Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

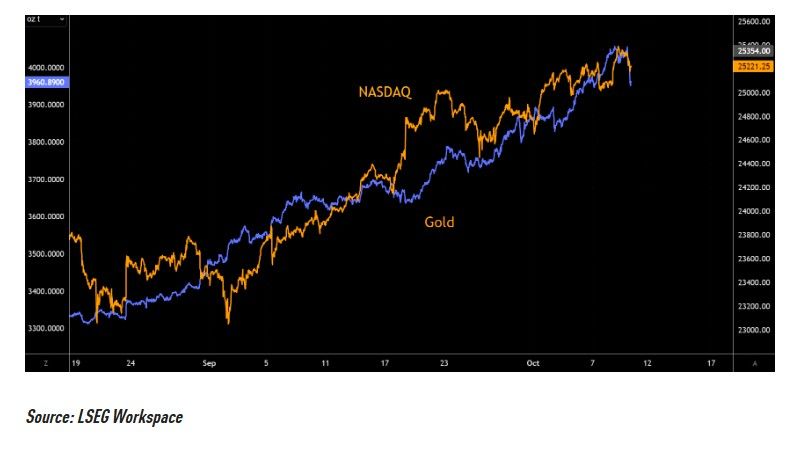

Same same... Below is a 30 min chart of the Nasdaq index and gold since September....

Stocks and gold have moved in close tandem over the past weeks when the last squeeze started. Slightly illogical given the fact gold is, at least partly, a fear hedge. It could be that the same short term money is just chasing momentum, irrespective of "logic". Source: The Market Ear

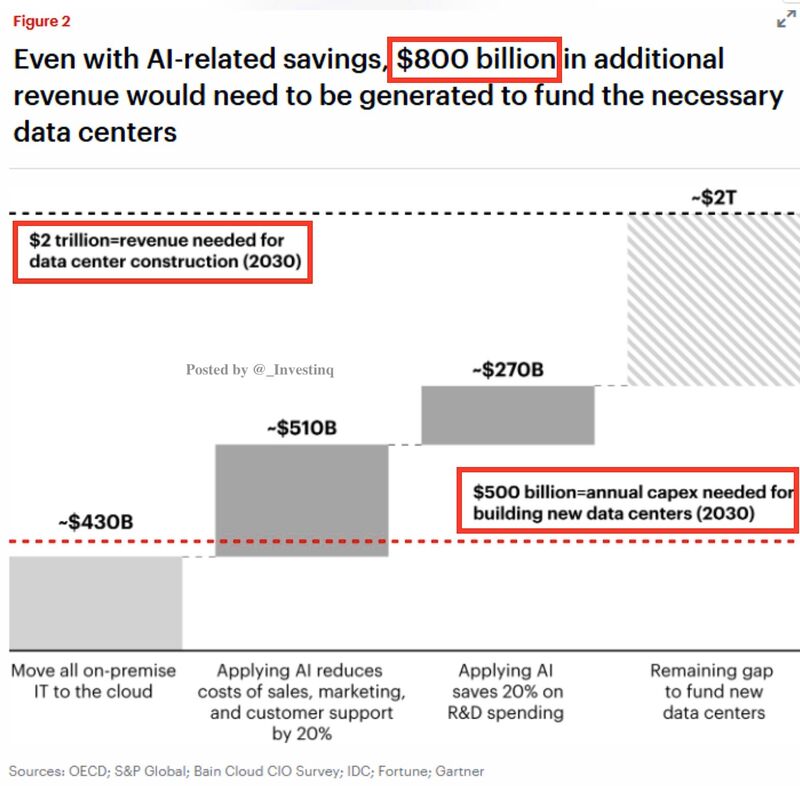

StockMarket.news: "AI isn’t cheap... By 2030, the world will need $2 trillion in revenue just to fund new data centers.

Even after AI-related cost savings, an $800 billion gap remains meaning $500 billion in annual capex just to keep building the infrastructure powering the AI boom. Can Big Tech and private equity afford to sustain this level of funding by 2030?" Source: StockMarket.news

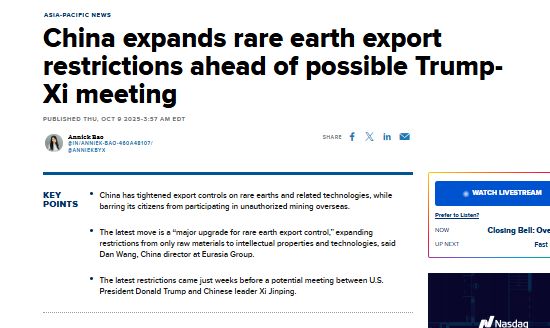

As pointed out by Wall St Mav, Rare earth metals are NOT rare. Plenty of sources around the world.

95% of the refineries and smelters that process raw ore are in China. Even if rare earths are mined in USA, it all needs to be shipped to China. Issue is that trying to build a smelter in the USA or Europe seems impossible these days. The environment litigation would take years. Hence the scarcity issue. Source: CNBC, Wall St Mav

The S&P500 is now up 71% and has hit 88 all-time highs since Michael Burry said ‘Sell.’

Source: Peter Mallouk

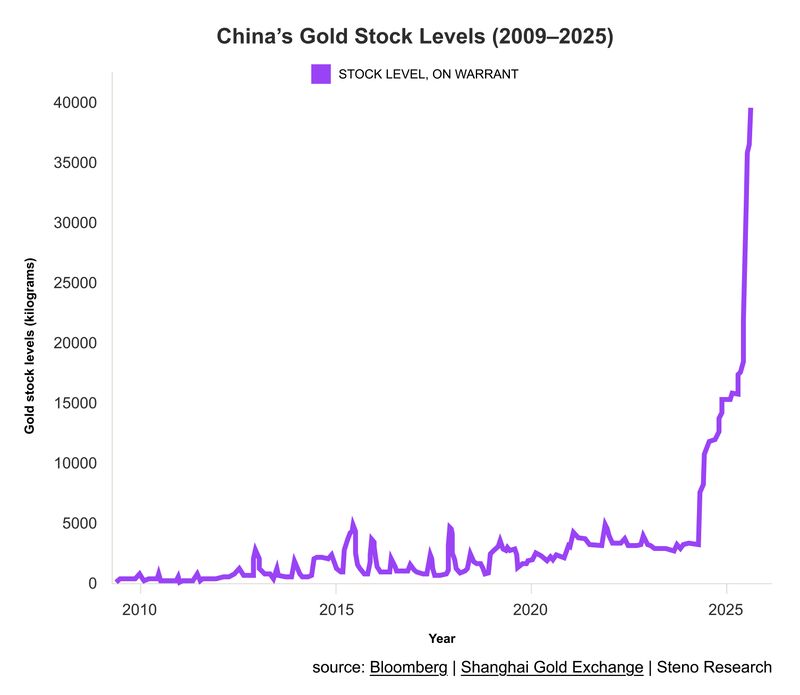

When geopolitical & socio-economic tensions rise, both people & nations turn to hard assets.

One big buyer in particular has been Beijing. China has been swapping Treasuries for gold for years, lifting reserves to over 74m ounces. 👉 This is a reflection of both state policy and popular sentiment: hedging against dollar risk, sanctions, and China’s own shaky property and stock markets. Source: Chamath Palihapitiya @chamath, Steno Research, Bloomberg

Gold is now above $4,000/oz, and who would’ve thought silver would remain this cheap relative to gold?

Source: Tavi Costa, Macro Trends

The United States has approved several billion dollars worth of Nvidia’s chip exports to the UAE, as per Bloomberg.

Nvidia is hitting all time highs. Source: The National News, it@amitisinvesting

Investing with intelligence

Our latest research, commentary and market outlooks