Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Rate cuts aren’t created equal.

Goldman’s data shows that when the Fed cuts outside of a recession, stocks usually surge, non-recessionary cuts have historically lifted the S&P 500 by 50%+ over two years. But if cuts arrive during a recession, the story flips. Equities struggle, with the index falling 20–30% on average. The takeaway is simple: it’s not just about cuts, it’s about the backdrop. Cuts in calm waters boost markets. Cuts in storms don’t. Source: StockMarket.news on X

Apollo just released a report titled: 'The extreme weight of AI in the S&P 500'

Here's the key message: Source: Niko Ludwig @Collateral_com

LAST MINUTE: Trump to Meet Top Congressional Leaders as US Shutdown Near¨s

The top four congressional leaders will meet with President Donald Trump at the White House on Monday. *JEFFRIES: 'HOPEFUL' ABOUT AVOIDING GOVERNMENT SHUTDOWN. House Minority Leader Hakeem Jeffries said Sunday he is "hopeful" a government shutdown can be avoided as Congress lurches toward its Tuesday deadline to reach a spending agreement. Jeffries' comments come after President Donald Trump canceled a meeting last week with Jeffries and Senate Democratic leader Chuck Schumer to hammer out a deal before saying Saturday he'd meet with the Democrats and Senate Majority Leader John Thune and House Speaker Mike Johnson on Monday. Source: Jim Bianco

In case you missed it...

Canada is up 25% in 2025, driven by strength in financials and mining stocks: Source: J-C Parets, Trend Labs

How to interpret such news? A contrarian signal?

Source: WSJ thru Jim Bianco on X

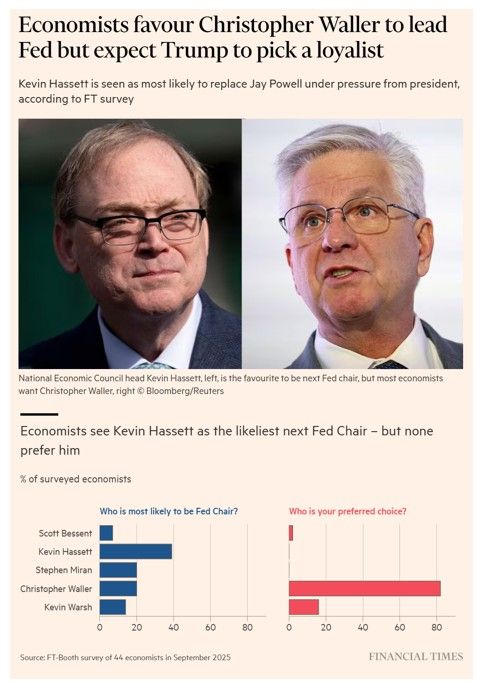

Very interesting FT article "Economists favour Christopher Waller to lead Fed but expect Trump to pick a loyalist"

>>> https://lnkd.in/ewBs4dUv Academic economists overwhelmingly want Federal Reserve governor Christopher Waller to succeed Jay Powell as chair of the central bank next year — but few think he will get the job. In a FT poll, 82% of the economists surveyed chose Waller as their favourite to Fed Chair. However, just a fifth of the academics polled think he will succeed Powell in 2026. Instead, Kevin Hassett is seen as the man most likely to head the Fed. The split between who economists want to get the job and who they think will become the next chair reflects the fierce pressure the Fed has come under from US President Donald Trump.

S&P 500 - How does the rally compare to history?

-The 4th strongest rally vs all other bulls (82, 09, 20 were >). -The STRONGEST recovery excluding recessionary cases. At 116 days w/o a 6% pullback, the rally has gone farther than all but two early-stage bulls (1966 & 1957). Source: Warren Pies @WarrenPies, 3Fourteenresearch

A beautiful quarterly candles chart of silver

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks