Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

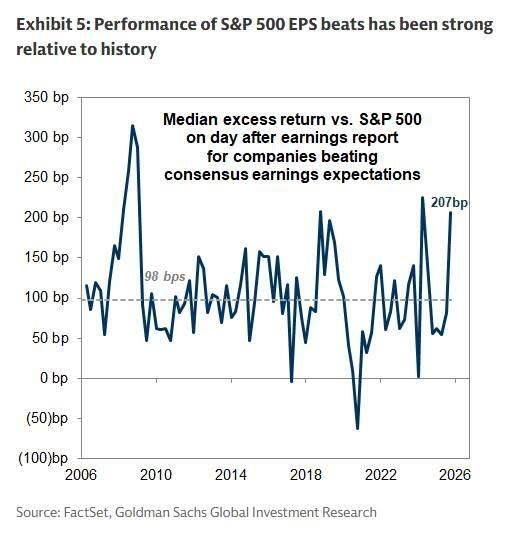

Goldman notes that after a few quarters of uninspiring market that follows positive earnings release, beats are finally being rewarded.

Companies beating consensus EPS estimates have outperformed on the day after reporting by +207 bp on average, more than double the historical average of +98 bp.

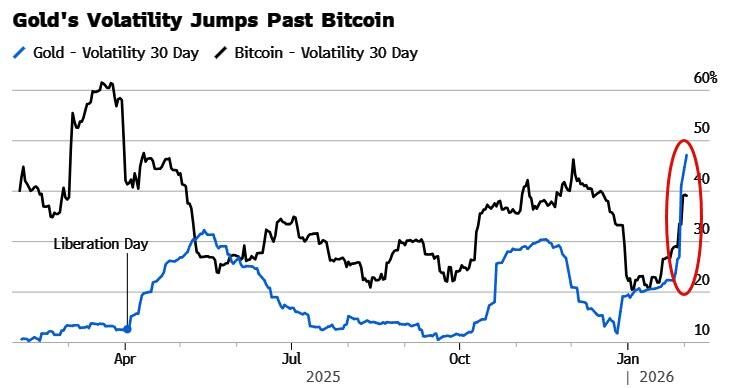

30-day realized vol in gold has climbed above 44%, the highest level since the 2008 financial crisis, according to data compiled by Bloomberg.

That surpasses the roughly 39% for Bitcoin, the original cryptocurrency often dubbed “digital gold.” Since Bitcoin’s creation 17 years ago, gold has only been more volatile on two occasions, most recently last May during a flare-up in trade tensions sparked by President Trump's tariff threats. Source: Bloomberg, www.zerohedge.com

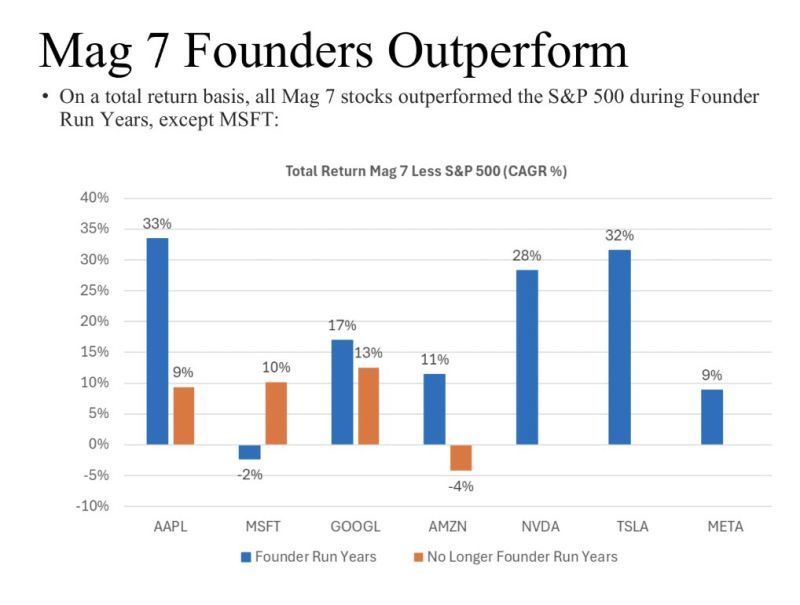

Here's how the Magnificent 7 names have performed when they were led by founders vs not

Source: Evan Evan StockMKTNewz

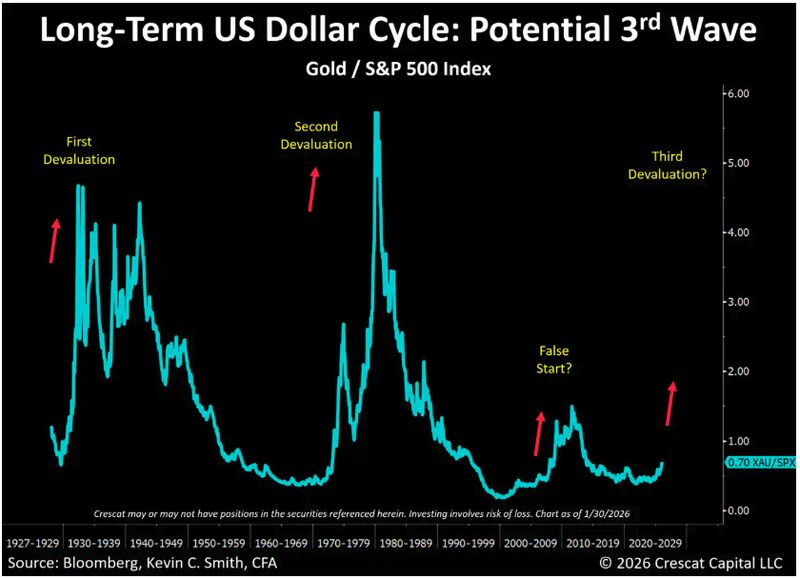

THIRD WAVE OF THE US DOLLAR CYCLE

Interesting comment by Crescat Capital: ‘We think the gold panic on Friday on the announcement of Kevin Warsh as the new Fed Chair caused a healthy pullback from short-term overbought conditions in the precious metals markets. While Warsh may appear the least dovish among President Trump’s candidates, we believe he is indeed in favor of lowering interest rates in 2026, as the President has also affirmed. Investors in Crescat’s portfolio of undervalued precious and critical metals miners should not be too concerned. Our activist mining portfolio outperformed gold, silver, and the gold equity benchmarks, both on Friday and cumulatively for the month of January. Still, the gold correction was no small matter. We think it presents a buying opportunity. In fact, now, as much as ever, is the time for gold investors not to panic but to step back and look at the big picture’. Source: Crescat Capital

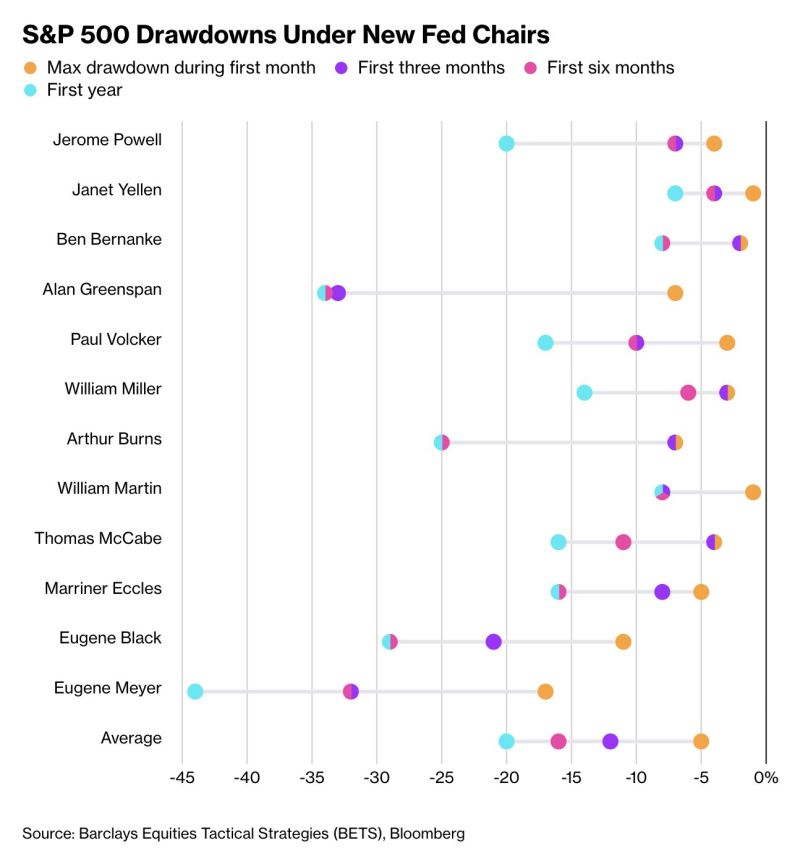

S&P 500 Drawdowns Under New Fed Chairs

Source: Bloomberg, Sam Ro, alexandraandnyc

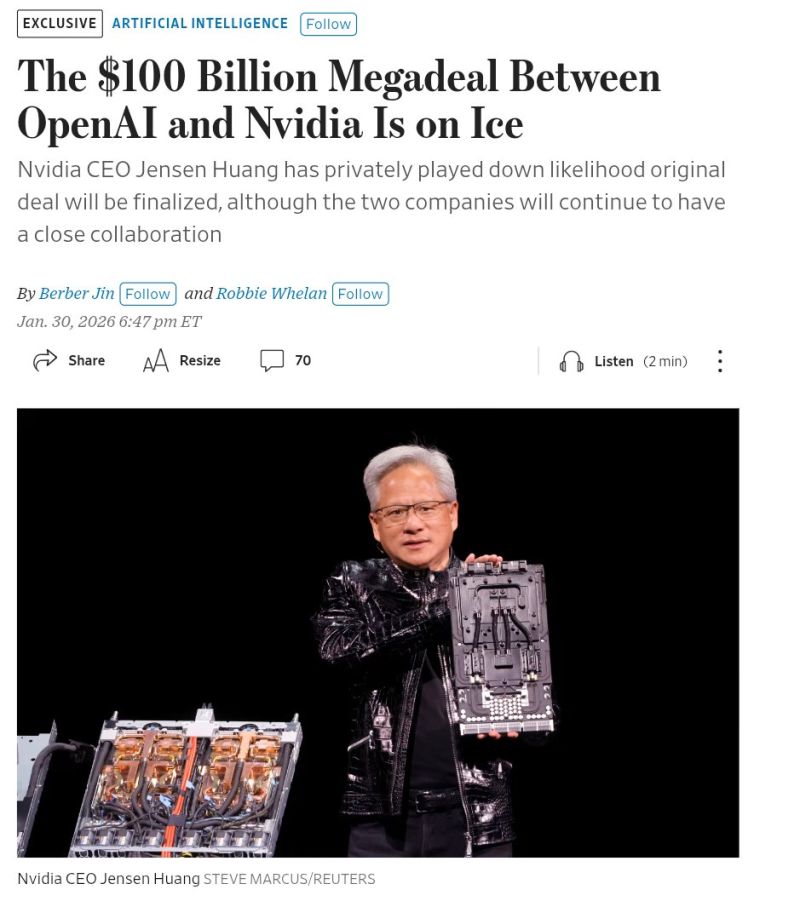

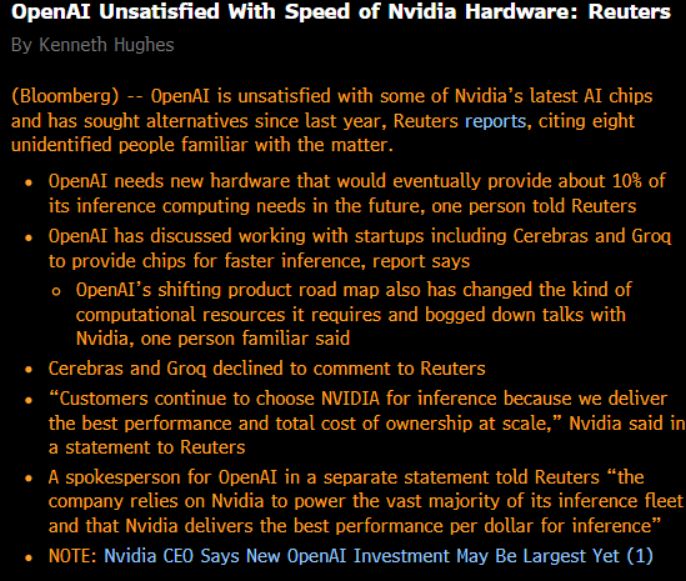

OpenAI claps back at Jen-Hsun.

Source: Sawyer Merritt @SawyerMerritt WallStreetMav (@Wall Street Mav)

The new merger between xAi and SpaceX means the following are all under one company

The new merger between xAi and SpaceX means the following are all under one company: - SpaceX rockets, with 90% market share of launching mass into orbit. - Starlink, the only global telecommunications system. - Starshield, another version of Starlink for the US military which enables the US military to communicate around the planet without using the telecomm systems of any other country. - xAi, Grok - X (formerly Twitter) Source: Sawyer Merritt @SawyerMerritt WallStreetMav (@Wall Street Mav)

Investing with intelligence

Our latest research, commentary and market outlooks