organizations to automate complex business processes, improve decision-making, and enhance productivity across departments like HR, finance, and supply chain. Unlike consumer AI (like a personal chatbot), enterprise AI is built with a focus on security, scalability, and integration with existing corporate systems like ERP (Enterprise Resource Planning) or CRM (Customer Relationship Management) Source: Puru Saxena @saxena_puru

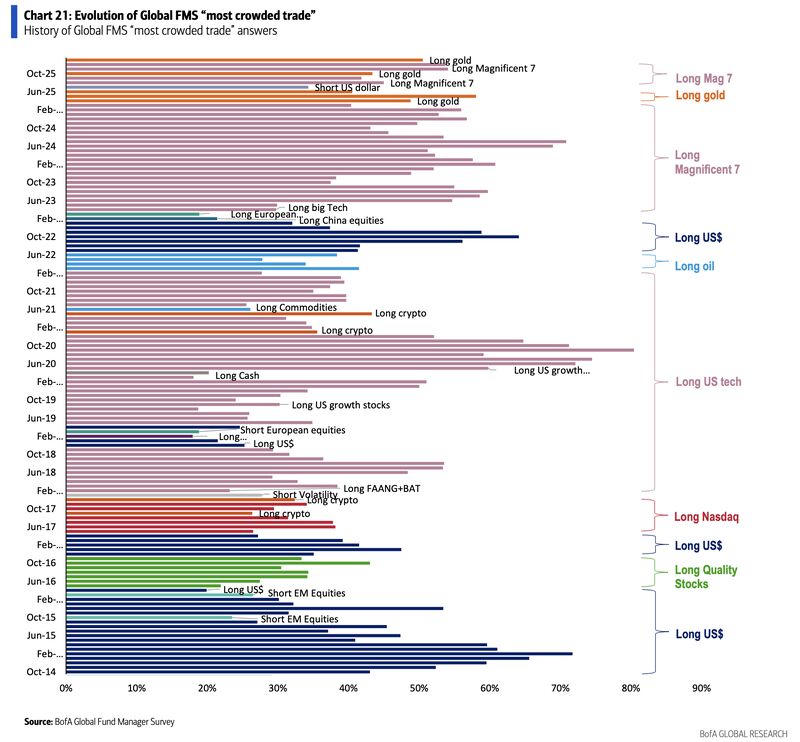

Gold is now the most “crowded trade”, acc to BofA’s monthly Global Fund Manager Survey.

Source: Holger Zschaepitz @Schuldensuehner BofA

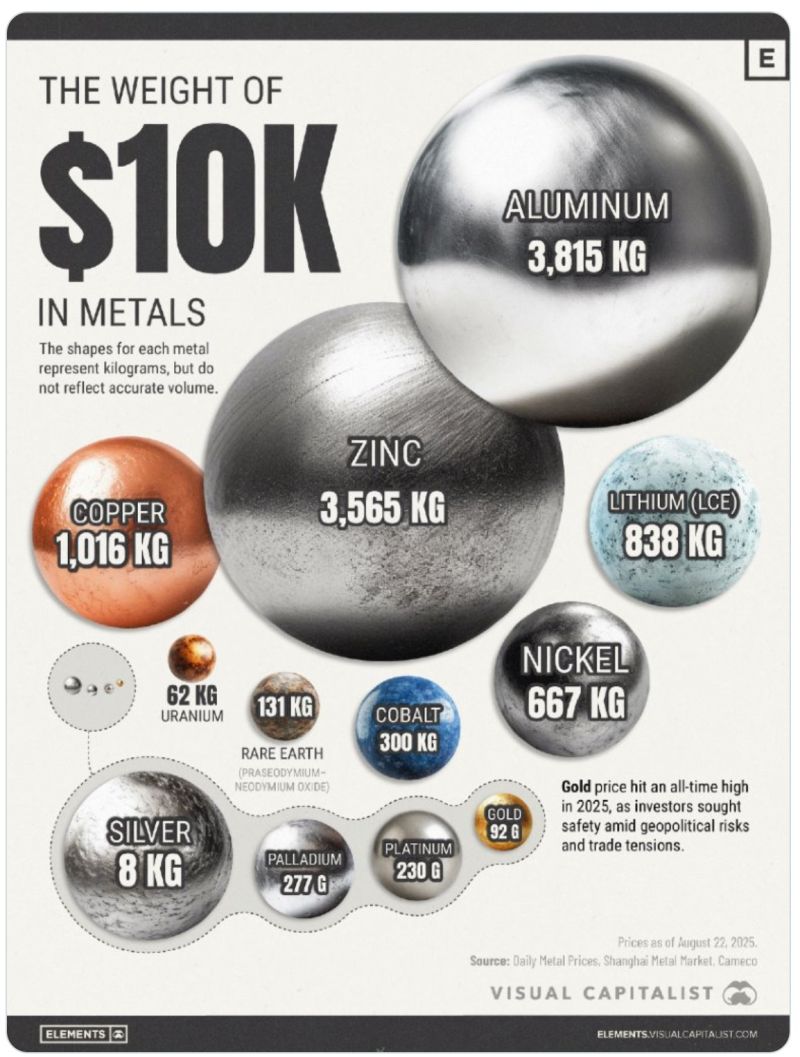

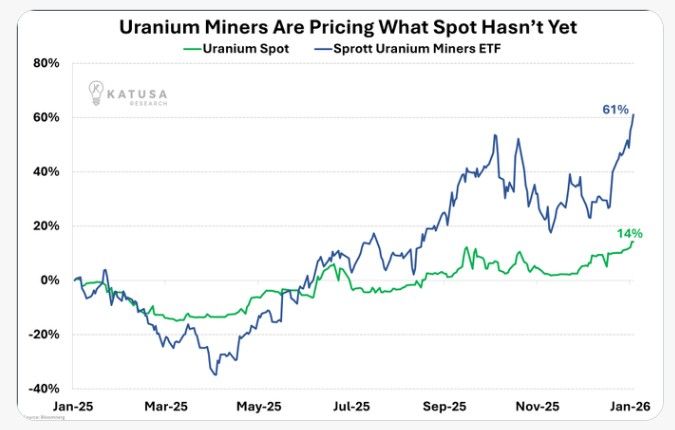

Watch Uranium

Almost 30% of Uranium is uncontracted, resulting in poor spot price performance. Utilities keep waiting for cheaper pounds that aren't coming. And every month they wait, the deficit grows. When they finally buy, spot won't walk higher. It'll gap. Source: Kasuha Research on X

Investing with intelligence

Our latest research, commentary and market outlooks