Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Will Truflation prove to be correct

Truflation is a digital, real-time alternative to government inflation numbers. Unlike the traditional CPI, which updates monthly and is based on a fixed “basket of goods,” Truflation tracks millions of prices daily from sources like Amazon, Zillow, and grocery stores. It’s faster, more reflective of actual spending, and transparent because it uses blockchain technology. This means you can see changes in prices almost immediately, giving a clearer picture of how your money’s value is changing in real time.

A carry trade unwinding time bomb? Watching the JPY appreciating is nice but note the strong correlation between the JPY and the VIX

Source: TME

Another data source for analyzing BTC and Bitcoin ETFs on the Bloomberg terminal: BTC volatility

James Seyffart @JSeyff

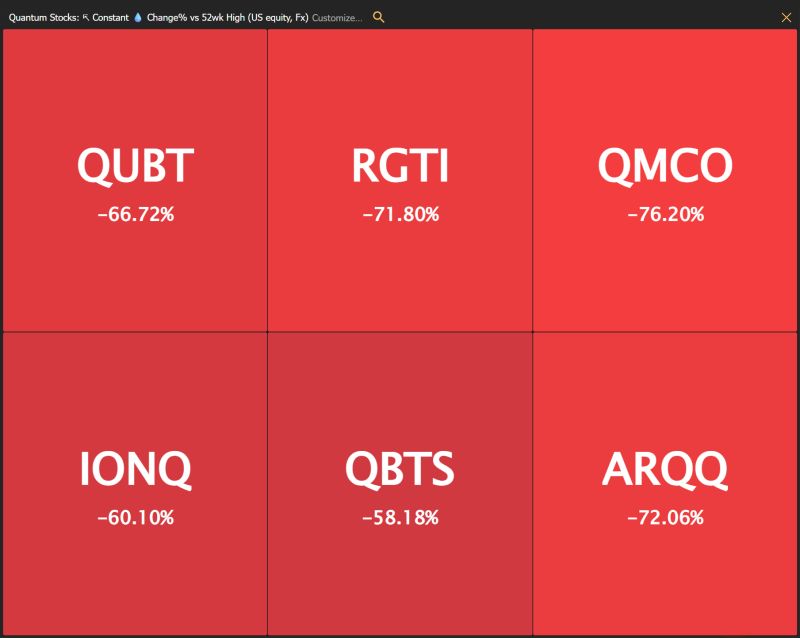

Quantum stocks are down substantially from their 52-week highs...

Source: Trend Spider

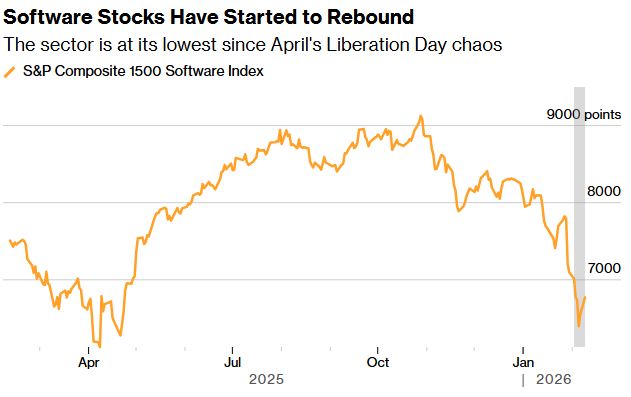

AI FEARS OVERDONE IN SOFTWARE

JPMORGAN: AI FEARS OVERDONE IN SOFTWARE JPMorgan says the selloff in software stocks is overblown, driven by unrealistic fears of near-term AI disruption. Strategists recommend rotating back into high-quality, AI-resilient names. They cite strong fundamentals, high switching costs, and positive earnings trends, naming Microsoft and CrowdStrike as beneficiaries. With 2026 earnings growth forecast near 17%, the team sees a rebound opportunity. Source: *Walter Bloomberg @DeItaone

Another day, another fresh high in skew.

The year-to-date rise is becoming meaningful, with the crowd long and paying up for downside protection. Rising markets alongside rising skew are a combo worth watching closely, and looks pretty similar to last year’s setup... Source; TME

Investing with intelligence

Our latest research, commentary and market outlooks