Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

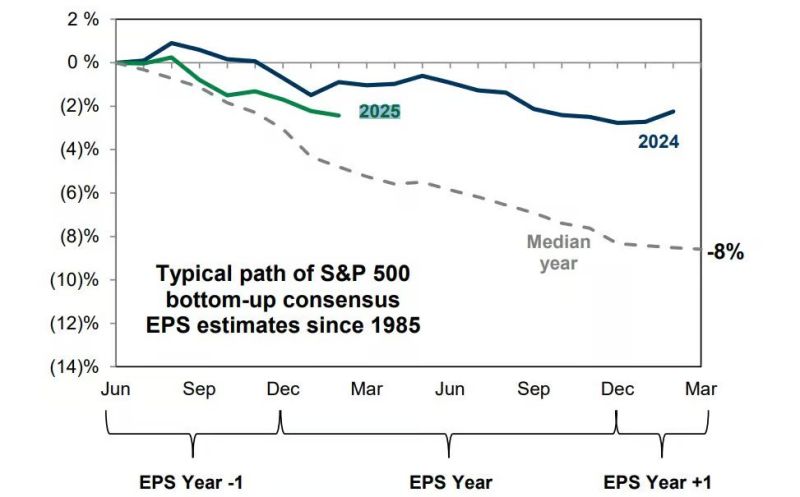

2025 US earnings estimates are tracking above the typical path.

Source: Goldman Sachs via @MikeZaccardi

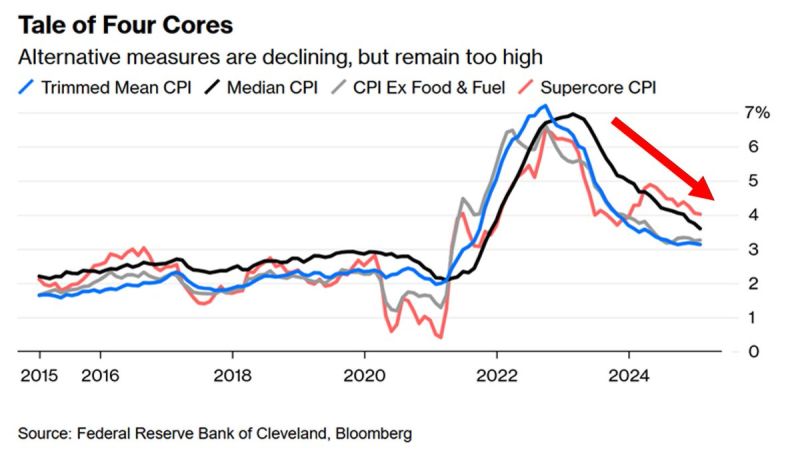

US inflation decline has slowed but is NOT re-surging:

US inflation metrics which exclude outliers and one-time bumps as still declining but at a slower rate. January is also the seasonally worst month as firms tend to announce price raises at the start of the calendar year. Source: Global Markets Investor

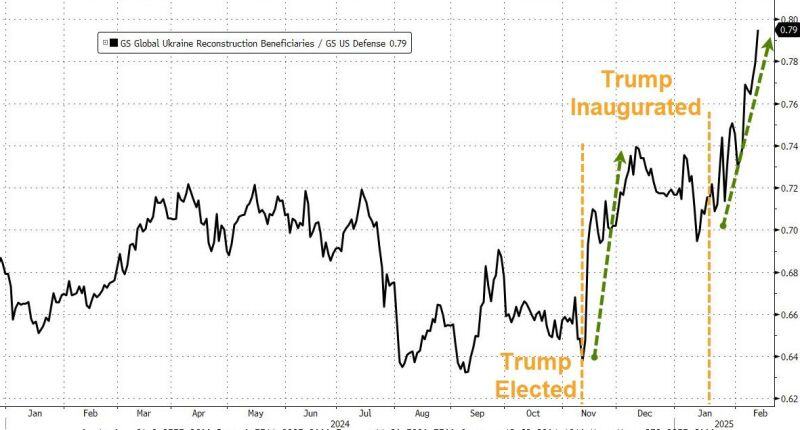

Goldman's basket of Ukraine reconstruction beneficiaries has dramatically outperformed defence stocks since Trump's election.

It's composed of industrials/infrastructure stocks. Source: www.zerohedge.com, Goldman

GameStop surged +20% on news it is considering buying Bitcoin with its $4.6 BILLION cash balance.

Source: Radar 𝘸 Archie

The success of Chinese artificial intelligence (AI) start-up DeepSeek is prompting investors to reassess the nation’s technology companies.

The Hang Seng Tech Index, whose biggest members include Tencent Holdings, Alibaba Group Holding and Xiaomi, approached a four-month high on Thursday, after rallying more than 10 per cent over the past two weeks, while the broader Hang Seng Index climbed about 6 per cent. As shown on the chart below, the valuation gap between Chinese stocks and the Mag7 remains massive. Source: Compounding Quality @finvibe

We don't necessarily see many China cars in so-called "developed countries".

But in the rest of the world, the number of Chinese cars we can see on the road is shocking. No surprise to see the numbers of Chinese cars exports skyrocketting as shown on this chart courtesy of Lyn Alden.

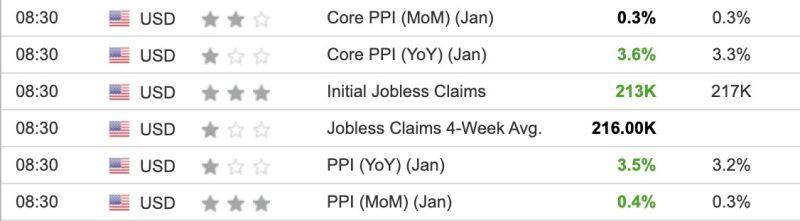

BREAKING: January PPI inflation unexpectedly RISES to 3.5%, above expectations of 3.2%.

Core PPI inflation was 3.6%, ABOVE expectations of 3.3%. PPI inflation is now at its highest since February 2023 while CPI jumped +0.5% month-over-month. Source: The Kobeissi Letter

On US inflation expectations, from @johnauthers daily note:

"The two-year breakeven has broken above 3% (the upper range of the Fed’s target) to its highest in two years, while the 10-year is also at a two-year high after reaching 2.5%. The breakeven for the five years starting five years hence, which the Fed tracks closely, remains anchored, but it’s obvious that markets are growing more jumpy about inflation." Source: Bloomberg, Mo El-Erian

Investing with intelligence

Our latest research, commentary and market outlooks