Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tesla $TSLA is currently the 5th worst-performing stock in the S&P 500 YTD, down 23%. Brutal.

Source: Trend Spider

➡️ Nvidia sales grow 78% on AI demand, company gives strong guidance

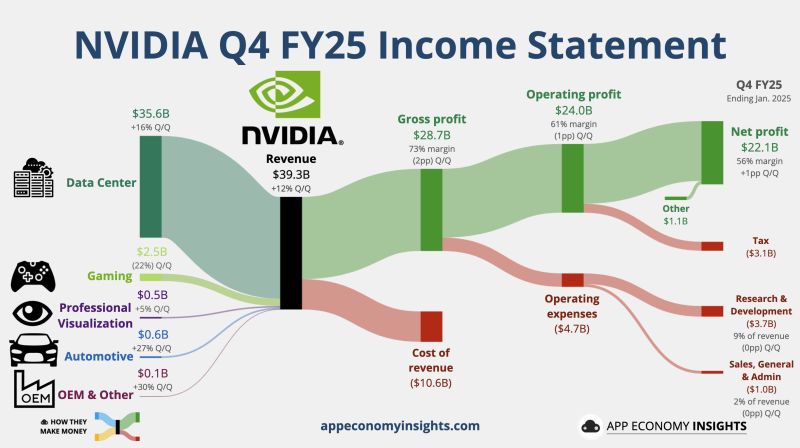

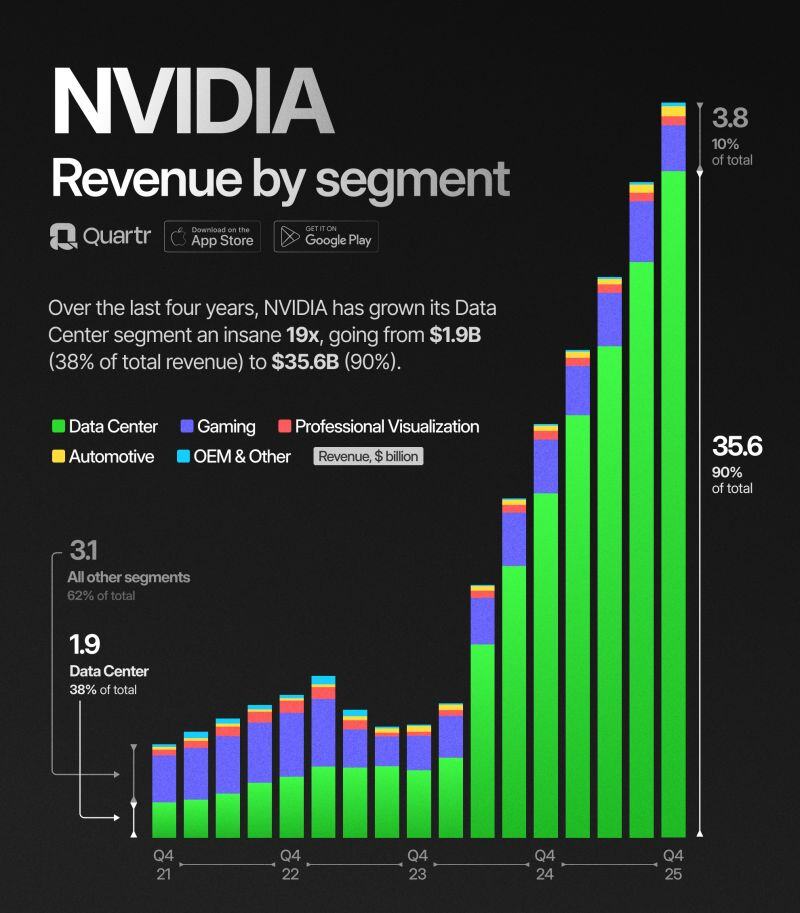

🔴 Nvidia reported fourth-quarter earnings after the bell on Wednesday that beat Wall Street expectations. 🔴The company’s revenue in the quarter rose 78%, and full fiscal-year revenue for Nvidia rose 114% to $130.5 billion. 🔴 Nvidia reported a 73% gross margin in the quarter, which was down three points on an annual basis. The company said the decline in gross margin was due to newer data center products that were more complicated and expensive. 🔴Nvidia said it expected about $43 billion in first-quarter revenue, plus or minus 2%, versus $41.78 billion expected per LSEG estimates. The first-quarter forecast implies year-to-year growth of about 65% from a year earlier, a slowdown from 262% annual growth in the same period a year prior. 👉 The stock was mixed after-hours $NVDA NVIDIA Q4 FY25 (January quarter). • Revenue +12% Q/Q to $39.3B ($1.2B beat). • Gross margin 73% (-2pp Q/Q). • Operating margin 61% (-1pp Q/Q). • Non-GAAP EPS $0.89 ($0.04 beat). Q1 FY26 guidance: • Revenue $43.0B ($1.0B beat). Source: CNBC, App Insights

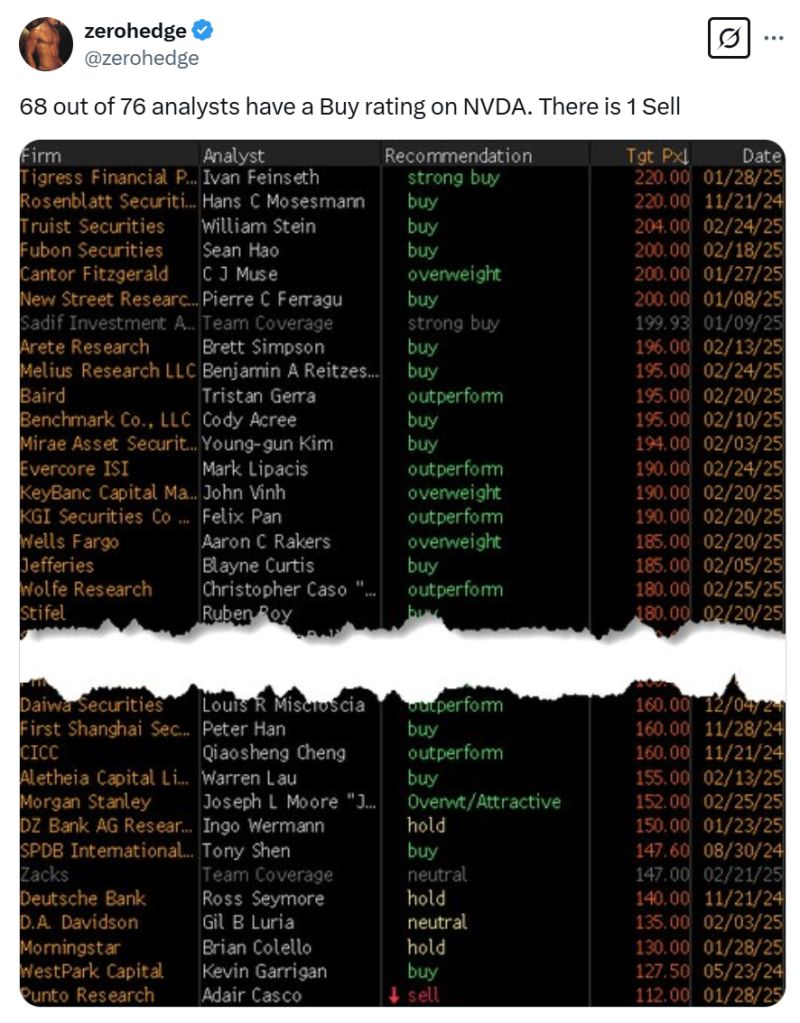

Nvidia $NVDA: if you wonder why the stock was not surging after-hours despite beating Street estimates, here's part of the answer:

everyone's is UBER-BULLISH on the stock. This caps the upside.

Yesterday, S&P 500 and 10y Treasury yield rolled over intraday ...

markets showing more concern for growth as opposed to inflation when it comes to tariffs. Source: Kevin Gordon @KevRGordon on X, Bloomberg

$NVDA Q4 2025

"We've successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter." - Jensen Huang Revenue +78% *Data Center +93% *Gaming -11% *Professional Vis. +10% *Automotive +103% EBIT +77% *marg. 61% (62) EPS +82% Source: Quartr

Bitcoin and TQQQ (3x QQQ) have moved in tandem for a long time.

Looks like BTC wants "this" even lower. Source: The Market Ear

Europe has AI regulations without AI companies.

Europe has crypto regulations without crypto. Europe wants to censor social media without social media companies. Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks