Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

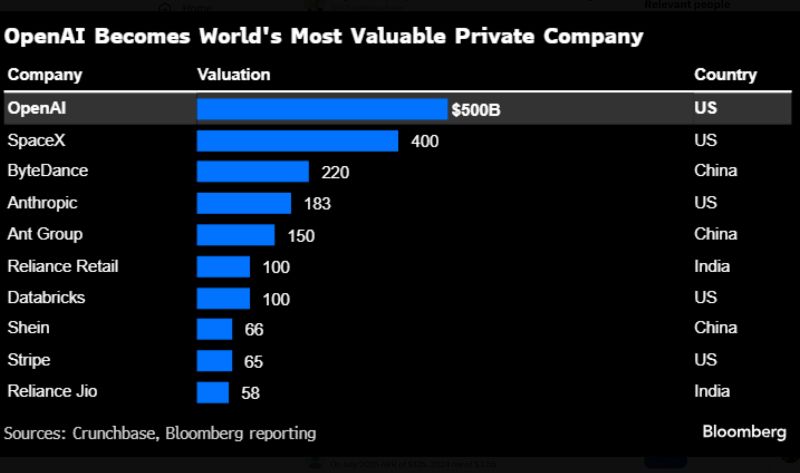

OpenAI valuation soars to $500bn, topping Musk’s SpaceX

Current and former OpenAI employees sold ~$6.6bn of stock to investors at a $500bn valuation, boosting the US company’s price tag well past its previous $300bn level. Source: HolgerZ, Bloomberg

StockMarket.news >>> Shutdowns don’t mean every federal worker goes home.

In fact, the majority keep working but many do so without pay. Defense alone accounts for over 800,000 employees, with nearly half exempt to maintain readiness. Veterans Affairs and Homeland Security also keep most staff on the job. By contrast, agencies like Treasury, Agriculture, and Commerce see heavier furloughs, meaning critical services like tax processing, farm programs, and trade oversight grind to a halt. All told, nearly 900,000 workers could be directly furloughed this time, while millions more are forced to work without pay, highlighting just how disruptive a full shutdown really is. Source: stockmarket.news

The federal government has officially shut down after Congress failed to pass short-term funding

Source. ABC News

FedWatch shows a 92.5% chance of a 25 bps Fed rate cut in October.

Source: CME FedWatch

gold just had its best monthly performance since August 2011...

Source: zerohedge

Dollar seasonality

Now is the time to buy the dollar, at least from a seasonality point of view Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks