Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

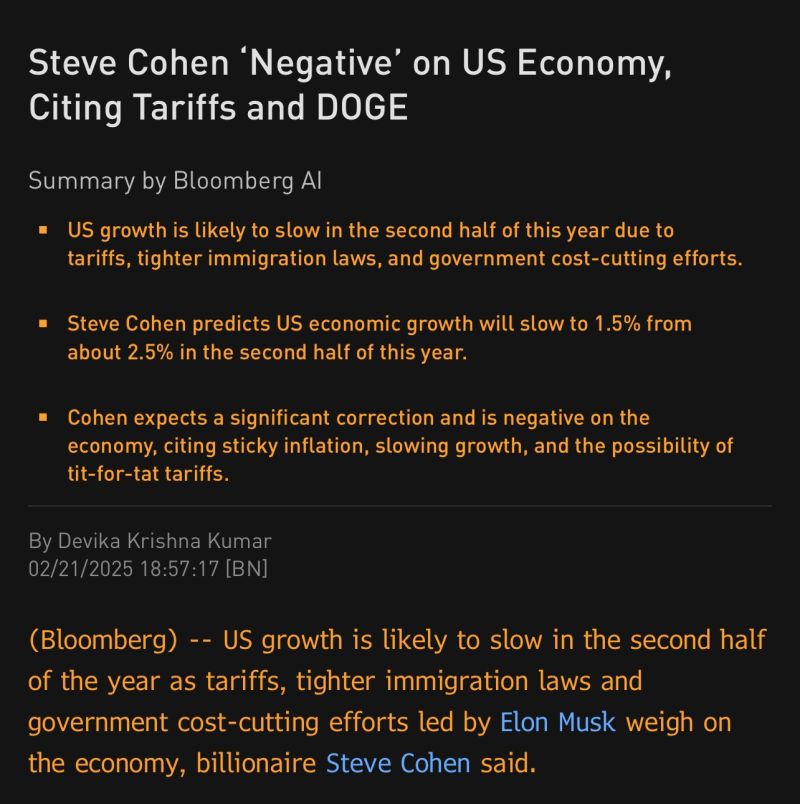

“I’m actually pretty negative for the first time in a while,” Cohen said.

“It may only last a year or so, but it’s definitely a period where I think the best gains have been had and wouldn’t surprise me to see a significant correction.” Source: Alexander Stahel 🌻@BurggrabenH, Bloomberg

Great post from Callum Thomas on X "Lessons from the past..."

While the internet would go on to become ubiquitous and a source of tremendous wealth and innovation -- at the height of the dot com bubble it was pure Hype at that stage... certainly relative to the valuations prevailing at that time. Note however that Mag 7 P/Es and fundamentals are quite different from the dot-com bubble. And that during the current AI bubble, we haven't seen the kind of IPO frenzy which prevailed at the time of the dot.com bubble. So maybe this bubble has more room to go...

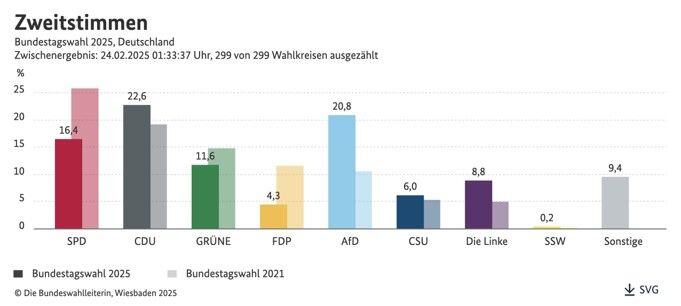

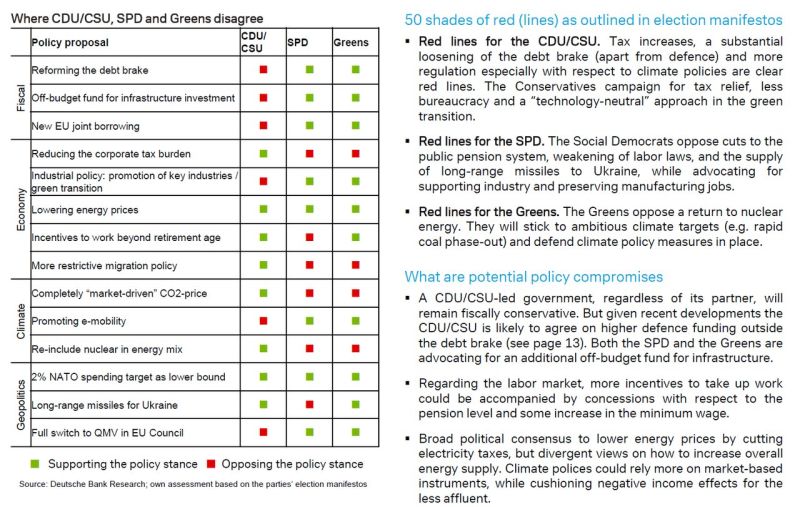

HolgerZ on German elections results 👇

•🚨 CDU leader Friedrich Merz has emerged as the winner of a turbulent federal election. The CDU/CSU secured just 28.6% of the vote—its second-worst result in history. The SPD, expected to be the next coalition partner, collapsed to 16.4%, marking its weakest performance since World War II. Meanwhile, the far-right AfD doubled its support to 20.8%, and the Left Party also saw a significant surge, reaching 8.8%. 👉 The FDP and BSW failed to clear the 5% threshold and will NOT be represented in the Bundestag. W/just 45% of the vote, a CDU/CSU-SPD coalition is possible, avoiding the need to include the Greens, who dropped to 11.6%. 👉However, fringe parties now hold a blocking minority, making constitutional changes—such as setting up an off-budget defense or infrastructure fund or reforming the debt brake—dependent on concessions to them or impossible altogether.

While equities took a beating Friday, bonds quietly broke out—closing above 5 months of trendzone resistance.

Right into PCE week… Interesting. $TLT Source: Trend Spider

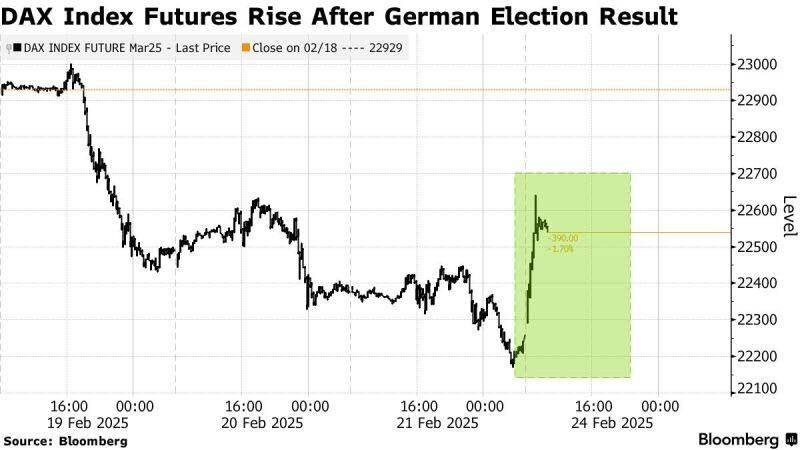

DAX Futures Gain With Euro in Asia After German Vote Outcome

Bloomberg, C.Barraud

German elections: the polls were spot on; no shocks, no surprises.

What does this mean for the new coalition government (most likely between CDU/CSU and SPD). Here is a handy primer from Deutsche Bank. Source: zerohedge, DB

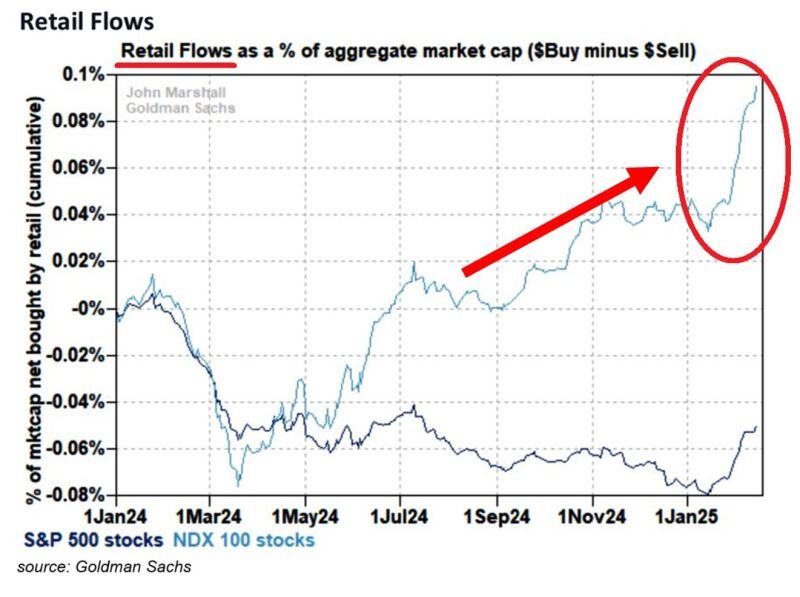

⚠️Retail investors are buying US stocks at the fastest pace on RECORD.

Mom-and-pop investors flows into technology stocks have more than DOUBLED in just a few weeks. Institutional investors selling to retail as they chase stocks at record valuations. Meanwhile, individual investors have UNDERperformed the market for 3 years in a row. Source: Global Markets Investor, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks