Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

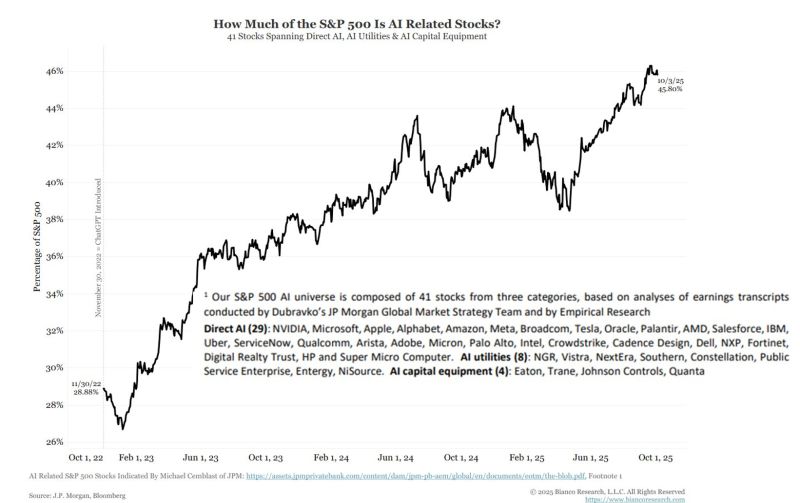

How much of the S&P 500 is AI related stocks?

JP Morgan has identified 41 "AI-Related" stocks. As this chart shows, they are now 45% of the S&P 500. Source: Bianco Research

Ken Griffin says investors are flocking to gold and ditching the dollar to “de-risk their portfolios from U.S. sovereign risk.”

Source: Bloomberg

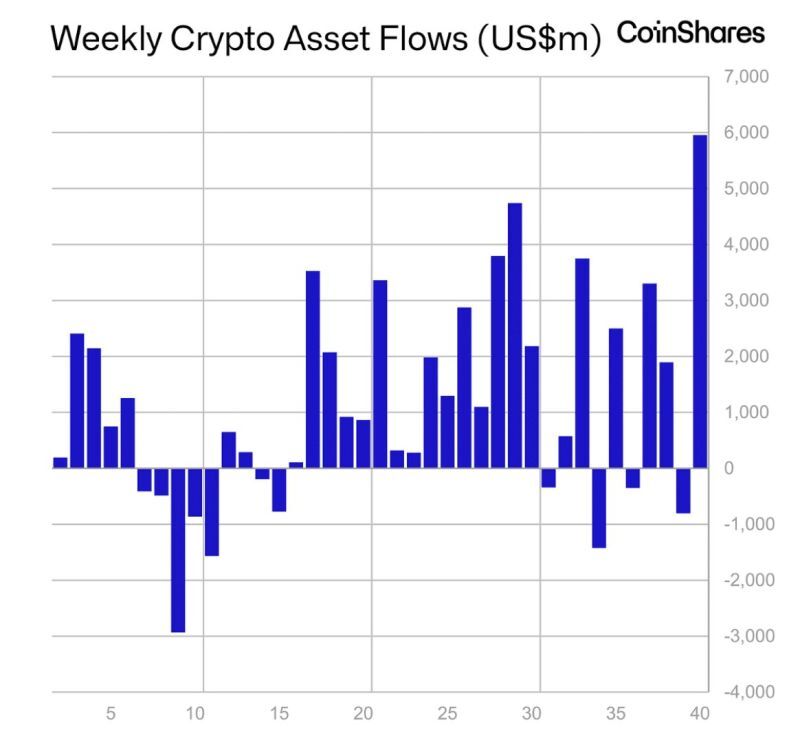

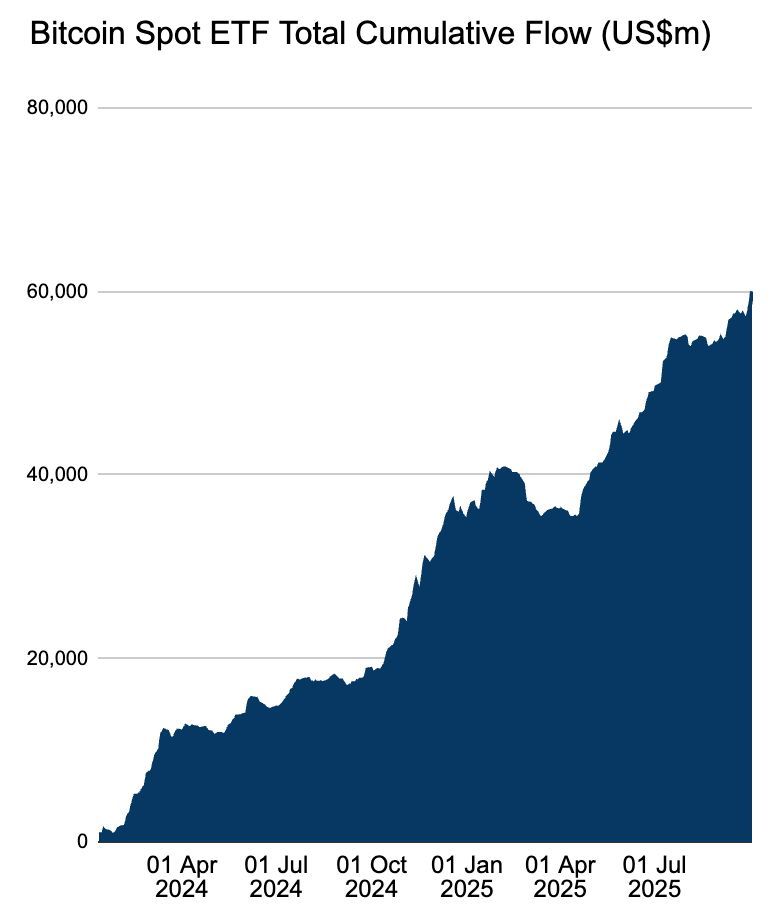

Crypto saw an inflow of nearly $6 Billion last week, the largest weekly inflow in history 🚨🚨

Source: Barchart, Coinshares

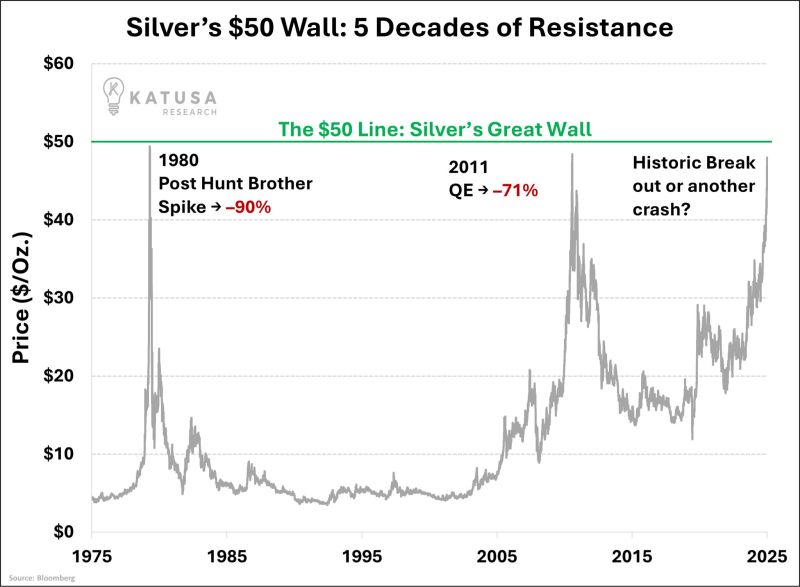

Silver’s approaching the level that destroyed it twice

1980 → down 90% 2011 → down 71% Will it be the breakout of a lifetime or another déjà vu? Source: Katusa Research

From the FT article on “Labour markets stuck in a ‘low hire, low fire’ cycle”:

“Labour markets in many leading economies are freezing up as uncertainty over trade, tax and artificial intelligence causes employers to put off hiring and firing and employees to stick with their jobs.”

Investing with intelligence

Our latest research, commentary and market outlooks