Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

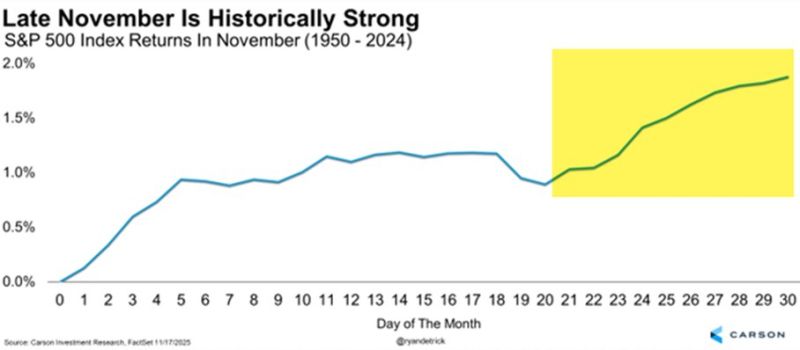

Late November is historically a strong time of the year. Is this year going to be different?

Source: Ryan Detrick, CMT @RyanDetrick

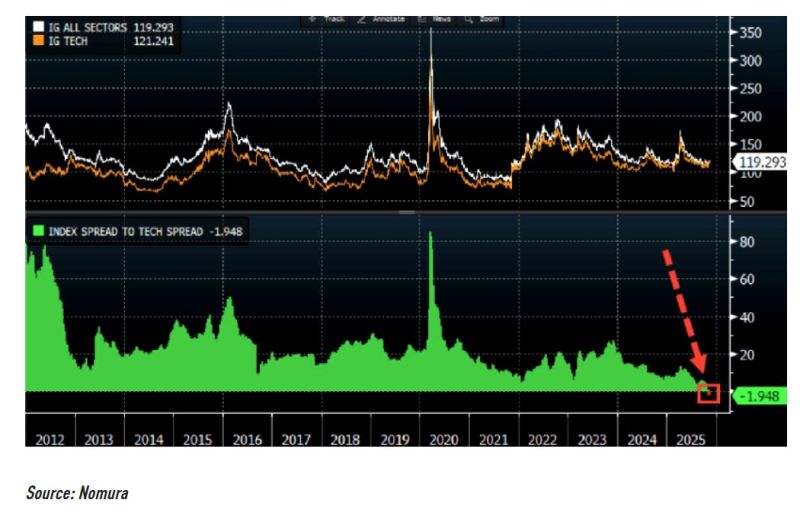

IG tech spreads are wider than the broad index for the first time since 2012...

Source: zerohedge

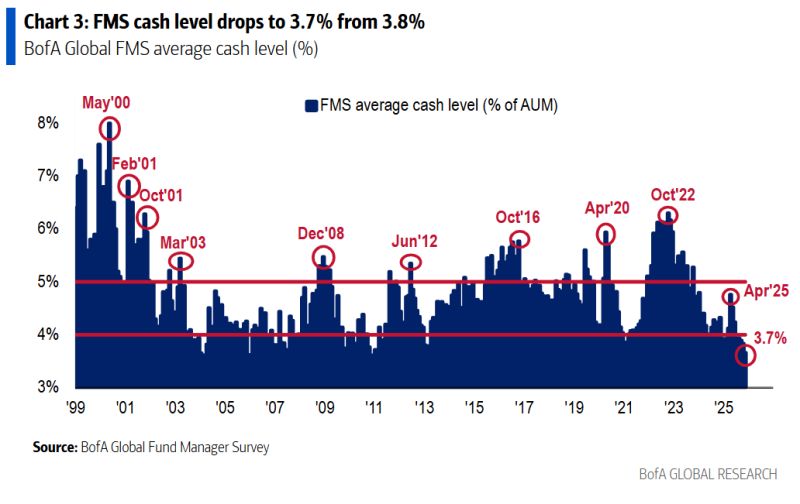

Investors are holding one of the lowest proportions of cash in modern history:

November BofA global fund manager survey. "Cash levels of 3.7% or lower has occurred 20 times since 2002, & on every occasion stocks fell and Treasuries outperformed in the following 1-3 months:" BofA

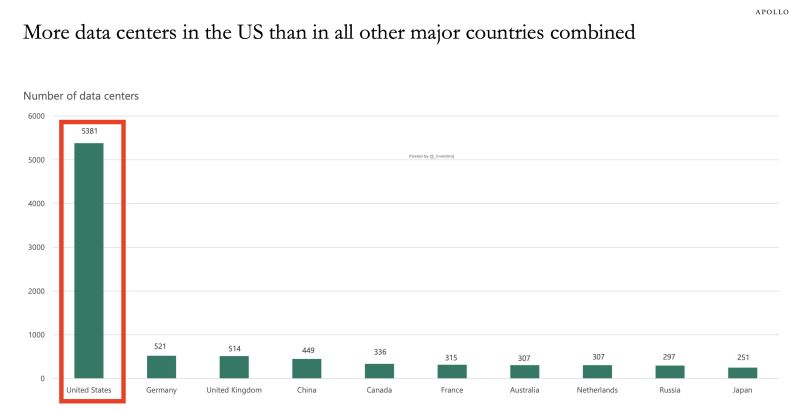

The US has 5,381 data centers — more than China (449) and every other major nation combined.

The American bet is simple: own the most compute, win the AI race. But China isn’t playing that game. Instead of chasing data center volume, China open-sourced frontier models (DeepSeek, Qwen, Baichuan) that run on cheap hardware. DeepSeek trained a frontier model for $5–6M (vs. tens of millions in the US). Inference costs are ~280x cheaper than ChatGPT. Modular data centers deploy in weeks, built around ultra-low-cost power. China isn’t scaling infrastructure. They’re scaling efficiency — and commoditizing intelligence. Meanwhile, the US is hitting a wall: the power grid. Data centers already use 6% of US electricity, headed to 11% by 2030. Spare grid capacity has fallen from 26% → 19%, on track for <15%. Some regions face 7-year waitlists just to connect new facilities. Ohio alone rejected 17 GW of new data center interconnection requests. You can build data centers. But can you power them? China can. By 2025, their installed capacity hits 3.99 TW (up 19% YoY). Renewables are nearly half of all generation. In the first five months of 2025 alone: 197 GW solar added 46 GW wind added By 2030, China is expected to have 400 GW of spare power capacity — over 3× global data center demand. The US built the most data centers. China built the power to scale whatever it wants. The real race isn’t about who has more compute today — it’s who can power their compute tomorrow. And on that dimension, China is pulling ahead. Source: StockMarket.news, Apollo

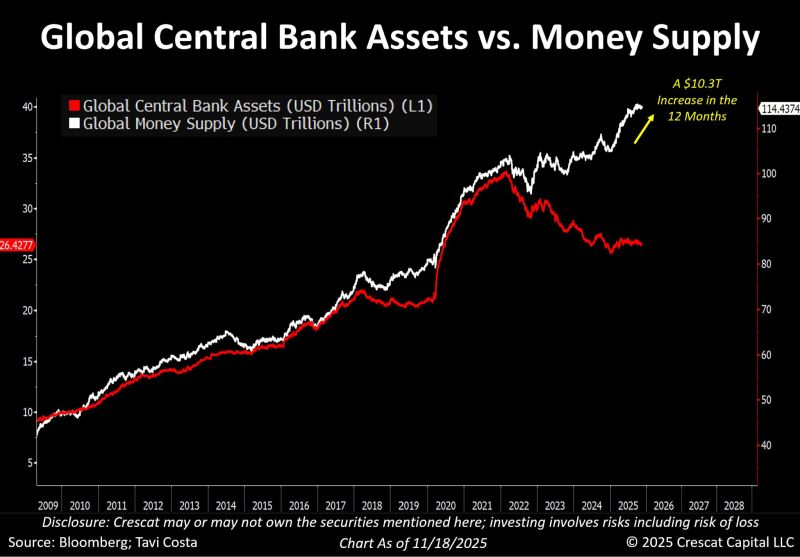

Very interesting to see money supply expanding this aggressively even as global central bank balance sheets have been contracting.

What will happen once central banks inevitably need to expand their balance sheets again? Source: Tavi Costa, Bloomberg

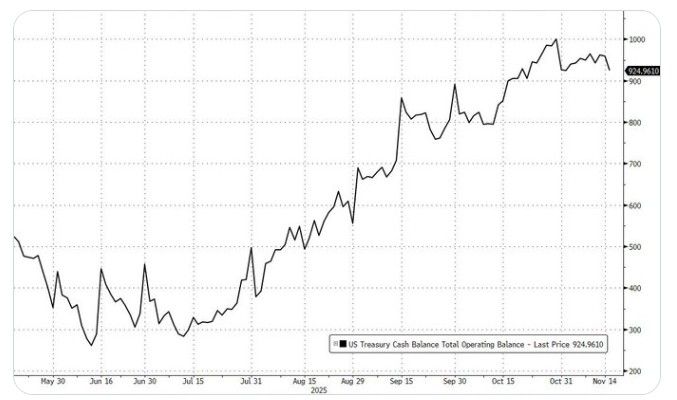

First notable slide in TGA (Treasury General Account):

Treasury cash is down $34BN to $925BN from $959BN Source: www.zerohedge.com, Bloomberg

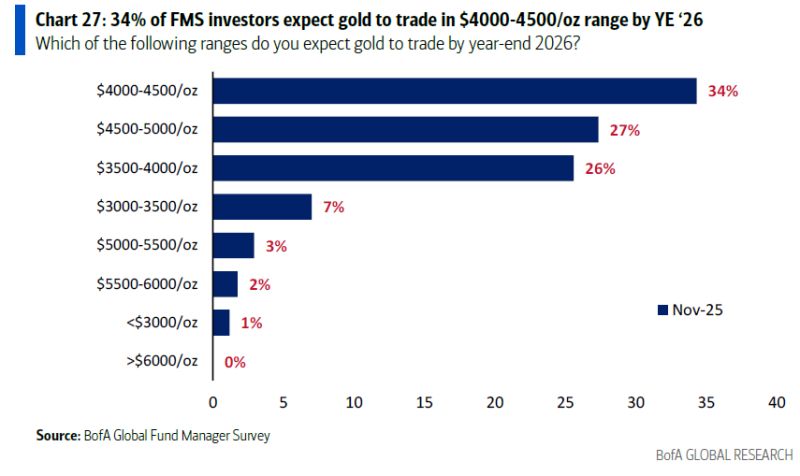

Only 5% of Fund Managers expect gold to trade above $5,000 by the end of 2026, none over $6,000

Source: BofA

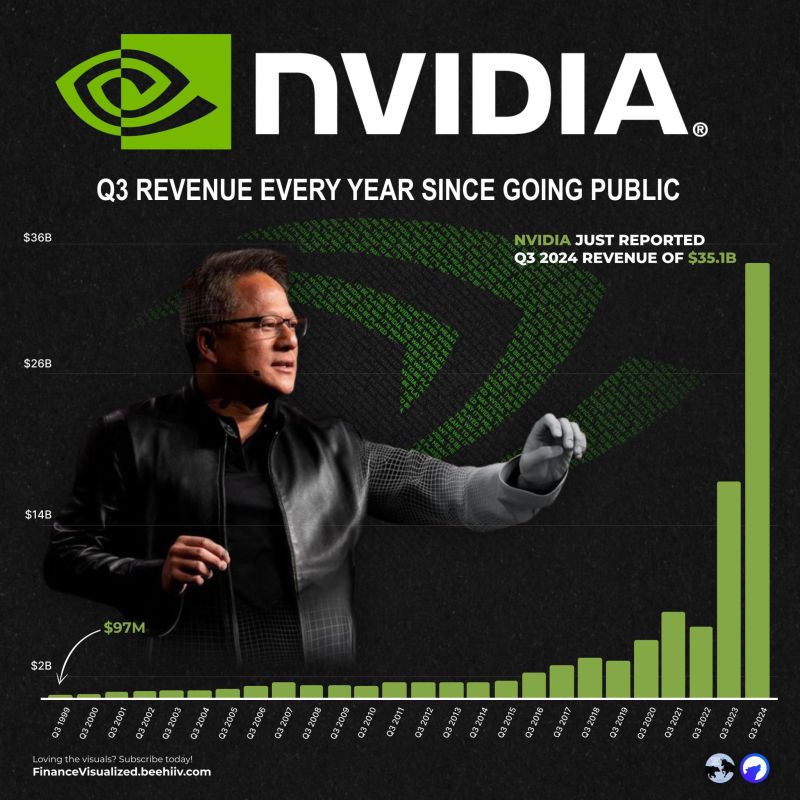

This chart will get soon updated

Wall ST is expecting Nvidia $NVDA to report revenue of $54.9 Billion tomorrow up from $35.1B in the same quarter last year Source: Wolf, https://lnkd.in/enK2fikS

Investing with intelligence

Our latest research, commentary and market outlooks