Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Lot of talk how valuations are 'high'.

Here's another reminder there is virtually no correlation between P/E multiples and what the S&P 500 does the next year (R-squared of -0.01). Source: Ryan Detrick, Carson

What’s fluffy, has big ears, and has seen its stock outpace the likes of Nvidia, Palantir, and Microsoft?

It’s Build-A-Bear Workshop, of course. The almost 28-year-old mall staple where one can stuff, name, dress, and accessorize a cuddly toy has seen its stock price soar more than 2,000% over the last five years, as reported by the Washington Post on Monday, outperforming some of the hottest names in AI and technology. Indeed, a theoretical $100 invested into BBW stock at the start of 2021 would be worth ~$1,600 today — about $200 more than the theoretical value of the same amount of Nvidia stock. Since its sales plunged in 2020, Build-A-Bear has only gone from strength to strength. The company reported its best Q1 results ever in May, with revenue rising 11% to $128.4 million, having emerged as a post-pandemic winner after tapping into a lucrative market: grown adults. Source: Chartr

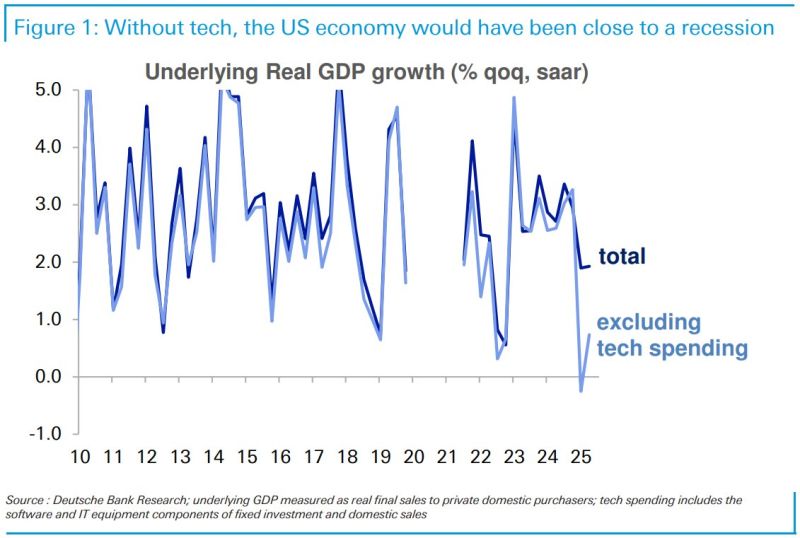

Without tech spending, the US would have been close to, or in, a recession earlier this year:

DB's Saravelos. "Perhaps Nvidia, which employed only 36,000 people at the last update earlier this year, holds the keys to all global macro in 2026:" Source: DB, Lisa Abramowicz

President Trump rolled out a new round of tariffs:

•25% on all heavy trucks •30% on upholstered furniture •50% on kitchen cabinets, bathroom vanities, and related products •100% on branded or patented pharmaceuticals unless the company is building its manufacturing plant in the US Source: StockMarket.news

AI is carrying the market:

Since ChatGPT’s launch in Nov 2022, AI-related stocks have delivered 181% gains in key names, while the rest of the S&P 500 has managed just 25%. More importantly, AI has powered 75% of total index returns, nearly 80% of earnings growth, and an incredible 90% of all capex growth. Without AI, the S&P’s rally would look far more modest. Source: StockMarket.news, JPAM

A "too much growth" scare on Wall Street?

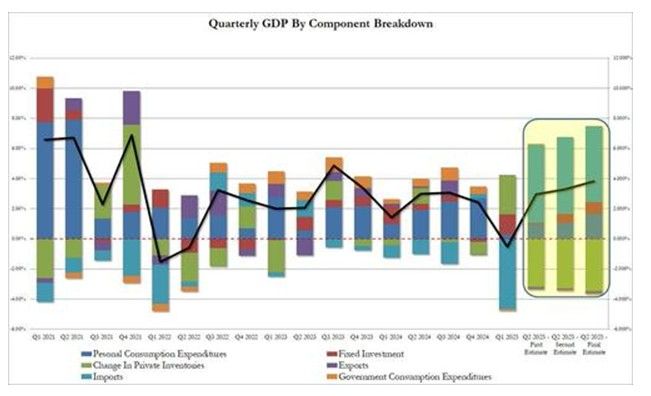

Interesting to see that yesterday's pullback was NOT prompted by bad US macro data: on the contrary, Thursday's economic number beat expectations across the board: 👉 Initial jobless claims unexpectedly tumbled to YTD lows, proving that the Texas-driven spike 2 weeks ago was indeed a one-time event... 👉 Durables goods ex-transports rose for a 5th straight month.... 👉 US Q2 GDP was unexpectedly revised sharply higher, printing at a whopping 3.8%, above all estimates, and the highest in 2 years driven by a bizarre surge in consumption - see chart below 👉US home sales were also well above expectations. In other words 4 for 4 on the data front. So much for those stagflation concerns... ‼️ But good (macro) news become bad news for the markets as the market quickly priced out odds of 2 rate cuts by December, closing the day at 1.56 rate cuts expected, down from 1.7 at the start of the day. It also pushed the 10 year yield and the greenback higher... At the time when equity valuations are extended, a rise in bond yields could indeed trigger some profit taking on US stocks Source chart: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks