Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A very important development for global markets ‼️

➡️ JGBs long-term bond yields are moving LOWER (see below the 30Y over the last month) while the Yen is firming against dollar (From nearly 158 on Sunday evening to roughly 155 this morning, it’s been a significant move in USDJPY). Takaichi landslide victory - which implies fiscal stimulus & tax cuts - hasn't trigger a bond or yen crash. Quite the contrary. Meanwhile, Japan equities continue to move upward. This is quite a compelling development overall for Japan macro & markets landscape.

🔴Hedge funds are pulling back from gold at the fastest pace in months:

Net long positions in gold dropped -23% last week, to 93,438 contracts, the lowest in 15 weeks and near the lowest in at least 12 months. This comes after gold suffered its biggest single-day plunge since 2013 on January 30. Net long positioning has now fallen -60% from the February 2025 peak of ~240,000 contracts. Hedge fund sentiment on precious metals is shifting rapidly. Source: Global Markets Investor, Bloomberg

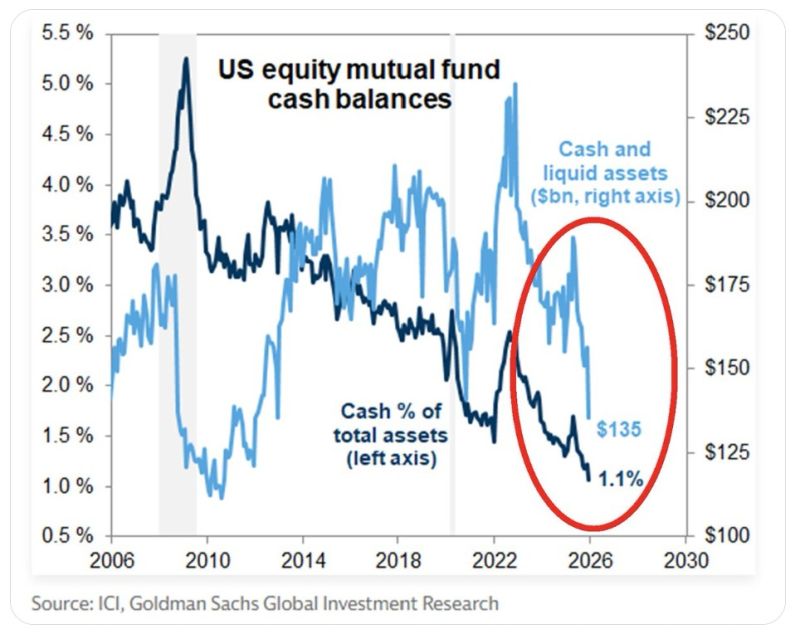

🚨There is BARELY any cash on the sidelines:

Cash levels in US equity funds fell to 1.1%, an ALL-TIME LOW. This is HALF the percentage seen just 3 years ago. US equity mutual fund cash balances as a % of total assets have been in a downtrend for the last 18 years. Nominally, cash and liquid assets fell to $135 billion, the lowest since 2013. Almost every equity fund is ALL-IN on US stocks. Source: Global Markets Investor, Goldman Sachs

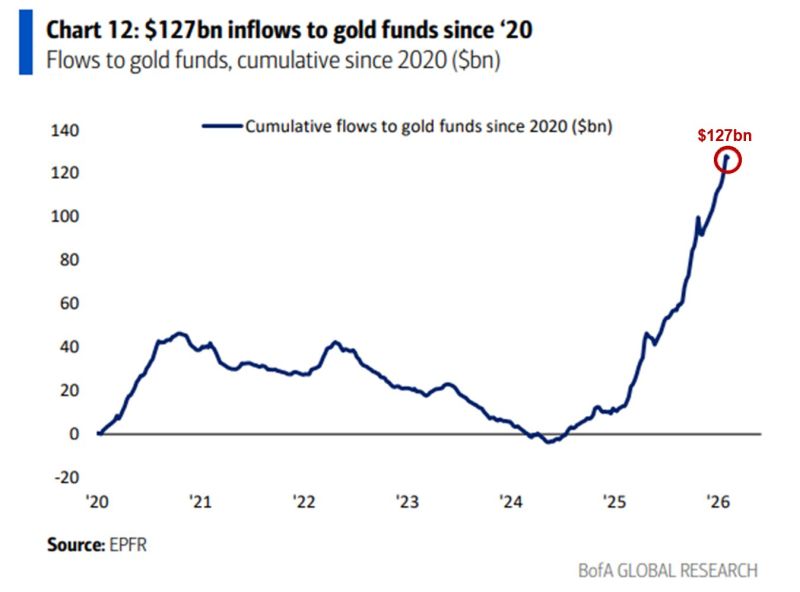

🔥Gold fund inflows are going parabolic:

Cumulative inflows to gold funds have surged to +$127 billion since 2020, according to BofA. Nearly +$120 BILLION has come since the start of 2025. Meanwhile, gold and gold mining ETFs received a record $91.86 billion worth of inflows in 2025, more than 8 TIMES the total in 2024. This all comes as gold hit multiple record highs over the last 2 years, and central bank buying remains historically elevated. Source: Global Markets Investor, BofA

J.P. Morgan in 1912: "Gold is money. Everything else is credit."

Source: Barchart

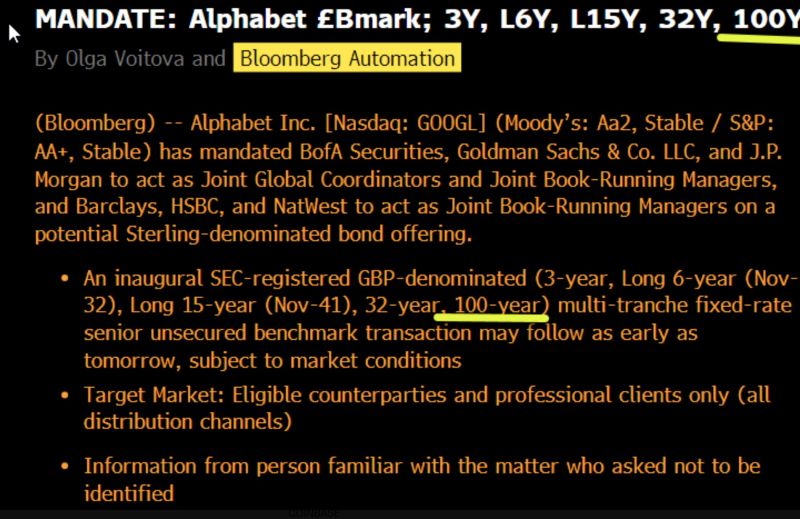

Alphabet has attracted >$100bn of orders for a bond sale that’s expected to be ~$15bn, BBG reports, citing people with direct knowledge of the matter.

The demand is among the strongest ever seen for a corporate bond offering, showing investor hunger to buy debt tied to the AI boom. Alphabet has also mandated banks for potential Swiss franc and Sterling debt offerings, including a rare 100-year Sterling note. Source: Bloomberg, HolgerZ

The AI action is in Asia

See below chart with SK Hynix, Samsung or Advantest all sky rocketing. Meanwhile, Nvidia $NVDA (below line in yellow) remains stuck Source: LESG, TME

Investing with intelligence

Our latest research, commentary and market outlooks