Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

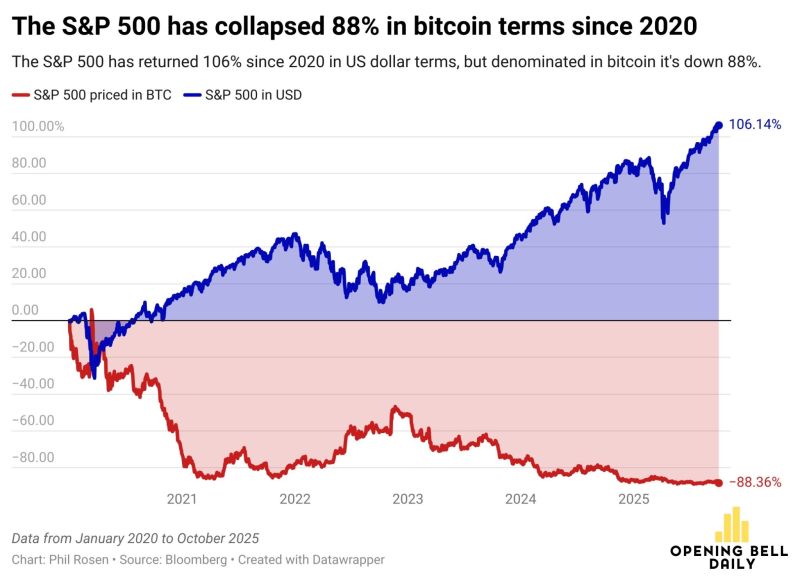

The S&P 500 is up more than 100% since 2020

But the index is actually down 88% when priced in a hard asset like bitcoin. Source: Anthony Pompliano 🌪@APompliano (H/t @philrosenn)

It's liquidity stupid!

Strong M2 growth in China, and to a smaller extent Brazil and India, add to the ongoing expansion of M2 in the United States and in Europe. Our Global M2 proxy continues to point to a broadly supportive liquidity environment for risk assets. The S&P 500 continues to follow the evolution of our Global M2 proxy with an 11-week lag. Bitcoin has desynchronized from our Global M2 proxy since mid-August but bounced up strongly last week. Will it catch up our Global M2 proxy (and rise toward 140k)? NB: liquidity is one risk assets driver among others. Past results do not guarantee future results

It seems that Russell 2000 small & mid caps ETF $IWM is joining the breakout party...

Source: Trend Spider

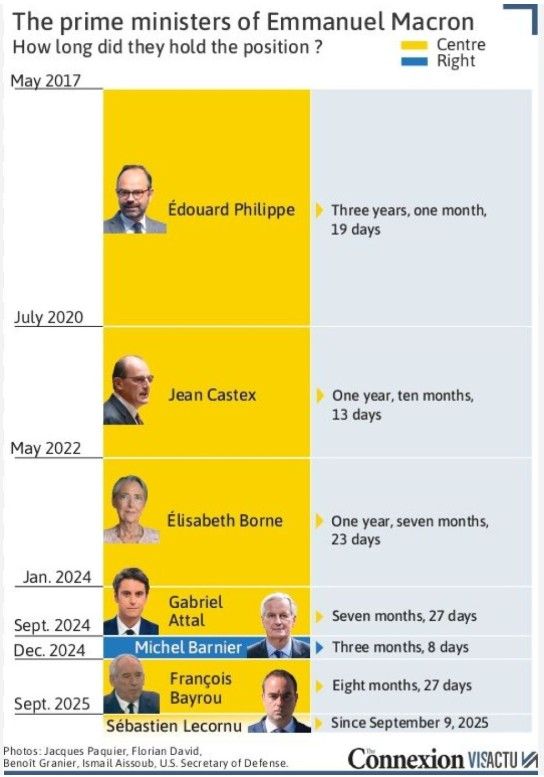

France changes its Prime Ministers more often than some people buy new underwear...

Source: Connexion VisActu

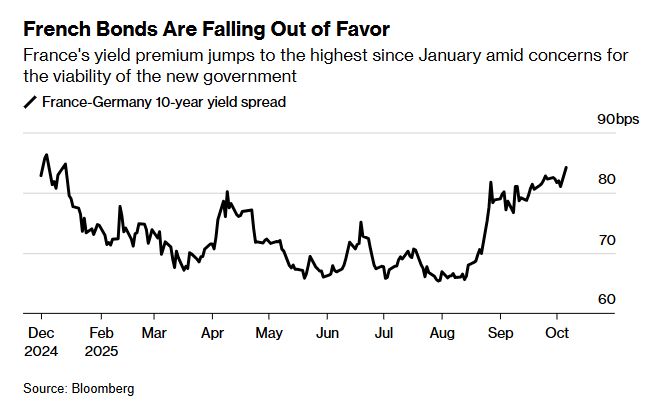

France bond risk hits Nine-Month high amid fears over government - Bloomberg

France’s new Prime Minister Sebastien Lecornu has resigned just weeks after his appointment, plunging the country into a fresh political crisis. Lecornu, France’s fifth PM in less than two years, had his work cut out to convince the country — and investors — that he could unite a fractious and divided parliament enough to get a 2026 budget over the line. With the prospect of a state budget being passed now in doubt, French markets reacted strongly to the news, with the yield on the 30-year government bond, or OAT, hitting a one-month high of 4.44% before retreating slightly. The yield on the benchmark 10-year bond rose to a 10-day high of 3.599%. Meanwhile, France’s CAC 40 index slumped 2.0% and the euro fell 0.7% against the dollar - CNBC

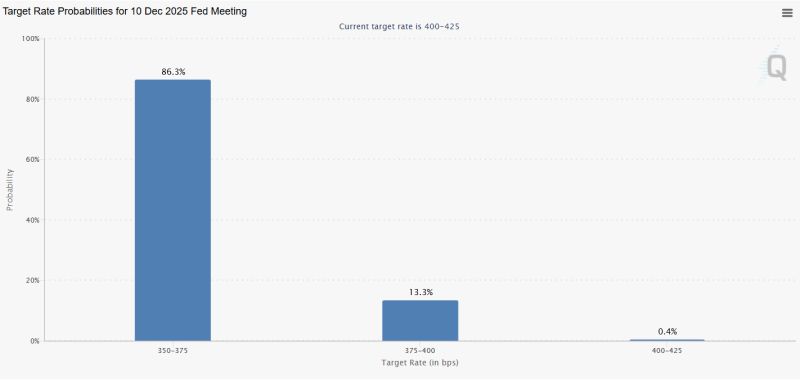

LATEST: December has an 86.3% of another rates cut.

That would make it 2 rates cuts before 2026. Source: Cointelegraph, CME Fed Watch

Investing with intelligence

Our latest research, commentary and market outlooks