Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The World’s Largest Sovereign Wealth Funds

Source: Voronoi, Visual Capitalist

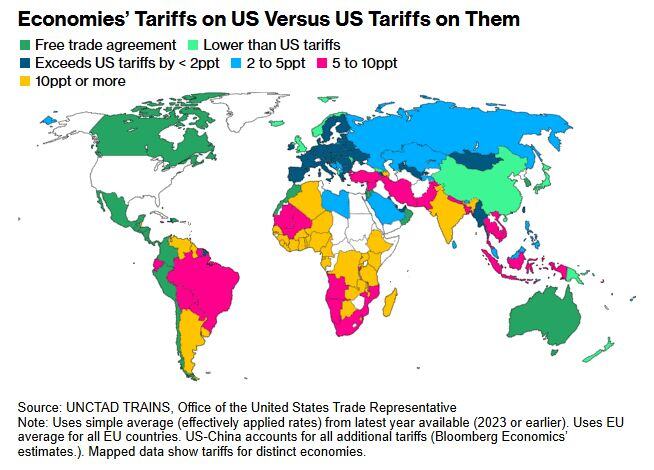

President Donald Trump has recently announced plans to implement "reciprocal tariffs"

aimed at addressing perceived trade imbalances between the United States and its trading partners. This policy intends to match the tariffs that other countries impose on U.S. exports by levying equivalent tariffs on imports from those nations. The goal is to promote fairness and encourage countries to reduce their tariffs on American goods. Source. Bloomberg, ChatGPT

The more we learn the more we realize how little we know

Source: Yasin Arafeh

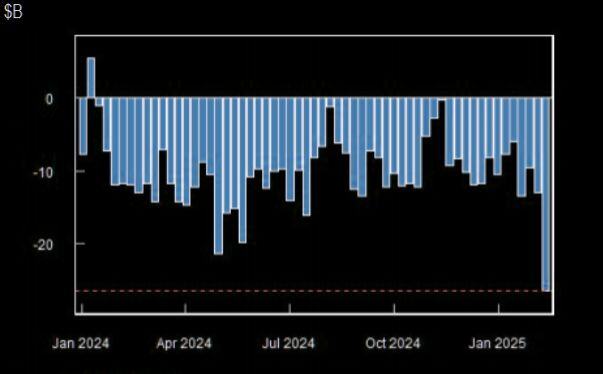

Retail Options Traders are now short the LARGEST amount of Gamma in AT LEAST the last 14 months 🚨

Source: Barchart, TME

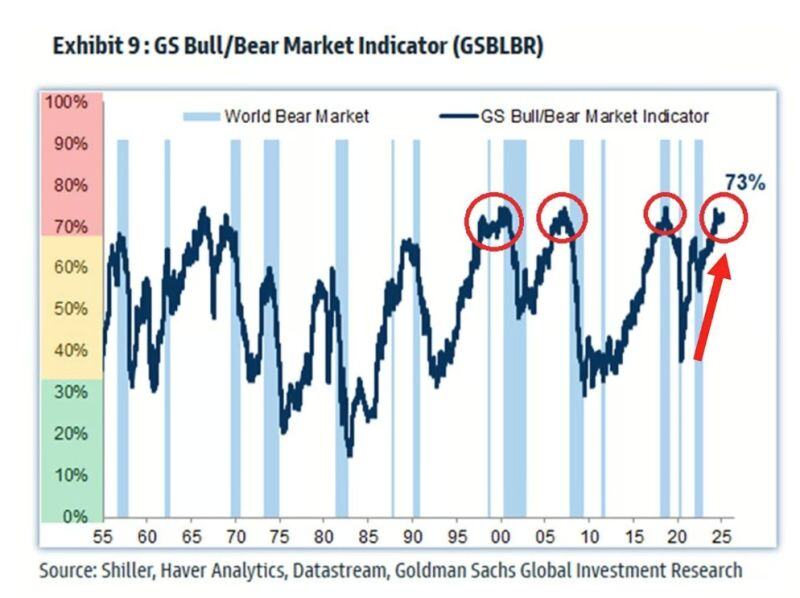

The Goldman Sachs Bull/Bear Market Indicator measuring market and economic sentiment hit 73% 🚀

One of the largest readings in history. As you can see, this is in line with the previous peaks that occurred before bear markets in 1999, 2007, and 2020. The index uses US stock market valuations, government bonds yield curve, unemployment, inflation, and other economic metrics. ➡️ It simply means that the sentiment has rarely been this euphoric before. Source: Global Markets Investor, GS

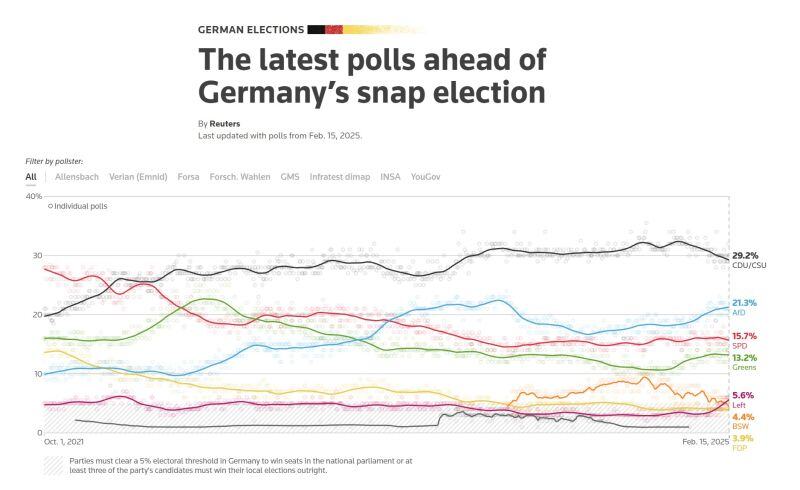

Germany will hold a snap national election on February 23 following the collapse of Chancellor Olaf Scholz's three-way coalition.

Currently, the CDU/CSU leads in Reuters polling aggregate by 8 points over the AfD. The far-right AfD has gained 4.6 points since June 2024. The SPD, the current leaders in the national parliament, have lost 12.1 points since the last federal election, and are currently in third place. Germany has two centrist, “big-tent” parties: Scholz's centre-left Social Democrats (SPD) and the opposition conservatives, an alliance of the Christian Democrats (CDU) and their Bavarian sister party, the Christian Social Union (CSU). Both have lost support in recent years, with smaller parties such as the Greens and far-right Alternative for Germany (AfD) gaining ground. The SPD, conservatives, Greens and AfD are all fielding candidates for chancellor. Also running are the pro-market Free Democrats (FDP), the far-left Linke and the leftist Sahra Wagenknecht Alliance (BSW), who are all at risk of missing the 5% threshold to make it into parliament, according to opinion polls. Source: Reuters

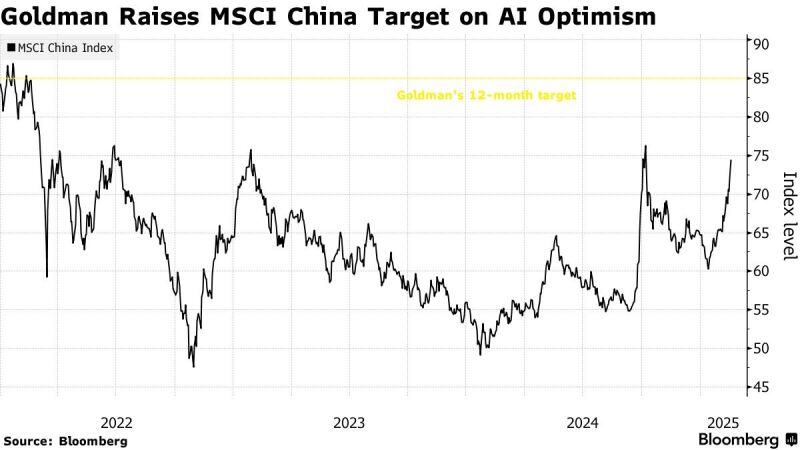

Goldman Raises MSCI China Target as DeepSeek Improves Outlook - Bloomberg

Strategists at Goldman Sachs Group Inc. expect a blistering rally in Chinese equities to continue, as the emergence of DeepSeek sparks optimism over the country’s technological advancements. Kinger Lau and his colleagues see the MSCI China Index reaching 85 over the next 12 months, up from their previous target of 75. That indicates another 16% rise from Friday’s close. The index has already entered a bull market earlier this month. Their target for the CSI 300 Index was raised to 4,700 from 4,600.

Investing with intelligence

Our latest research, commentary and market outlooks