Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

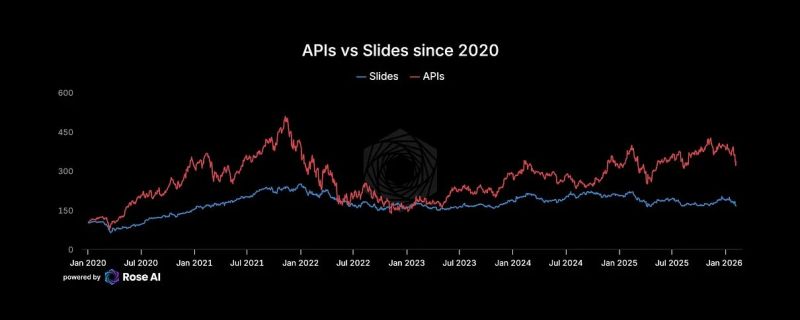

"A pair trade for the AI transition: long API / short slides"

🚨 The "Software is Dead" Narrative is Wrong. You’re Just Looking at the Wrong Software. The market is panicking. The $IGV hashtag#etf is down 30%. The headlines say AI is writing code now, so software companies are toast. 📉 They’re making a massive Category Error. If you're investing without looking at the "plumbing," you're missing the biggest bifurcation of the decade. Here is how the "Singularity" is actually playing out: 1. The Victim: Human-UI SaaS (Type 1) 🖱️ If your software requires a human to stare at a dashboard for 8 hours, you have a target on your back. The Logic: AI agents replace humans. One less Customer Service rep = one less Zendesk seat. One less PM = one less Monday.com seat. The Result: Seat-based SaaS compresses as headcount shrinks. 2. The Winner: Bot-Infrastructure (Type 2) 🤖 AI agents don't have eyes. They use APIs. They don't click; they call. The Logic: One human generates a few clicks an hour. One AI agent generates thousands of API calls per minute. The Winners: The "Tollbooth Operators"—Okta, MongoDB, Snowflake, Datadog. They don't care if the user is a human or a bot; they charge per unit of consumption. Bots consume orders of magnitude more than we do. 🪦 The Real Casualty: The "Body Shops" The IT outsourcing model (Infosys, Wipro, Cognizant) is built on Labor Arbitrage. Hire for $15/hr in Bangalore, bill for $80/hr in NYC. The Problem: AI makes labor arbitrage worthless. You can’t get cheaper than "nearly free." The Proof: India's Big 4 are already cutting thousands of heads. The hiring machine has stopped. 🛑 The Bottom Line: The market is selling "Technology" as a monolith. This is a mistake. AI replaces Road Workers (IT services/Human-UI). AI pays Tolls (Infrastructure/APIs). The Play: Buy the dip in APIs. Short the slides. The infrastructure layer is the only place to hide when the bots take over.

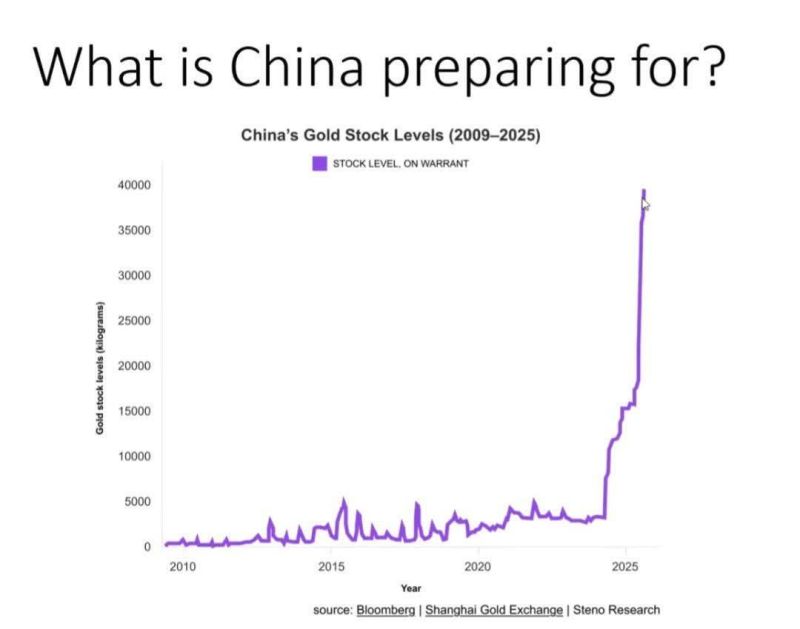

The Chinese leader told his people to hold gold. The people responded. Demand skyrocketed.

Now, the directive has shifted: Get USD off the books. The banks will respond. We aren't just talking about a policy change. We are talking about a fundamental shift in the global monetary order. Why does this matter? Liquidity is shifting: When the world's second-largest economy pivots away from the Dollar, the ripples hit every portfolio. Gold is the anchor: Central banks are returning to "real" assets as a hedge against geopolitical volatility. The Signal: When a superpower tells its financial institutions to de-risk from a specific currency, the "quiet part" is being said out loud. The world is de-dollarizing faster than most people realize. Source: Blomberg, Steno Research

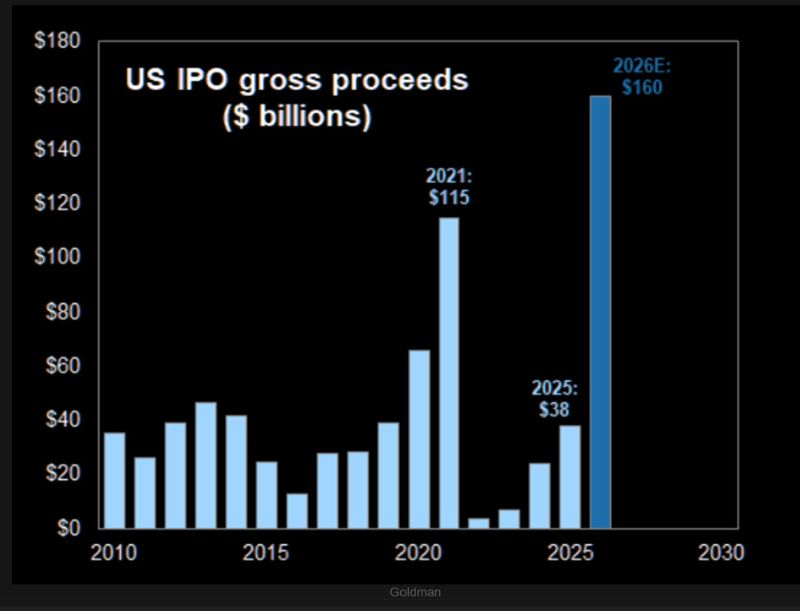

GS: "We forecast 120 IPOs this year and $160 billion in gross IPO proceeds in 2026".

Source: TME

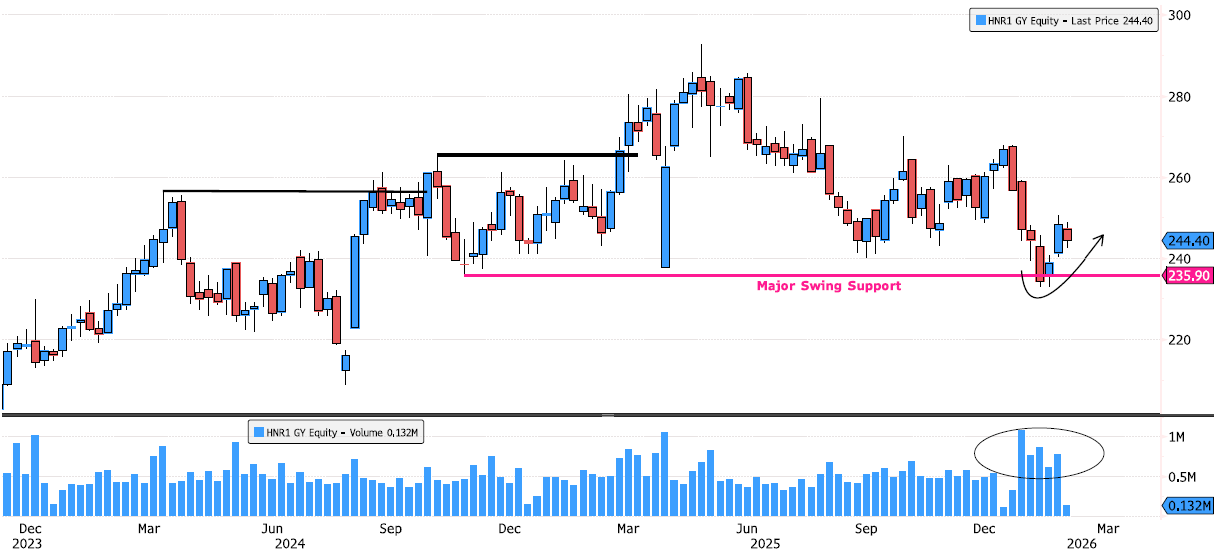

Hannover Rueck reacting on swing support

After a +20% consolidation from the May 2025 highs, price has done something technically very clean 👇 Swing support at 235.90 was tested at the end of January Clear liquidity sweep below that level, followed by a swift reaction Since then, positive momentum is building Volume expansion right at support → strong signal of institutional interest This kind of price–volume behavior often suggests absorption at key demand, rather than distribution. As long as price holds above the reclaimed support, the structure favors a base-building phase with upside potential. Source: Bloomberg

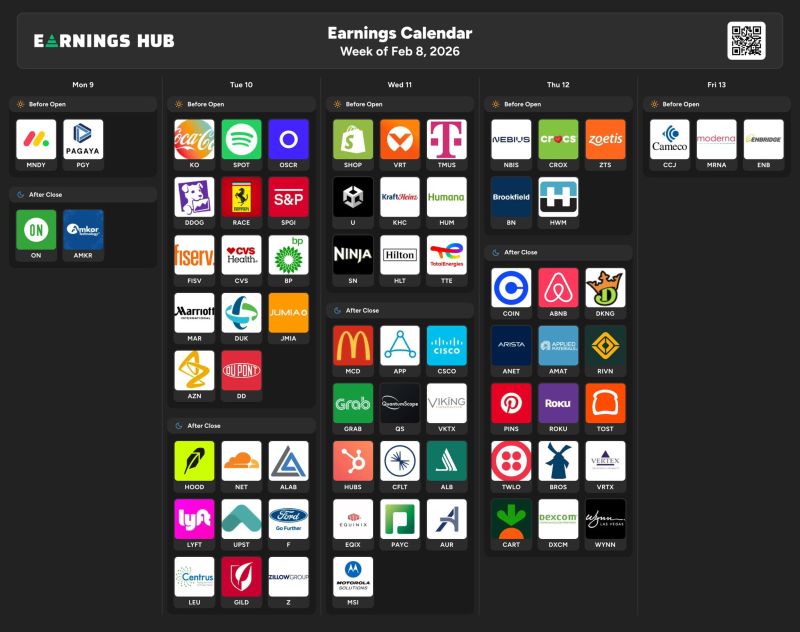

THE MASTER EARNINGS SEASON CALENDAR

Here are the most popular stocks that report earnings this week February 9th - February 13th. Source: Earnings Hub

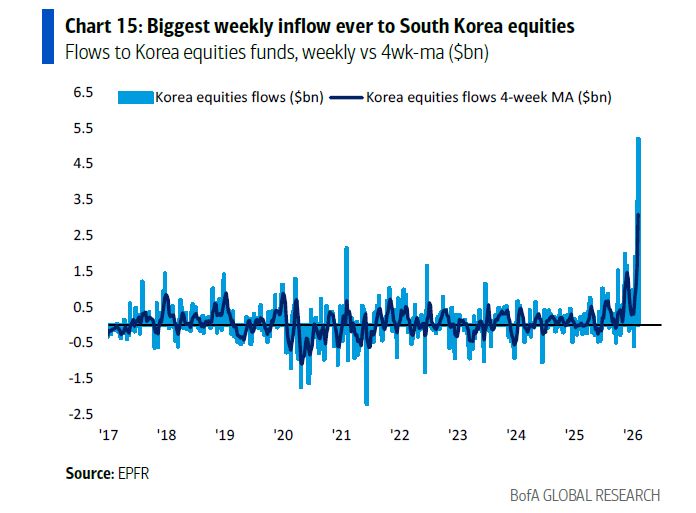

Massive inflows into Korean stocks have some cross-border ripple effects...

The Korean momentum kamikazes dumped bitcoin, dumped gold, dumped silver, dumped anything that did not have upward momentum and piled into Korean memory stocks at a record pace. Source: BofA, zerohedge

🚨NEXT WEEK COULD DECIDE THE FUTURE OF US CRYPTO REGULATION 🚨

Next week, the White House is hosting a high-stakes meeting that could change the U.S. financial system forever. 🇺🇸⛓️ The entire Crypto Market Structure Bill is currently deadlocked over one single, explosive question: Should stablecoin holders be allowed to earn yield? 💰 Here is what you need to know about the "Yield War" happening behind closed doors: 🏦 THE BANKS’ PERSPECTIVE: Traditional banks are terrified. If a stablecoin offers 3-4% yield while a standard checking account offers 0%, the math is simple. Industry groups warn that $6 TRILLION in deposits could migrate out of the banking system. They see this as an existential threat to their liquidity. ⚖️ THE CRYPTO PERSPECTIVE: Crypto firms and exchanges view yield as the heartbeat of the digital economy. They’ve made their stance clear: They would rather have no bill at all than a bill that bans yield just to protect legacy banks. ⏳ THE TICKING CLOCK: With the 2026 Midterm Elections looming, lawmakers are running out of time. If a compromise isn't reached by the end of February: The CLARITY Act remains stalled. Regulatory uncertainty continues. The U.S. risks falling further behind in global fintech. This isn't just about "crypto." It’s about the future of how money moves, how it grows, and who controls the rails. The Feb 10 meeting is the pressure point. Will the White House force a "Grand Bargain," or will the divide between TradFi and DeFi become a canyon? Source: Crypto Rover

Investing with intelligence

Our latest research, commentary and market outlooks