Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Waymo just confirmed it has raised $16 Billion at a $126 Billion valuation

Source: Evan on X

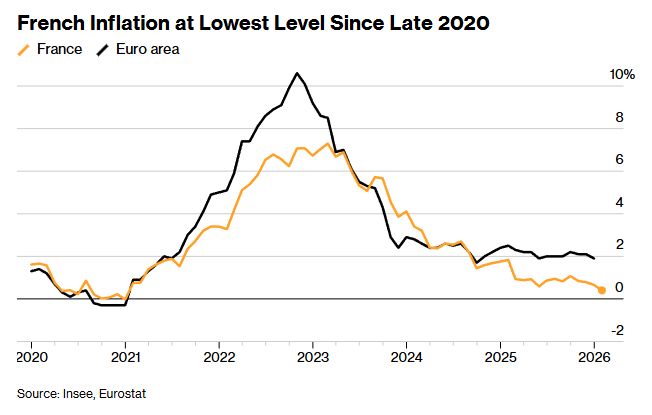

In case you missed it French Inflation Rate Unexpectedly Sinks to Five-Year Low

Source : Bloomberg

Corporate Insiders are dumping shares at the fastest pace in 5 years

Source: Bloomberg

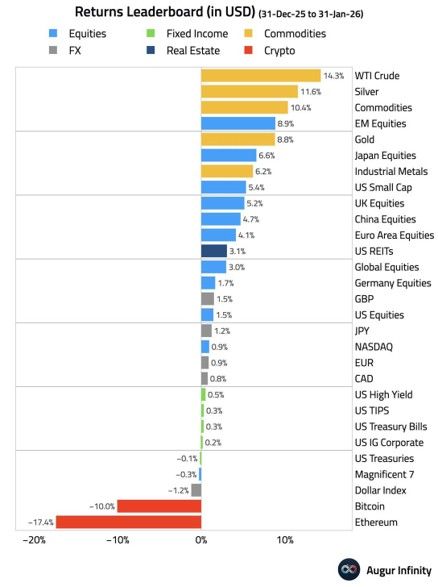

January 2026 best and worst performers 👇

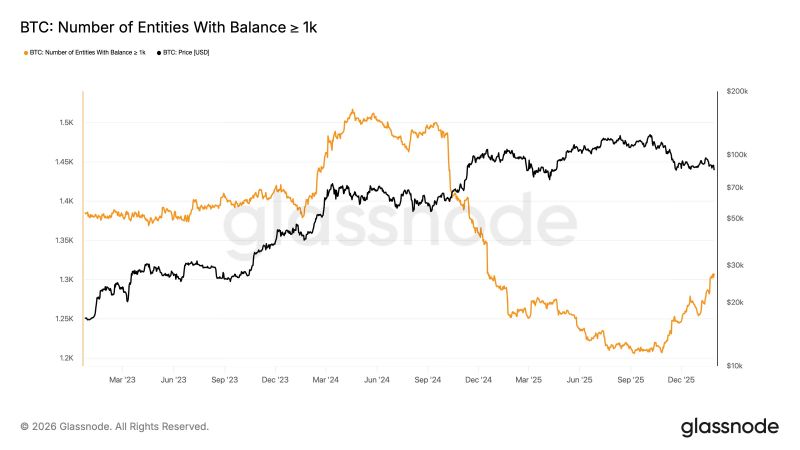

🟢 Commodities is the best performing asset class YTD: WTI Crude is up +14.3%, Silver +11.65% and Gold +8,8% 🟢Global equity markets gained +3.0%. EM equities lead (+8.9%) ahead of Japan (+6.6%), UK (+5.2%), China (+4.7%) and Euro area (+4.1%). As it was the case in 2025, US equities underperform (+1.5%) as Mag 7 are negative YTD 🟢Credit posted modest gains while US Treasuries are slightly down 🔴 Dollar index is down -1.2% 🔴 Bitcoin and Ethereum are the worst performers, down double-digit Source: Augur Infinity

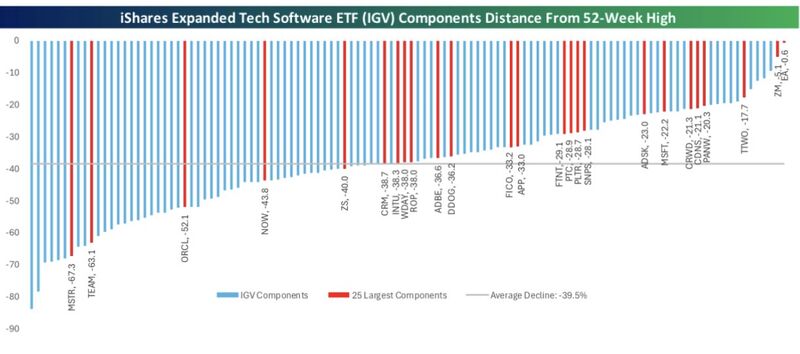

The average software stock is now in a 40% drawdown!

Absolute carnage in the space recently even with the broad market close to record highs. Source: Bespoke

Silver just "crashed" 31% in a single day. 📉

But if you’re looking at the price on your screen, you’re missing the real story. On January 30, while paper silver was hitting $78, physical silver in Shanghai was trading at $120. That is a 54% premium. 🤯 The Great Divorce In a legitimate market crash, physical assets usually trade at a discount. Buyers disappear. Panic sets in. But what we just witnessed wasn't a bubble bursting. It was Paper and Physical divorcing in real-time. 💔 The system is breaking because the arbitrage required to close that gap relies on metal that simply doesn't exist in the vaults. The Math of a Meltdown Look at the COMEX leverage right now: - Registered Inventory: 108.7 million ounces. - Open Interest: 1.586 BILLION ounces. - The Leverage Ratio: 14:1. The Reality: If just 7% of contract holders stand for physical delivery, the vaults are empty. Game over. 🛑 The Bottom Line We are watching a game of musical chairs where 14 people are fighting for one seat. The "price" is becoming irrelevant when you can't actually source the metal at that cost. Is March 2026 the ultimate stress test for the global financial system? ⏳ Source: Shanaka Anslem Perera ⚡@shanaka86 on X

No bounce... pickup up where we left off on Friday.

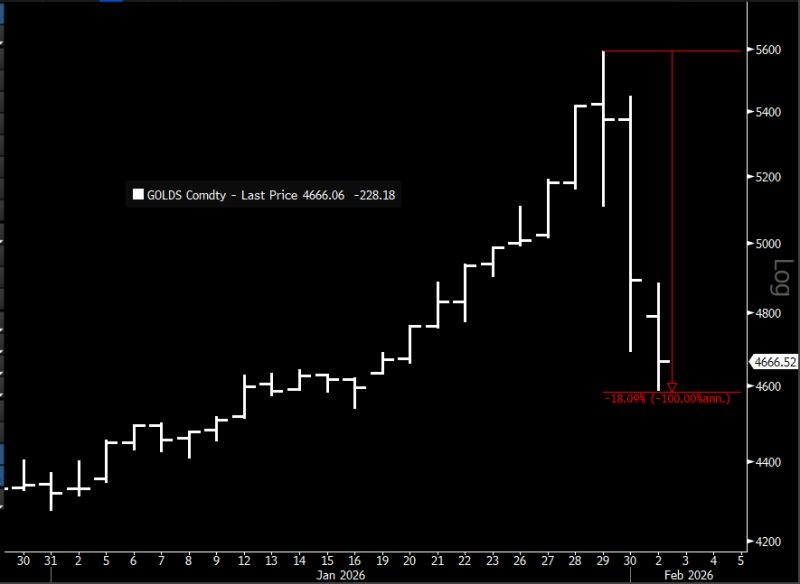

*SPOT GOLD FALLS 5%, ADDING TO BIGGEST PLUNGE IN OVER A DECADE (Down 18% from Thursday's high) Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks