Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US technology stocks now account for a record 56% of total US stock market cap.

At the same time, defensive stocks make up just 16%, AN ALL-TIME LOW. This has NEVER happened. Source: Global Markets Investor, Topdown charts

Did you know there are more PE funds than McDonald's in the US ?

Source: Mr. VIX @yieldsearcher

In the US, searches for "second job" reach an all time high, surpassing 2008 financial crisis and COVID pandemic levels

Source: Kalshi

Good chart by @GoldmanSachs on AI exposure by industry

Source: Goldman Sachs, @tanayj on X

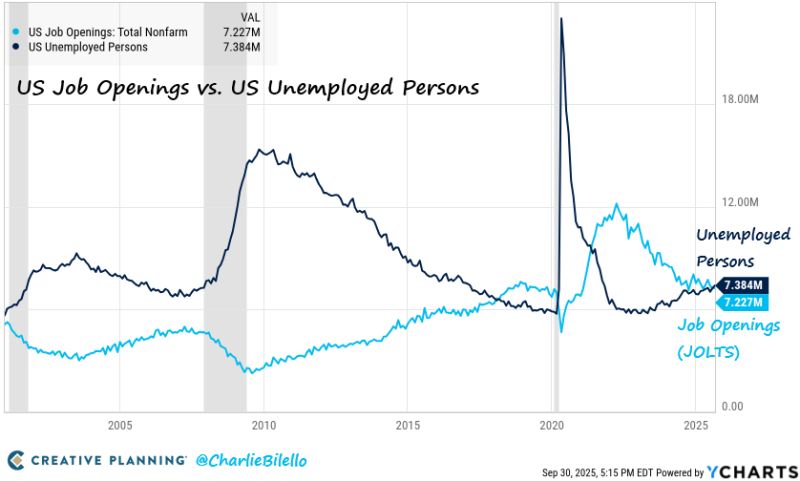

There are now 157k more Unemployed Persons than Job Openings in the US.

Excluding the 2020 recession, this is the widest spread we've seen since 2017. Labor market continues to cool... Source: Charlie Bilello

President Trump says he is considering $1,000 - $2,000 stimulus checks for all taxpayers using tariff revenue.

Source; Geiger Capital on X

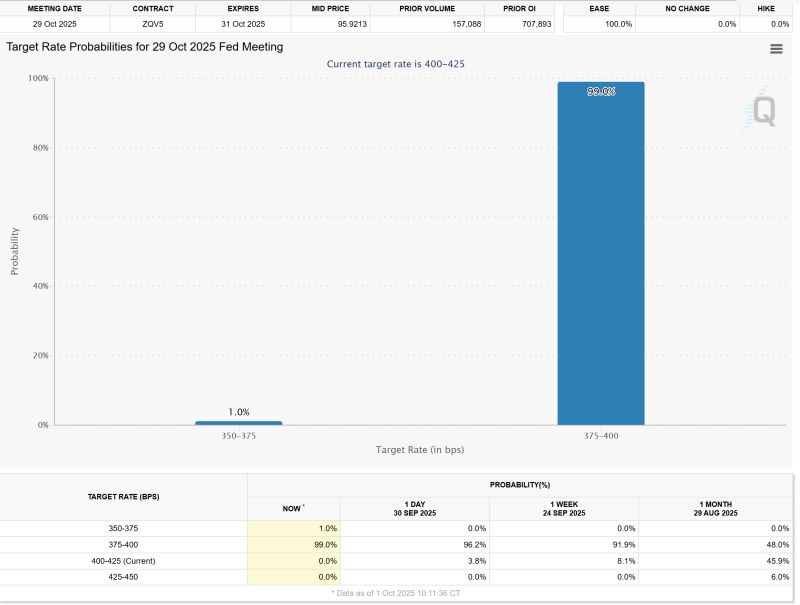

According to CME Fed watch tool, odds of a Fed rate cut in October are now 99%...

So done deal after the poor ADP payrolls numbers...

Kalshi is currently pricing in a 57% chance that the 🇺🇸 Government shutdown will last more than 10 days

Source: Kalshi

Investing with intelligence

Our latest research, commentary and market outlooks