Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oracle’s debt-to-equity ratio is ~520%, way above other AI stocks

E.g Amazon is near 50%. Microsoft close to 30%. Google’s even lower. How long can Oracle afford to keep this up? Source: StockMarket.news

The circular AI economy...

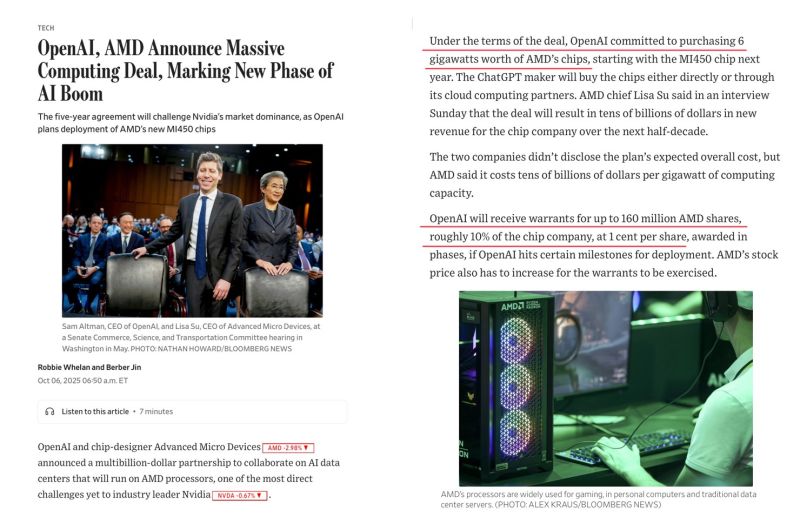

$AMD giving OpenAI 10% of its stock (worth roughly $35bn pre-market) so OpenAI can buy 6 GW of AMD chips over the next few years. Stock up +27%. Source: Wasteland Capital @ecommerceshares

Japan 30-Year Bond Yield jumps to 3.29%, the highest level in history.

Source: Carl ₿ MENGER @CarlBMenger

$MSFT is following the path of $GOOGL

This translates to around $340,000 for every citizen, making it one of the richest countries per capita. Source: Massimo @Rainmaker1973, Quartr

Norway, a country with just over 5 million people, manages the world’s largest sovereign wealth fund, worth nearly $2 trillion.

This translates to around $340,000 for every citizen, making it one of the richest countries per capita. Source: Massimo @Rainmaker1973, Quartr

Goldman is raising their gold price Dec2026 forecast to $4,900 (prior $4,300)

Source: Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks