Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

- Bitcoin is now down 41% since hitting $126,200 on the 6th of October.

- 4 consecutive red months is the longest bearish run since 2018. Source: Bitcoin archive

The drawdown in S&P 500 Software stocks is now -25.2% from the high...

That's worse than last year's plunge Source: Kevin Gordon @KevRGordon Bloomberg

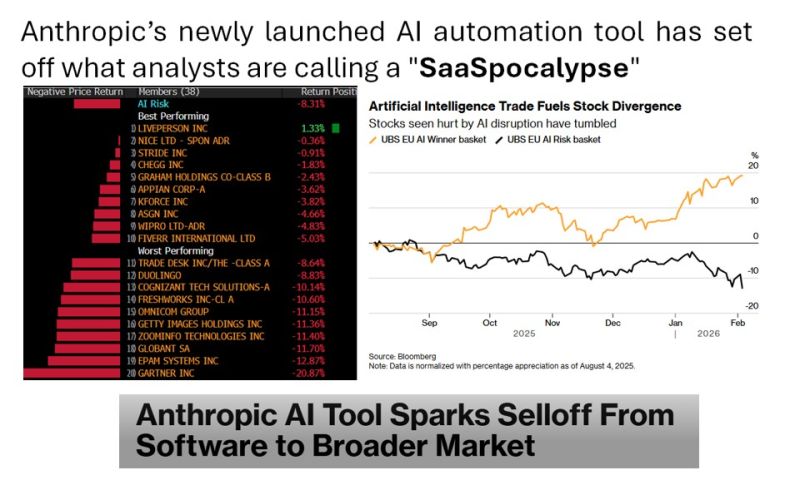

Anthropic’s newly launched AI automation tool has set off what analysts are calling a "SaaSpocalypse", rattling global technology markets

Anthropic recently released 11 new plug-ins for its Claude Cowork agent, an agentic, no-code AI assistant designed for enterprise users. The tool is aimed at automating tasks across legal, sales, marketing and data analysis functions Vishwa Sharan @vmsharan_ "Anthropic latest AI tool can automate tasks in legal, sales, marketing, and data analysis. Routine work such as document review, compliance tracking, risk flagging, and data processing. It essentially targets professionals in service automation. Expect reduced demand for consulting engagements, lesser billing hours. IT firms may see slower headcount growth or reductions as AI handles clerical work, shifting focus to higher level AI oversight and innovation" Source: Bloomberg

Nasdaq $QQQ survives the 100-day moving average test again

✅ Absolutely incredible Source: Barchart

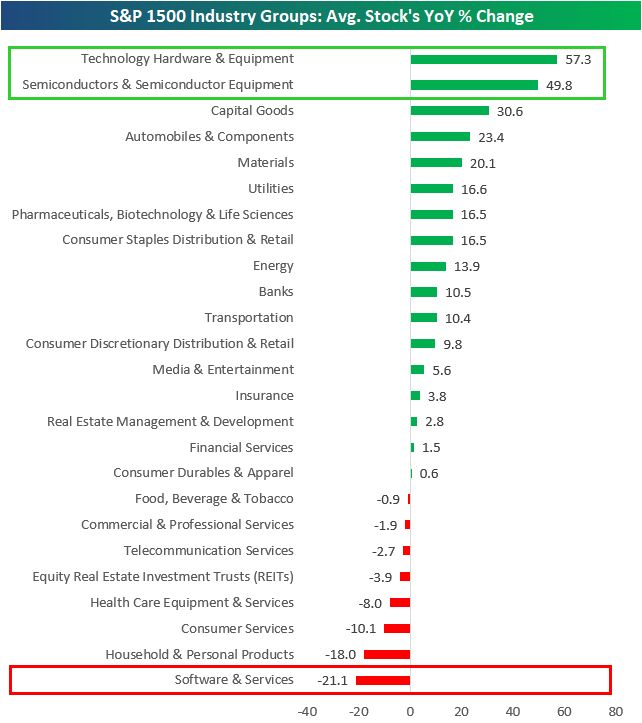

Amazing dichotomy between Tech hardware and software stocks over the last year.

Hardware and semis stocks are up the most of any group with average gains of 50%+. Software stocks are down the most of any group with an average decline of 20%+. Source: Bespoke

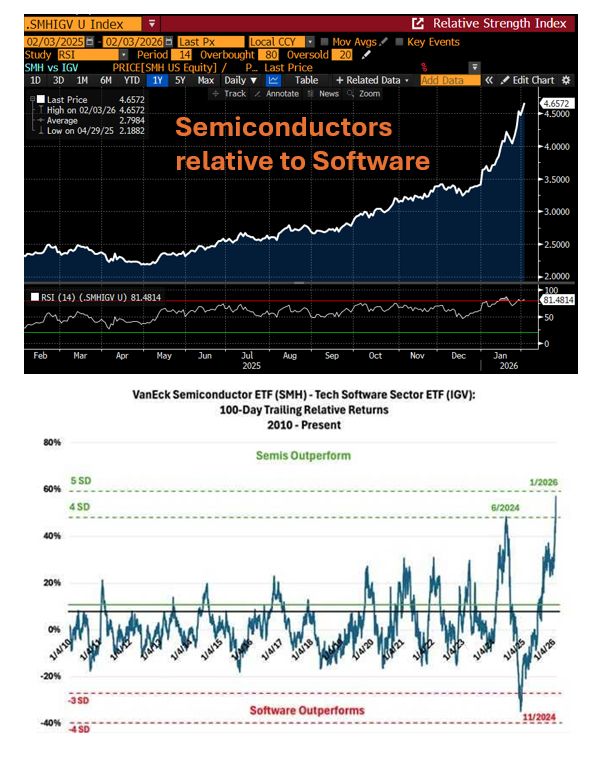

The semiconductors relative to software performance is getting very very extreme...

Long / short positioning on this pair by hedge funds is also hitting extreme levels Source: RBC, Bloomberg

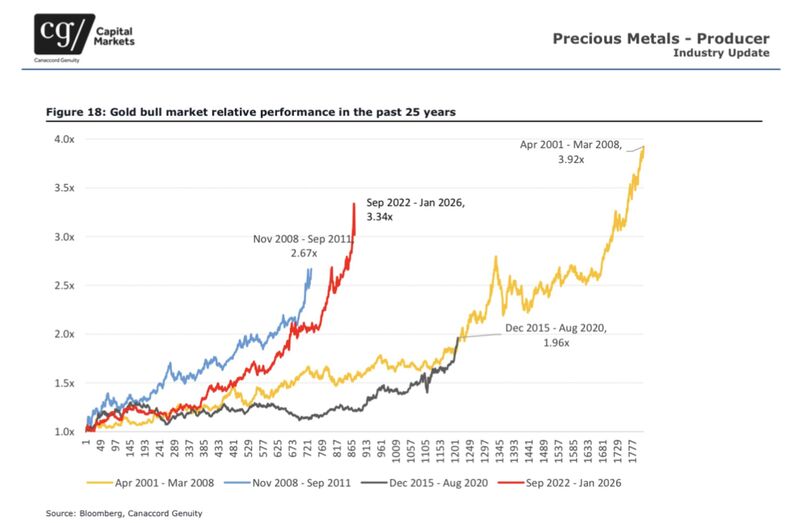

Current gold bull market in historical perspective

Source: Willem Middelkoop @wmiddelkoop Canaccord Genuity Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks