Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

*SOFTBANK SHARES FELL AS MUCH AS 10% (before recovering somewhat to close at -3.5%)

Maybe liquidating NVDA to invest in its biggest cash-incinerating client wasn't the best idea... Source. zerohedge

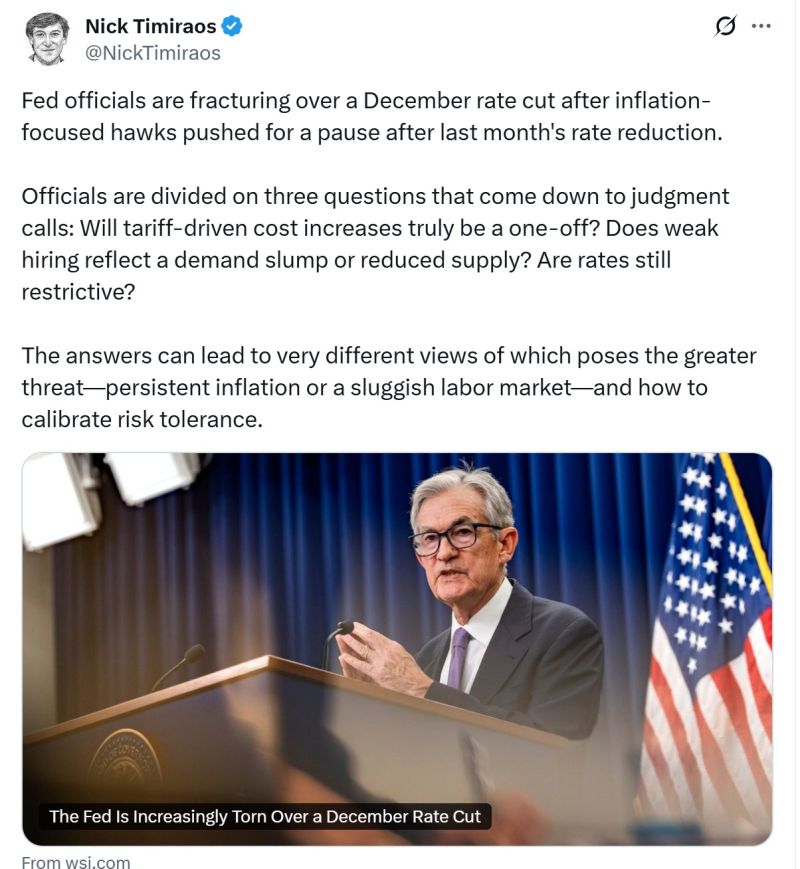

Odds of a rate cut at Fed December meeting have increased again (70%+) but Fed officials remain divided on three questions that come down to judgment calls:

1. Will tariff-driven cost increases truly be a one-off? 2. Does weak hiring reflect a demand slump or reduced supply? 3. Are rates still restrictive?

🌍 The IEA just dropped a bombshell:

If the world stays on its current path, oil and gas demand will keep rising for the next 25 years. That’s right — no peak this decade, no major drop in CO₂ emissions, and likely no chance of keeping global warming below 1.5°C. 🔥 2024 was the hottest year on record. Yet the International Energy Agency says “climate change is rapidly declining on the global energy agenda.” Why? Governments are prioritizing energy security and affordability over climate goals. Growth of electric vehicles is slowing. Demand for energy from AI, air conditioners, and manufacturing is exploding. 📈 Under the IEA’s new “Current Policies” scenario: Oil demand grows from 100M → 113M barrels/day by 2050 EV adoption plateaus around 40% by 2035 Gas demand continues to climb Coal finally peaks — but still lingers 💡 Even so, renewables will shoulder most of the new electricity demand — especially in India, SE Asia, Latin America, and Africa. ⚠️ Translation: The clean energy revolution is real… …but fossil fuels aren’t going anywhere unless policies change fast. Source: FT

The index is derived from state-level employment, wage, and unemployment data, capturing how many U.S. states experience significant labour-market deterioration at any given time.

About $1.5T may come from investment-grade bonds, plus $150B from leveraged finance and up to $40B a year in data-center securitizations. Even then, there’s still roughly a $1.4T funding gap likely filled by private credit and governments. Source: Wall St Engine

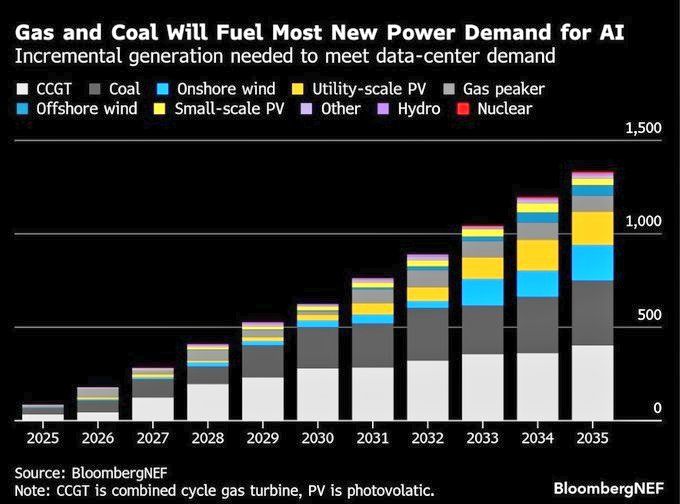

And the winner of the power demand is .... Coal !

Source: Bloomberg, @AzizSapphire

More "crockroaches" in private credit land.

Last week, lending giant BlackRock wrote down a private loan made to home improvement company Renovo Home Partners to zero. As recently as last month, BlackRock valued the loan at 100 cents on the dollar. The drastic revision comes as Dallas-based Renovo — a roll-up of regional kitchen and bathroom remodeling businesses created by private equity firm Audax Group in 2022 — abruptly filed for bankruptcy last week, indicating it plans to shut down. BlackRock held the majority of Renovo’s roughly $150 million of private debt, while Apollo Global Management Inc.’s MidCap Financial and Oaktree Capital Management held smaller chunks, according to people with knowledge of the matter, who asked not to be identified discussing a private transaction…” When one of America’s largest, most sophisticated lenders takes a 100% loss on a loan over the course of one month, it begs the question: what other "cockroaches" are hiding in the shadows? Source: Ross Hendricks @Ross__Hendricks

The 🇺🇸 Senate just passed a bill to fund the government and end the longest shutdown in U.S. history

The bill which passed 60-40 will now be sent to the House of Representatives ... If it passes in both chambers of Congress, it will head to President Donald Trump to be signed into law - CNBC, Evan

Investing with intelligence

Our latest research, commentary and market outlooks