Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"AI" +"Adoption" mentions of the US companies with over $1 billion in market capitalization spiked to ~100, an all-time high.

During Q4 2024 earnings, a record 50% of S&P 500 firms mentioned “AI”. Source: Global Markets Investor

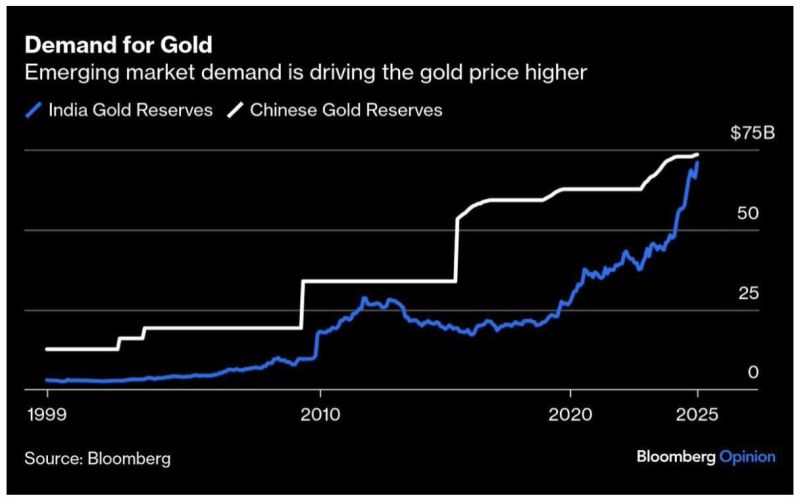

India and Chinese Gold Reserves are at all-time highs

Source: Barchart, Bloomberg Opinion

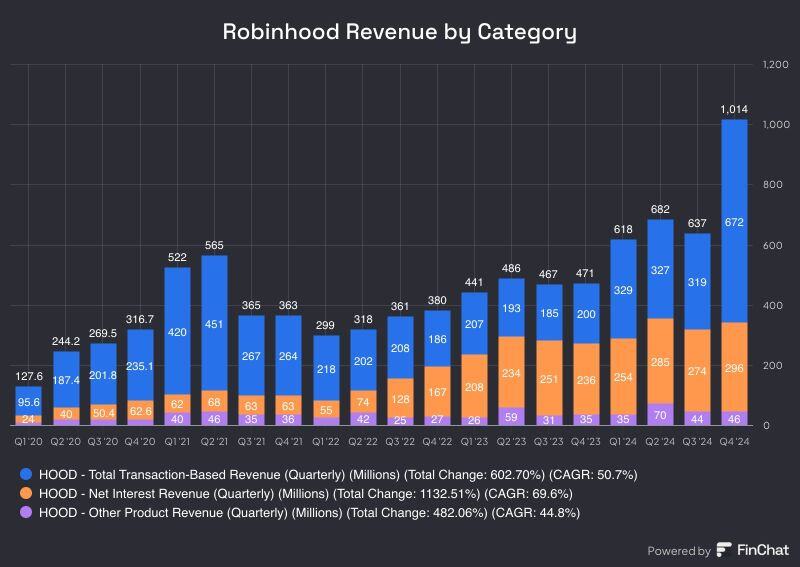

ONE BILLION DOLLAR BABY.....

FOR THE FIRST TIME EVER 🚀 Robinhood $HOOD just had its first quarter with more than $1 Billion of Revenue Source: Evan

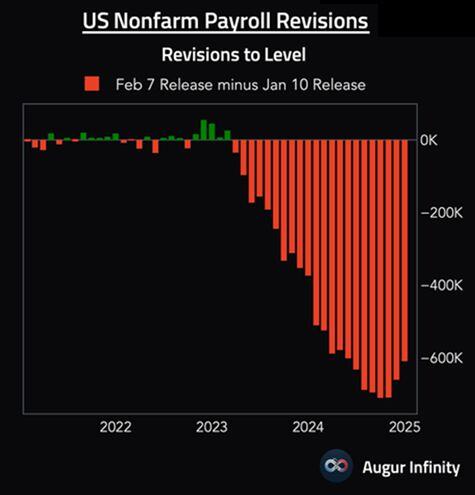

Lower wage inflation and higher US unemployment rate ahead?

🚨 One US job market leading indicator is plummeting: The average weekly hours worked by Americans fell to 34.1, the lowest since the Great Financial Crisis and in line with the 2020 crisis low. Typically, hours worked decrease before LAYOFFS pick up...👇 Source: Global Markets Investor, Augur infinity

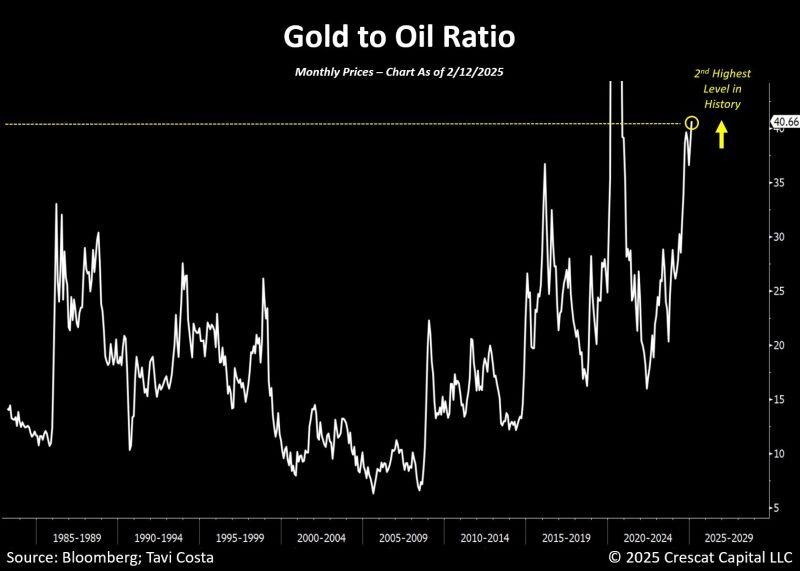

The gold-to-oil ratio just hit its highest level ever on the monthly chart—excluding the COVID spike.

Could the mining companies be the biggest beneficiaries? This directly impacts their margins, which are expanding significantly as metal prices climb. As pointed out by Tavi Costa, Gold is up nearly $1,000/oz from a year ago, while production costs have risen only about $100–$200/oz, depending on the mine. Source: Crescat Capital, Bloomberg

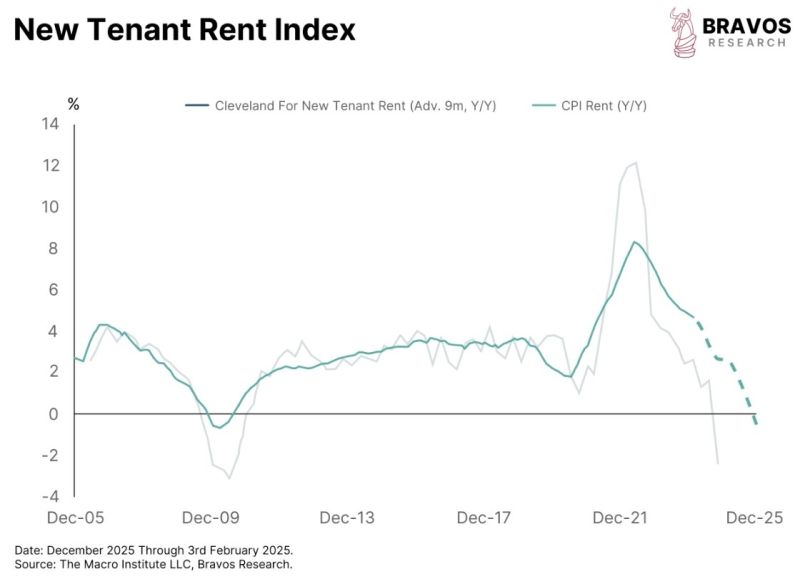

ALERT: New tenant rent data predicts CPI rent inflation by about 9 months

Currently, it’s pointing to a continued decline in rent inflation. And since rent is one of the biggest components of inflation, it suggests that inflation will keep trending lower Source: Bravos Research

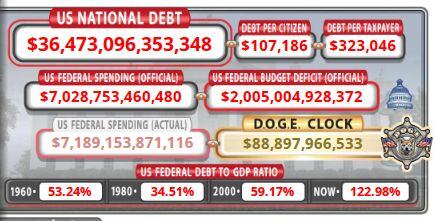

The D.O.G.E clock is ticking... 🚨‼️

JUST IN: President Trump commends Elon, announces a news conference set for Thursday (TODAY) — during which he will read list of names of recipients of waste, fraud and abuse. "I'm going to read to you some of the names that hundreds of millions and even billions of dollars have been given to." “I say it in front of our our attorney general. There's no chance that there's not kickbacks or something going on. When you give millions and millions of dollars to somebody that stands to look at something for 15 minutes and walks away with millions of dollars. That money's coming back in some form. And that's only one form of corruption." "I went through a list of 200 expenditures that were made, and I found three that looked like they were reasonable. Okay, three and, we'll be talking about that tomorrow (read TODAY)." Teh debt clock below now features a D.O.G.E clock with all the savings already planned through the D.O.G.E program.

Investing with intelligence

Our latest research, commentary and market outlooks