Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

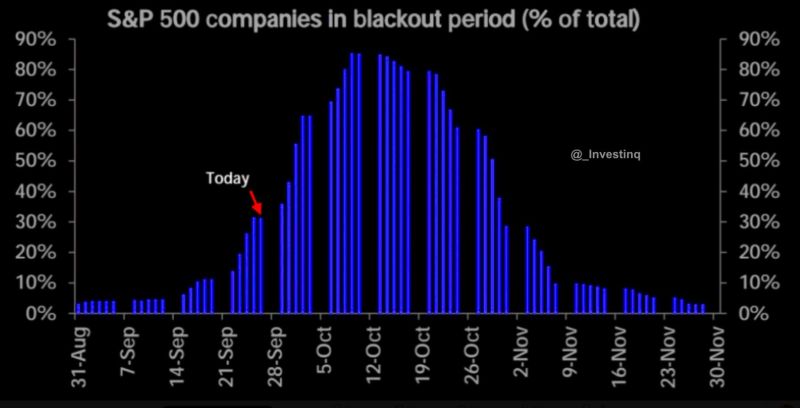

We’ve officially entered buyback blackout season in the US

Roughly one-third of SP500 companies are already restricted from repurchasing shares as of today. That figure will climb rapidly, peaking near 80–85% by mid-October. This matters because buybacks are one of the biggest sources of demand for equities. Source: StockMarket.news

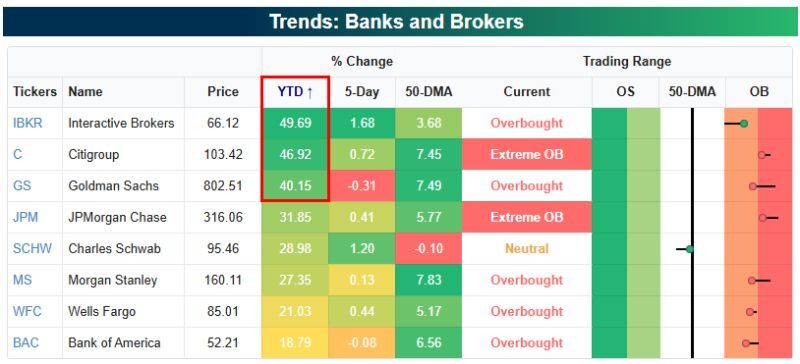

Goldman $GS, Citi $C, and Interactive Brokers $IBKR are all up 40%+ year-do-date.

Source: Bespoke

According to CNBC, a looming federal government shutdown appeared even more likely after top Democrats and Republicans met with President Donald Trump at the White House on Monday.

“I think we’re headed to a shutdown because the Democrats won’t do the right thing,” Vice President JD Vance told reporters after the meeting, which came less than two days before the shutdown will begin in the absence of a funding deal. The Democratic participants, House Minority Leader Hakeem Jeffries and Senate Minority Leader Chuck Schumer, likewise said that the two sides remain far apart. “We have very large differences,” Schumer said after the meeting. But he added that he believes Trump heard Democrats’ objections “for the first time,” suggesting the face-to-face was at least partially constructive. Both sides continued to assert that the other will be to blame if the government shuts down starting Wednesday. Source: CNBC, Reuters

The effective US tariff rate on China (red)

The effective US tariff rate on China (red) based on imports and estimated duties paid - has stabilized near 43%, which is up from 17% before Trump 2.0 and up from 5% before Trump 1.0 before that. The effective tariff rate on everyone else (excluding Canada and Mexico) is 14%. Source: Robin Brooks on X

Rate cuts aren’t created equal.

Goldman’s data shows that when the Fed cuts outside of a recession, stocks usually surge, non-recessionary cuts have historically lifted the S&P 500 by 50%+ over two years. But if cuts arrive during a recession, the story flips. Equities struggle, with the index falling 20–30% on average. The takeaway is simple: it’s not just about cuts, it’s about the backdrop. Cuts in calm waters boost markets. Cuts in storms don’t. Source: StockMarket.news on X

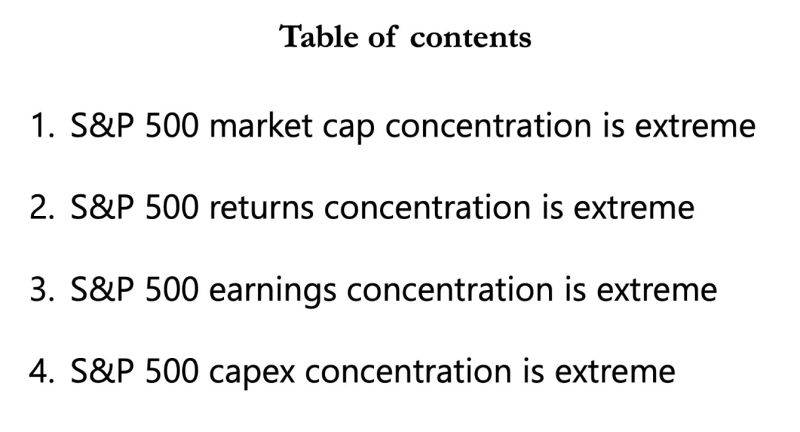

Apollo just released a report titled: 'The extreme weight of AI in the S&P 500'

Here's the key message: Source: Niko Ludwig @Collateral_com

LAST MINUTE: Trump to Meet Top Congressional Leaders as US Shutdown Near¨s

The top four congressional leaders will meet with President Donald Trump at the White House on Monday. *JEFFRIES: 'HOPEFUL' ABOUT AVOIDING GOVERNMENT SHUTDOWN. House Minority Leader Hakeem Jeffries said Sunday he is "hopeful" a government shutdown can be avoided as Congress lurches toward its Tuesday deadline to reach a spending agreement. Jeffries' comments come after President Donald Trump canceled a meeting last week with Jeffries and Senate Democratic leader Chuck Schumer to hammer out a deal before saying Saturday he'd meet with the Democrats and Senate Majority Leader John Thune and House Speaker Mike Johnson on Monday. Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks