Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

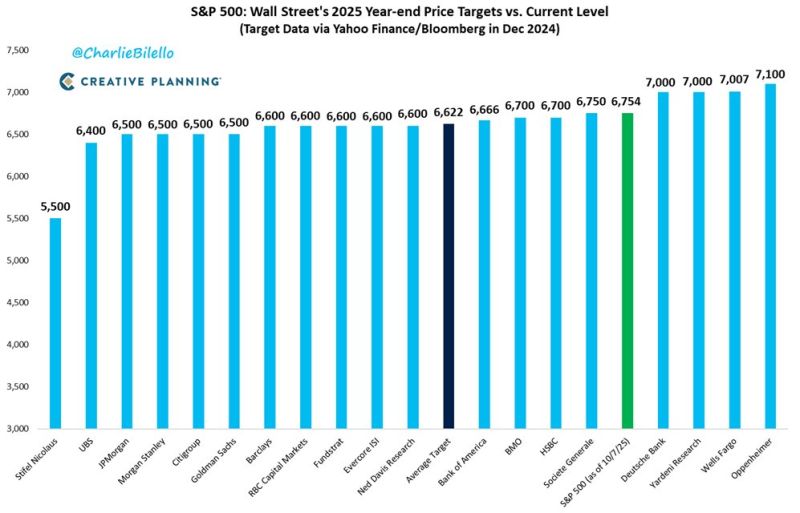

If the S&P 500 gains another 5% from here until December 31, it will exceed every single Wall Street price target for the 3rd consecutive year.

$SPX Source: Charlie Bilello

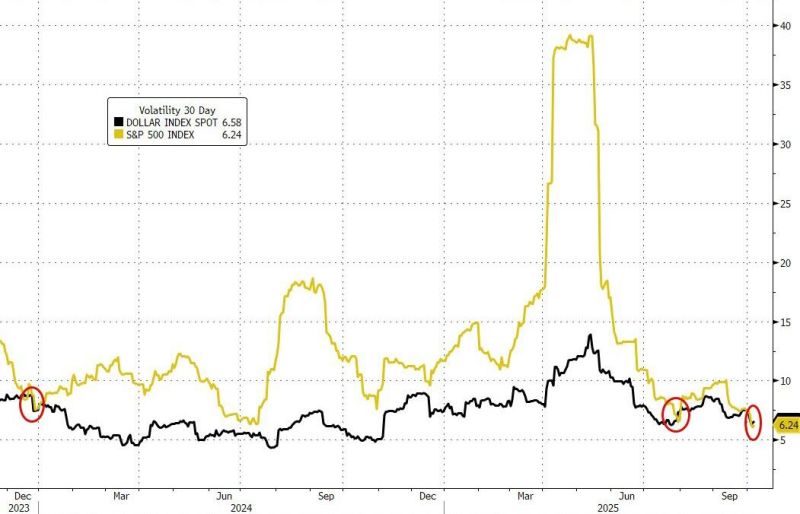

Over the last 1 month, the US dollar has been more volatile than the S&P500.

As Goldman Sachs Brian Garrett notes, this has happened twice in the last 7 years (Dec 2023 and Jul 2025)... Source: zerohedge

The OpenAI deal framework is very concentrated into a few companies

Source: Lance Roberts @LanceRoberts

Carlyle Group says the US job market is absolutely finished.

Source: Bloomberg, Spencer Hakimian

Oracle $ORCL was the market mover yesterday, down -2.5% and driving Tech stocks, the S&P500 and cryptos lower. So what happened?

A month ago Oracle stock soared after forecasting extraordinary growth: "We signed four multi-billion-dollar contracts with three different customers in Q1," said Oracle CEO, Safra Catz. $455B in contract backlog. Multi-billion-dollar deals. But according to The Information, newly surfaced internal documents paint a very different picture. Oracle’s AI cloud margins are razor-thin around 14 cents of profit for every $1 in Nvidia server rentals. That’s less than most retail businesses, and in some cases, the company’s actually losing money. The data shows margins fluctuating between 10% and 20%, averaging just 16%. And reportedly, Oracle lost nearly $100 million last quarter renting out Blackwell chips, the very product driving its “AI boom.” The first crack in the matrix? Not really. This looks more like margin issue rather than a demand issue. Basically, this is not about Oracle not finding customers for renting their GPUs but customers asking for good deal or they go elsewhere. As a result, Oracle margins have not been that strong. Source: STockMarket.news

AI’s energy demand is about to go vertical, and in many countries, the grids aren't ready.

China’s building 29 large nuclear reactors right now. The U.S. has none under construction. High costs, regulatory delays and market challenges hold us back, though advanced smaller reactors are emerging. Source: StockMarket.News

Semiconductors SOX's relative performance to the equal-weighted S&P 500 is nearing the highest levels since the dot-com bubble...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks