Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

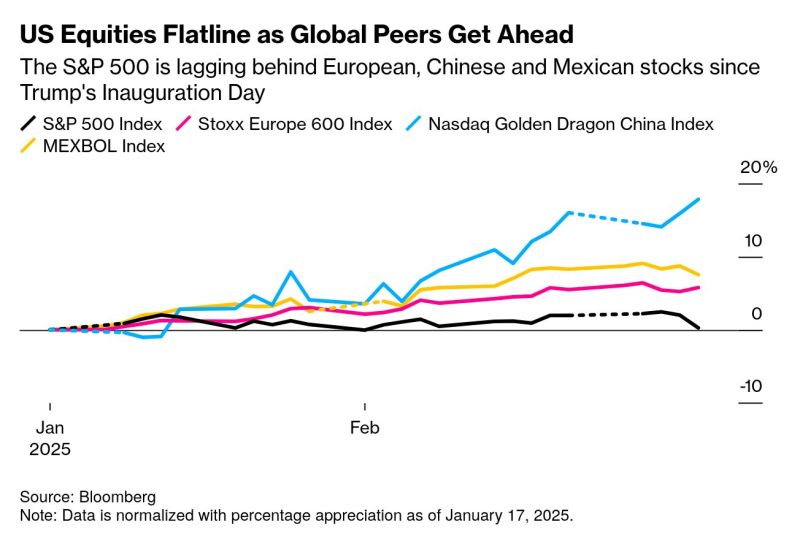

Wake up it is nvdia $NVDA earnings week...

Disappointing data could be a major blow for all Mag 7. Will a positive surprise trigger a revival of Mag 7 relative strength versus the rest of the world?

Strategy $MSTR, formerly known as MicroStrategy, has plummeted 48% since its November 21 all-time high 🚨

That's a total market cap loss of roughly $70 Billion

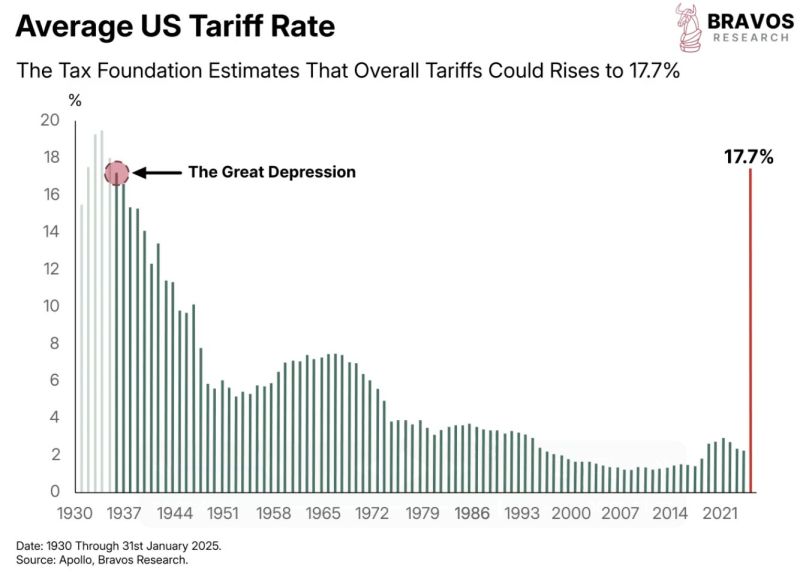

Tariffs are set to rise to 18% under Trump - according to the Tax foundation This level was last seen around the Great Depression

Source. Bravos Research, Apollo

Below is a list of 55 financial websites that are either free or offer extensive free functionalities.

Source: @realLigerCub on X

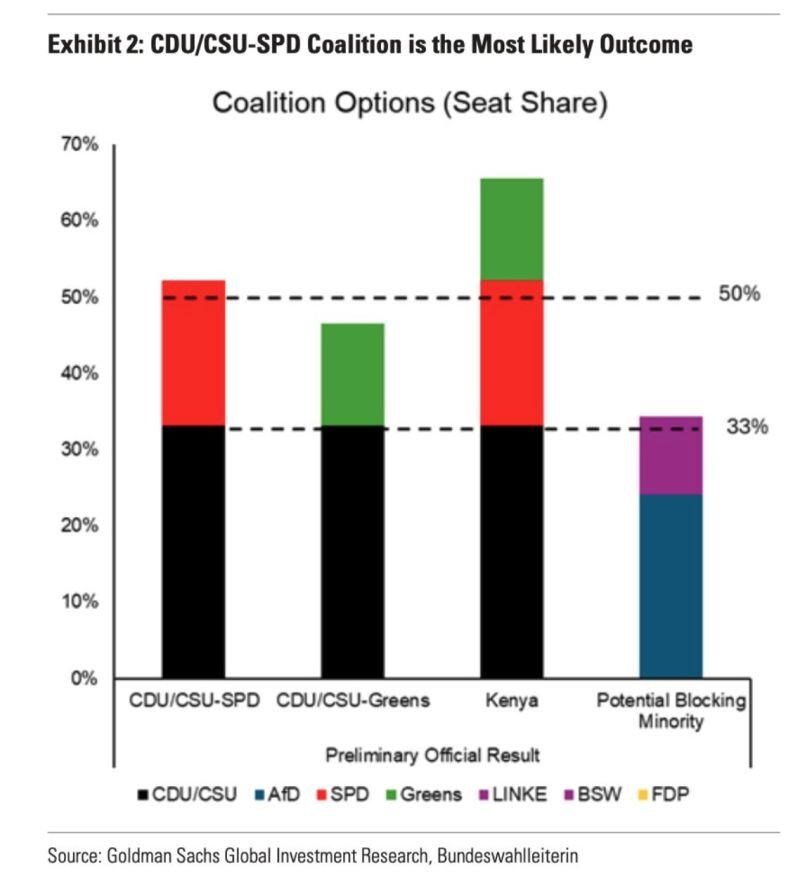

Germany political situation summarized in one chart

A CDU/CSU and SPD coalition holds a clear majority w/328 out of 630 seats. However, fringe parties AfD and Linke have a blocking minority of 216 seats, making it harder to revise the debt brake. Still, defense spending can be arranged through European mechanisms, bypassing the German debt brake, and the Left Party is likely to support changes for infrastructure investment in Germany. Source: HolgerZ, Goldman Sachs

The mid-cap MDax is significantly outperforming the benchmark Dax, driven by optimism for economic reforms after the election.

Since the MDax is heavily tied to the German economy, it benefits the most from these expectations. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks