Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

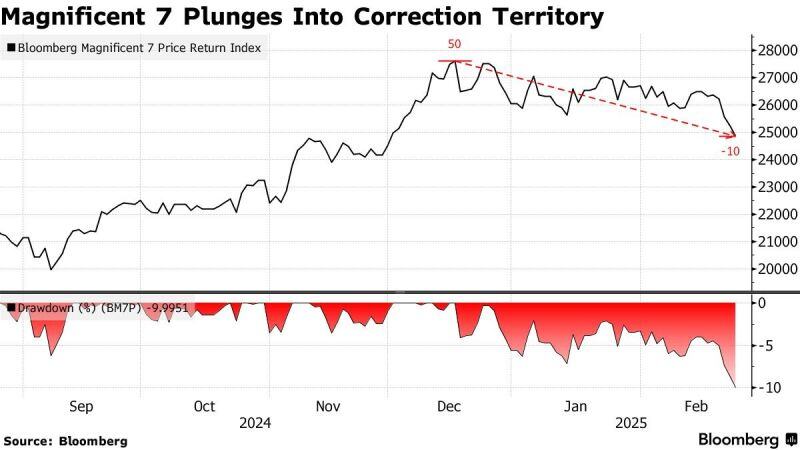

MAGNIFICENT 7 ENTERS CORRECTION TERRITORY

The equal weight Magnificent 7 index is now down 10% off its most recent All Time Highs the technical definition of a Correction - Bloomberg (Magnificent 7 = Apple, Nvidia, Microsoft, Amazon, Google, Meta, Tesla) Source: Bloomberg, Evan

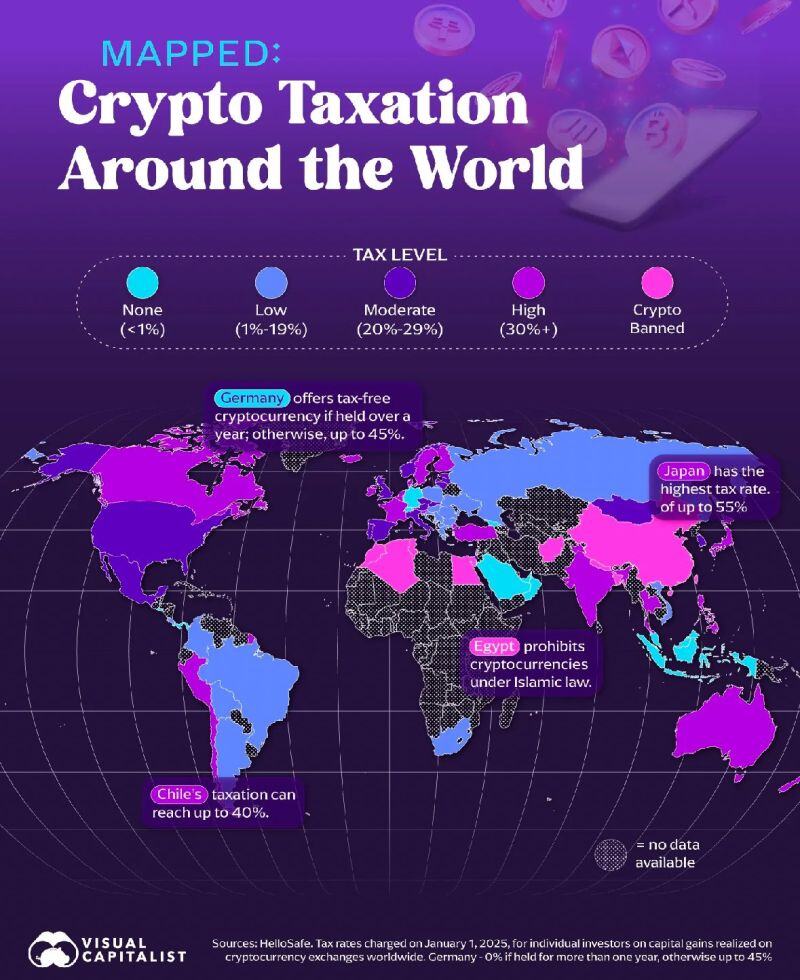

Crypto taxation around the world 🌎

Source: Blossom @meetblossomapp, Visual Capitalist

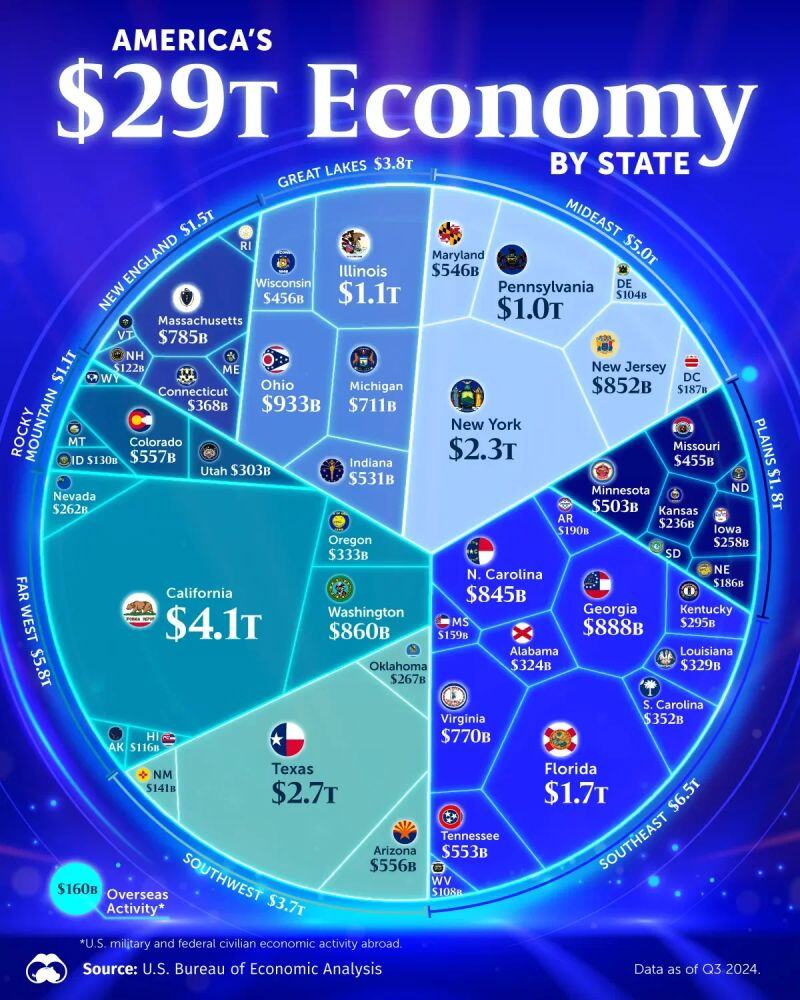

Visualizing America's $29 Trillion Economy by State

Which states contribute the most to the U.S. economy? his graphic breaks down the country's GDP by state, including overseas activity. source : visualcapitalist, voronoiapps

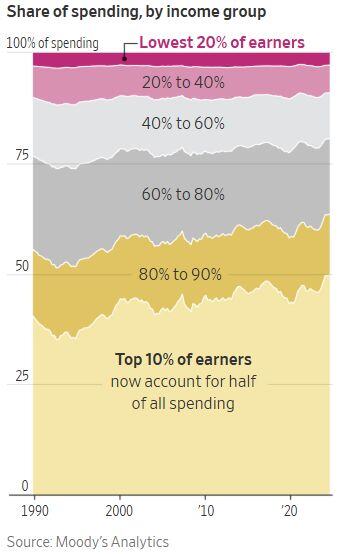

The top 10% of income earners in the US now account for half of all consumer spending, a record high.

(Note: top 10% = households making >$250k). Source: Charlie Bilello, Moody's analtics

Gold ETFs drew largest weekly inflow since March 2022, says WGC

Physically backed gold exchange-traded funds (ETFs) registered the largest weekly inflow since March 2022 last week, data by the World Gold Council (WGC) showed on Monday. Gold ETFs store bullion for investors and account for a significant amount of investment demand for the precious metal, which hit a record high of $2,956.15 per troy ounce on Monday. Gold ETFs saw an inflow of 52.4 metric tons worth $5 billion last week, the largest amount since the first week of March 2022, when global markets were grappling with immediate consequences of Russia's invasion of Ukraine. This raised their total holdings by 1.6% to 3,326.3 tons, the largest since August, 2023. The U.S.-listed funds led the inflow last week with 48.7 tons. For comparison, in January they saw an outflow of 6.3 tons. source : reuters

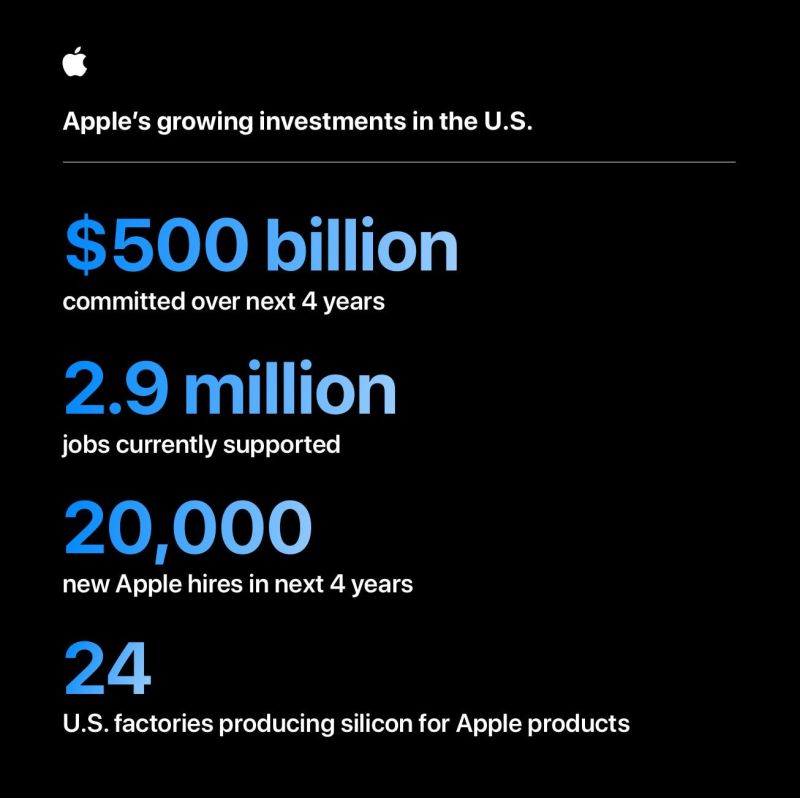

Apple's largest-ever investment commitment, by the numbers:

• Includes work in all 50 states • Doubles its US Manufacturing Fund • Creates Detroit manufacturing academy The project will start later this year with construction of a Houston-based AI server facility Source: Morning Brew

Oups...

Microsoft will NOT participate in OpenAI Stargate project due to overestimation of demand

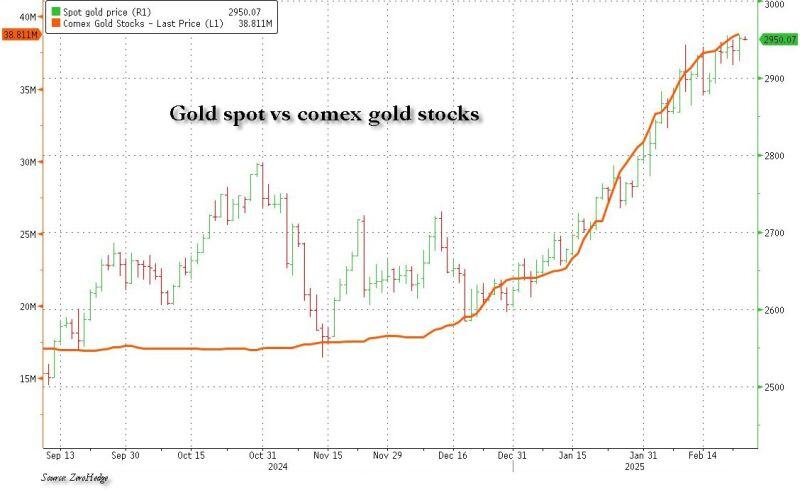

Another day, another 220K oz of gold delivered to comex vaults, another record high above $2950.

Gold is a straight line higher ever since the panic scramble for physical began in late December Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks