Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US companies announced the largest number of job cuts for any January since the depths of the Great Recession in 2009

according to data from outplacement firm Challenger, Gray & Christmas Inc Source: Bloomberg

To put things in perspective...

The Amazon $AMZN CAPEX estimates ($200B for 2026) aren’t even on the screen on the Bloomberg GF page yet… Source: Bloomberg, RBC

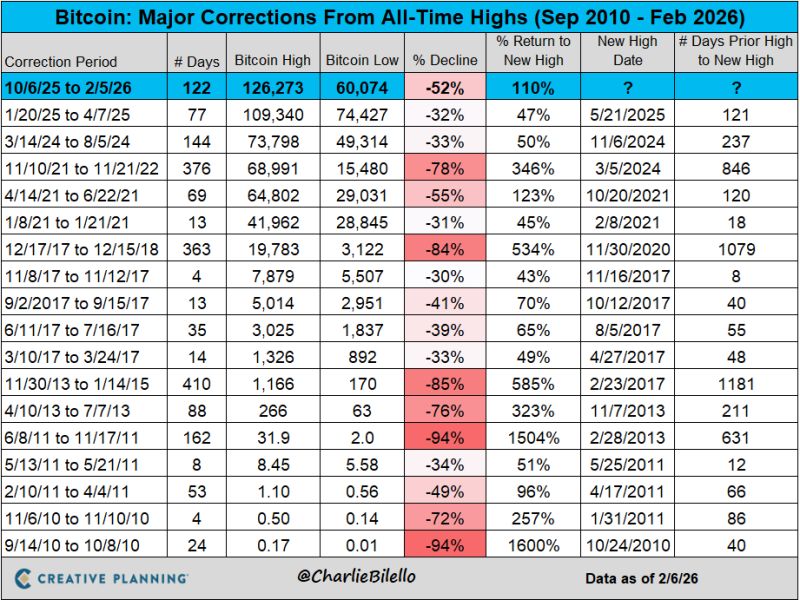

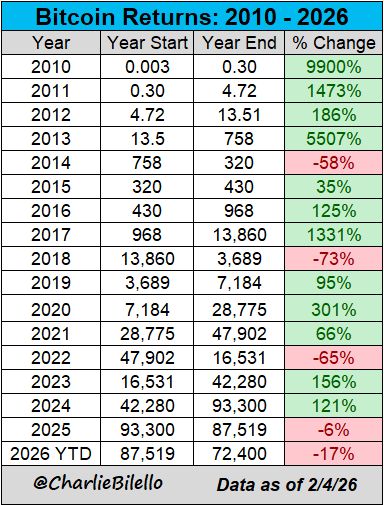

At yesterday's low of $60k, bitcoin was down over 52% from its October 2025 peak.

This was its 9th 50+% decline off an all-time high since it began trading on exchanges back in 2010. $BTC Source: Charlie Bilello

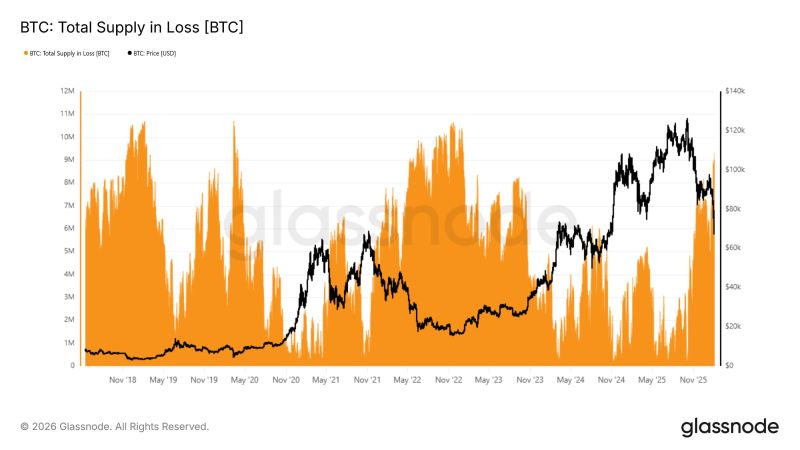

Over 9.3M Bitcoins are underwater, the highest supply in loss since January 2023, per Glassnode.

Source: www.cointelegraph.com

The economy is K-shaped. Premium spending remains strong while economy spending falls

Source: Blackstone investment outlook

Will the Nasdaq see the same pattern we saw from Nov ’24 into the Feb ’25 selloff???

This time, we consolidated since last November, and suddenly things look ugly again. Last year’s real puke began when NASDAQ broke the 100-day MA. We’re seeing that exact break today. Source: The Market Ear

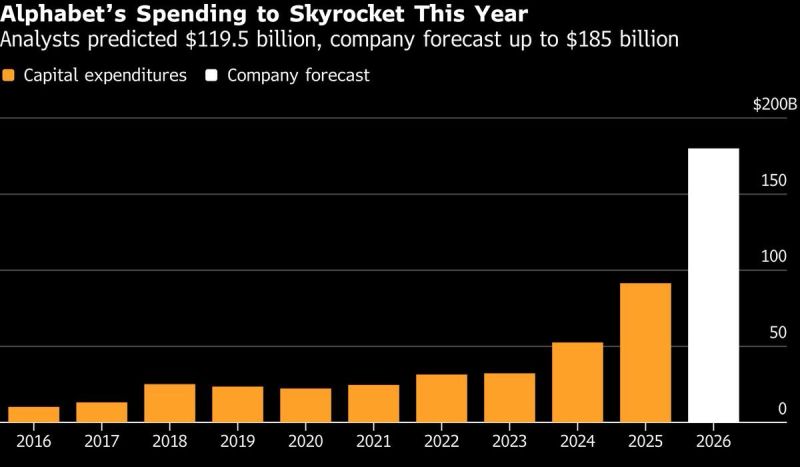

Alphabet is going to be spending more than the capex of:

ExxonMobil, Chevron, BP, Shell, TotalEnergies, Equinor, Eni, Antero Resources, APA Corporation, ConocoPhillips, Expand Energy, Continental Resources, Coterra Energy, Devon Energy, EOG Resources, EQT Corporation, Diamondback Energy, Occidental Petroleum, Range Resources, Permian Resources, Imperial Oil, Cenovus Energy, Canadian Natural Resources, Ovintiv, Suncor Energy, Tourmaline Oil COMBINED! Can the US grid support these projections ??? Source: The Crude Chronicles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks