Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

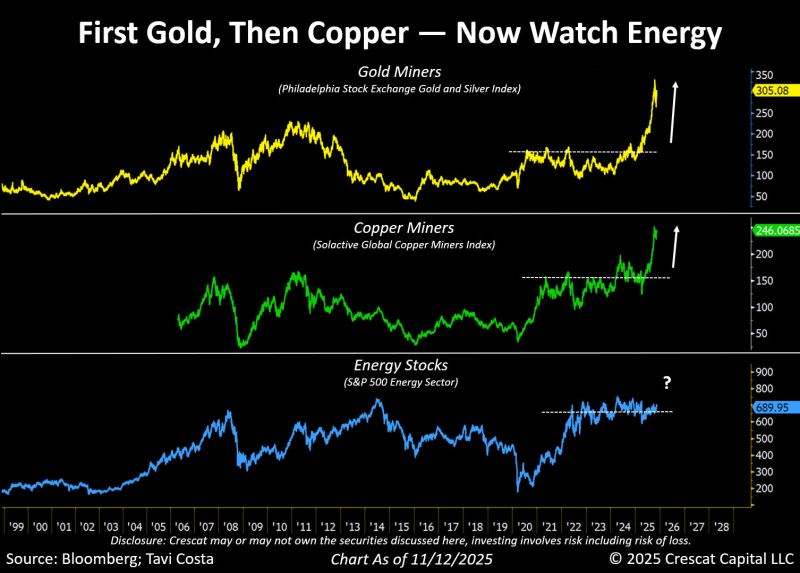

Gold stocks broke out of a major consolidation.

Copper miners followed with almost the same pattern. Are energy equities next? Source: Tavi Costa

Mom, can you come pick me up?

I'm scared. Source: Trend Spider

🔥 OpenAI’s “Go Big or Go Bust” Strategy Just Went Public — and the numbers are insane.

According to leaked financials, OpenAI is preparing to lose $74B in 2028 alone — yes, one year — before expecting to swing to real profitability by 2030. What about this year? $13B in revenue $9B in cash burn A burn rate of ~70% of revenue ‼️ And it only gets wilder: OpenAI expects three-quarters of its 2028 revenue to be wiped out by operating losses. Meanwhile, competitor Anthropic expects to break even in 2028. OpenAI expects to burn $115B cumulatively through 2029. OpenAI’s commitments: Up to $1.4T over 8 years for compute deals Nearly $100B on backup data-center capacity Aiming for $200B in revenue by 2030 (a 15x jump from today) 💡 The read-through: This is the biggest strategic divergence in AI right now: Anthropic = disciplined scaling OpenAI = moonshot economics OpenAI is effectively saying: “We’ll lose tens of billions now to own the entire future later.” But there’s a catch: 95% of businesses still get zero real value from AI today. And OpenAI is funding its hyperscale buildout not from revenue (like AWS did), but from debt, investors, and chip-supplier deals — while losing money on every ChatGPT interaction. This ends one of two ways: 🚀 The most valuable company in history 💥 Or a case study in overestimating demand There’s no middle lane when you’re burning cash faster than any startup in history... Source: hedgie on X

Bitcoin's weekly RSI is at its most oversold level since the April bottom, the end of last summer's 'chopsolidation', and the end of the last bear market.

Source: Joe Consorti @JoeConsorti

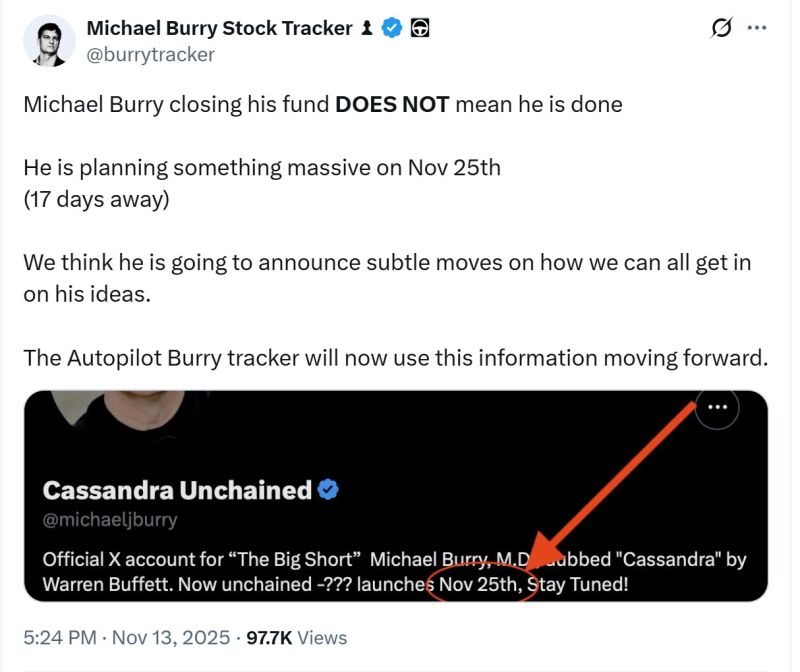

Yesterday: Michael Burry shutting down hedge fund

April 7: Tom Lee issues apology to investors Signs of time? 🤔 Source: The Market Stats @TheMarketStats

It seems that Michael Burry closing his fund DOES NOT mean he is done

He is planning something massive on Nov 25th...

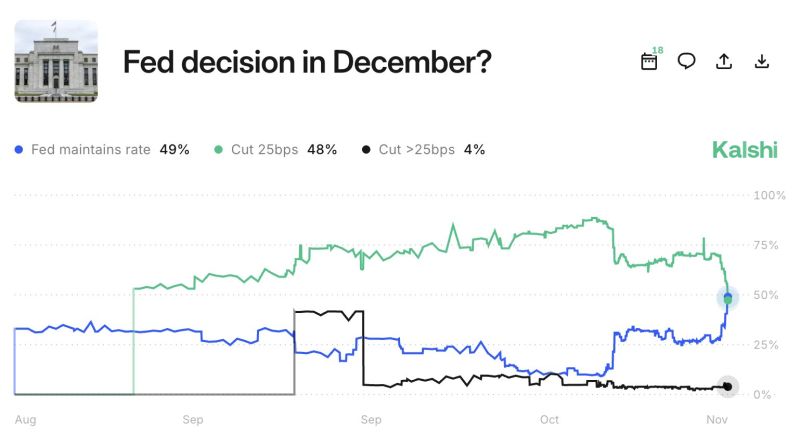

"NO CUTS" IS NOW MORE LIKELY THAN 25 BPS CUT IN DECEMBER

Mid-October, it was almost a done deal Source: Kalshi @Kalshi

Investing with intelligence

Our latest research, commentary and market outlooks